- Germany

- /

- Aerospace & Defense

- /

- XTRA:HAG

Hensoldt (XTRA:HAG): Gauging Valuation After PMRExpo 2025 Spotlights Digital Defense Advances

Reviewed by Simply Wall St

Hensoldt (XTRA:HAG) caught the spotlight at PMRExpo 2025, as executives led by Oberst d.R. Sven Heursch outlined developments in software-defined defense and digitalization. These topics frequently influence how investors value the company’s long-term prospects.

See our latest analysis for Hensoldt.

After grabbing headlines at PMRExpo 2025, Hensoldt’s share price cooled off from earlier highs, pulling back nearly 28% over the last month. That said, momentum remains impressive in the big picture with a year-to-date share price return of 104%, and a remarkable five-year total shareholder return of 486% continues to showcase its long-term growth story.

If Hensoldt’s recent moves have you watching the defense sector more closely, now is a great moment to spot new opportunities with our aerospace and defense screener: See the full list for free.

With recent gains still fresh in investors’ minds, the question now is whether Hensoldt’s current share price reflects the full extent of its future potential or if there is an attractive entry point for those willing to look ahead.

Most Popular Narrative: 30% Undervalued

Hensoldt’s most followed valuation narrative estimates the stock’s fair value at €98.69, around 30% above the recent close of €69. This sets the stage for debate around whether analyst assumptions on growth and profitability truly justify current optimism for the shares.

The company reports robust order intake growth driven by increased defense spending, particularly in air defense, across Europe. However, future revenue expectations are based on elevated budget levels, which may not fully materialize, leading to potential overvaluation risk tied to revenue projections.

Want to peek behind the high-powered valuation curtain? The narrative’s punchy price target rests on ambitious estimates for sales growth, rising margins, and booming defense demand. Can Hensoldt sustain the momentum to meet those lofty forecasts? Discover the bold projections analysts stake their fair value on, plus the crucial numbers that could tip the balance.

Result: Fair Value of €98.69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing concerns remain around overstretched valuations and potential profit margin pressures, especially if competitive intensity rises or order growth slows.

Find out about the key risks to this Hensoldt narrative.

Another View: What Do Market Ratios Say?

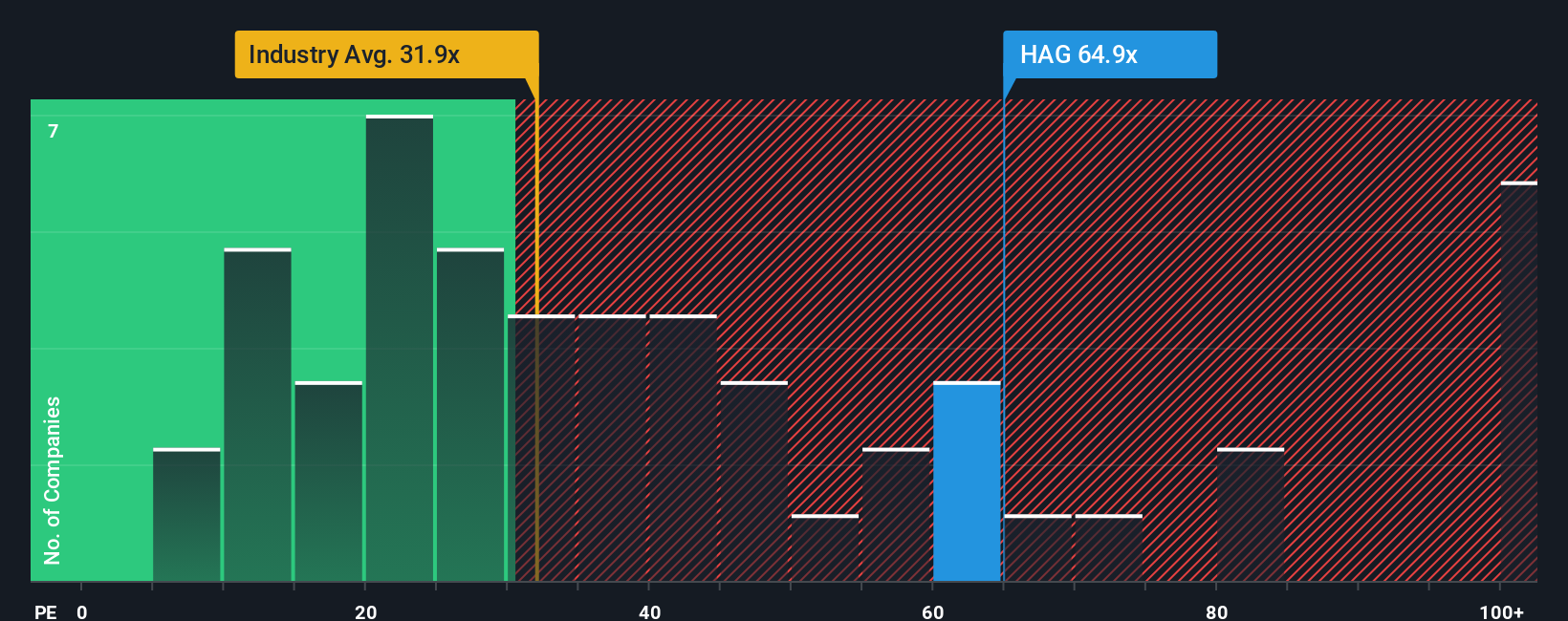

Looking at Hensoldt’s price-to-earnings ratio, the picture gets interesting. The company trades at 64.3 times earnings, which is more expensive than the average for both its European peers (46.4x) and the broader industry (31.9x). Even compared to its fair ratio of 41.8x, there is a sizable premium. This premium reflects strong optimism, but could it also signal valuation risk if growth does not meet expectations?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hensoldt Narrative

If this perspective doesn't quite fit with your outlook or you enjoy drawing your own conclusions, you can put together a personalized narrative in just a few minutes. Do it your way

A great starting point for your Hensoldt research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t miss the chance to step ahead of the crowd. Maximize your portfolio potential by checking out investment opportunities that could redefine your returns today.

- Tap into untapped growth by pursuing these 3578 penny stocks with strong financials with strong foundations and the potential for big moves in the market.

- Unlock powerful income streams by selecting these 15 dividend stocks with yields > 3% offering compelling yields that can boost your regular returns.

- Ride the momentum in cutting-edge technology and innovation by joining the surge in these 25 AI penny stocks reshaping entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hensoldt might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:HAG

Hensoldt

Provides sensor solutions for defense and security applications worldwide.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success