- Germany

- /

- Aerospace & Defense

- /

- XTRA:HAG

Why Hensoldt (XTRA:HAG) Is Down 5.0% After Cutting Its 2025 Revenue Guidance

Reviewed by Sasha Jovanovic

- Hensoldt AG recently lowered its earnings guidance for 2025, now expecting revenue to total approximately €2.50 billion versus the prior outlook of €2.50 billion to €2.60 billion.

- This downward revision in revenue expectations signals management's more cautious outlook amid changing market conditions and could shift investor sentiment.

- We will explore how Hensoldt's revised outlook may challenge the earlier investment narrative, particularly around confidence in future revenue growth.

We've found 24 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Hensoldt Investment Narrative Recap

To be a Hensoldt shareholder today, you need to believe in the company’s potential to capture long-term growth in European defense spending while effectively managing shifting demand and operational complexity. The latest downward revision to 2025 revenue guidance appears modest, but any signals of softer demand or execution issues could affect near-term sentiment and amplify existing concerns. The short-term catalyst remains strong order intake, and the biggest risk is that elevated expectations for defense budgets may not be realized, this update does not meaningfully change that equation. One recent announcement with particular relevance is Hensoldt’s addition to the FTSE All-World Index, which could attract new capital flows and increase trading liquidity. While index inclusion is often viewed positively, its impact depends on consistent operational delivery, especially given the fresh revenue guidance and heightened attention on defense sector projections. In contrast, investors should be aware that while order intake is robust, there remains uncertainty if planned European defense budgets will actually lead to realized revenues...

Read the full narrative on Hensoldt (it's free!)

Hensoldt's narrative projects €3.8 billion in revenue and €353.8 million in earnings by 2028. This requires 17.7% annual revenue growth and a €263.8 million earnings increase from €90.0 million today.

Uncover how Hensoldt's forecasts yield a €98.00 fair value, a 7% upside to its current price.

Exploring Other Perspectives

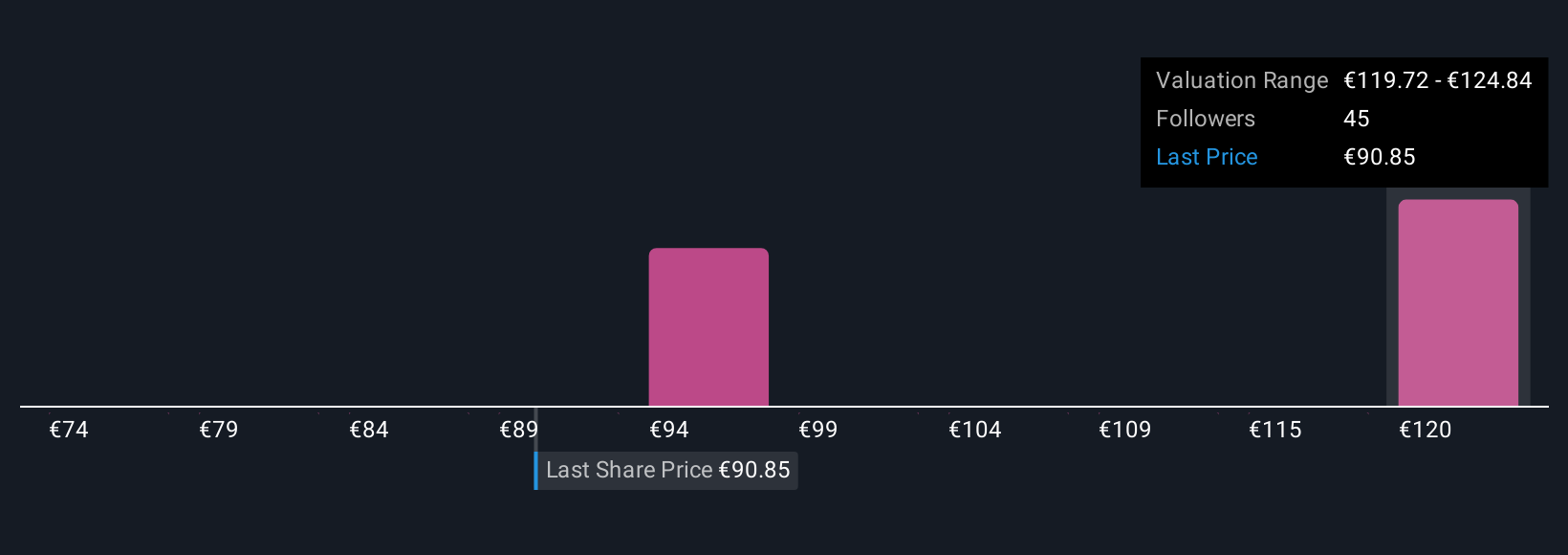

Eleven members of the Simply Wall St Community estimate Hensoldt’s fair value from €73.60 to €124.25, showing a wide spectrum of opinions. While some expect Hensoldt to benefit from increased defense spending, others remain concerned about revenue risks tied to government budget decisions.

Explore 11 other fair value estimates on Hensoldt - why the stock might be worth 20% less than the current price!

Build Your Own Hensoldt Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hensoldt research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Hensoldt research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hensoldt's overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hensoldt might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:HAG

Hensoldt

Provides sensor solutions for defense and security applications worldwide.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives