Evaluating GEA Group (XTRA:G1A) Valuation Following DAX Index Inclusion

Reviewed by Kshitija Bhandaru

GEA Group (XTRA:G1A) has been added to the Germany DAX index, a move that often captures attention from investors and passive funds. Index inclusion can influence trading volumes and highlight a company's position in the market.

See our latest analysis for GEA Group.

GEA Group’s recent addition to the DAX index follows its presentations at major investment conferences and steady operational progress. The stock’s momentum has attracted attention, with a robust 1-year total shareholder return of 44% and improving sentiment that points to growing institutional interest over the long term.

If you’re watching for what’s next in the market, this is an ideal time to broaden your search and uncover fast growing stocks with high insider ownership

This raises a crucial question for investors: Is GEA Group’s recent run-up leaving room for upside, or has the market already priced in the company’s future growth prospects?

Most Popular Narrative: 5.5% Overvalued

GEA Group's most-followed narrative shows the calculated fair value trails the current market price, suggesting that optimism may be outpacing fundamentals. To understand what is driving this view, let's look at a key catalyst highlighted by leading analysts.

Ongoing expansion of the high-margin recurring service and digital solutions business, evidenced by 19 consecutive quarters of organic service growth and growing penetration of service contracts across GEA's installed base, is structurally raising EBITDA margins and improving long-term earnings visibility.

Want to know the formula behind this high price tag? The narrative is betting on a transformation powered by service margins and aggressive recurring growth. Curious which metrics justify this bold level? Click to see the detailed assumptions that drive the overvalued call.

Result: Fair Value of $60.29 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including unpredictable large project orders and persistent currency headwinds. Either of these factors could quickly undermine recent optimism around GEA Group’s outlook.

Find out about the key risks to this GEA Group narrative.

Another View: What Does Our DCF Model Say?

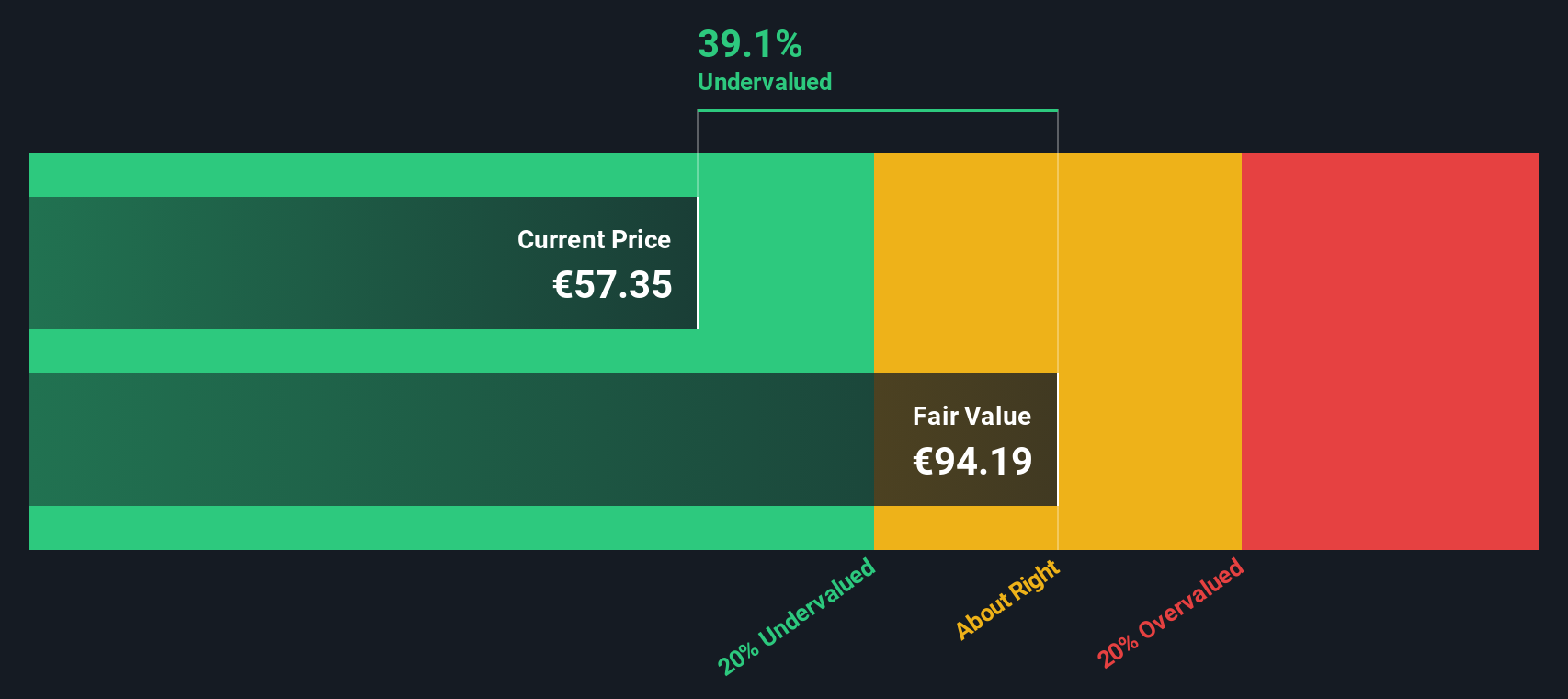

While the most-followed narrative considers GEA Group to be overvalued based on its current market price compared to analyst targets, the SWS DCF model presents a different perspective. According to this method, GEA Group’s intrinsic value is significantly higher than its current trading level. This suggests the stock may be undervalued when viewed through a long-term cash flow lens. Which approach will prove most accurate as market sentiment shifts?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own GEA Group Narrative

If you have different insights or enjoy building your own view from the numbers, you can easily develop a fresh narrative in just a few minutes, so why not Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding GEA Group.

Looking for more investment ideas?

Take the next step in growing your portfolio. Simply Wall St makes it easy to target high-potential opportunities across sectors, so don’t leave winning stocks on the table when the right filters can spotlight your next favourites.

- Jump on high yields by checking out these 19 dividend stocks with yields > 3% returning over 3 percent, ideal for building steady income from strong payers.

- Accelerate your tech advantage by tapping into these 24 AI penny stocks shaping tomorrow with breakthroughs in artificial intelligence and automation.

- Catch early momentum in these 3568 penny stocks with strong financials offering strong fundamentals and the potential for outsized gains while they’re still flying under the radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:G1A

GEA Group

Produces and supplies systems and components to the food, beverage, and pharmaceutical industries worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives