- Germany

- /

- Auto Components

- /

- XTRA:VTSC

Slowing Rates Of Return At Vitesco Technologies Group (ETR:VTSC) Leave Little Room For Excitement

What are the early trends we should look for to identify a stock that could multiply in value over the long term? One common approach is to try and find a company with returns on capital employed (ROCE) that are increasing, in conjunction with a growing amount of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. However, after briefly looking over the numbers, we don't think Vitesco Technologies Group (ETR:VTSC) has the makings of a multi-bagger going forward, but let's have a look at why that may be.

What Is Return On Capital Employed (ROCE)?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. The formula for this calculation on Vitesco Technologies Group is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

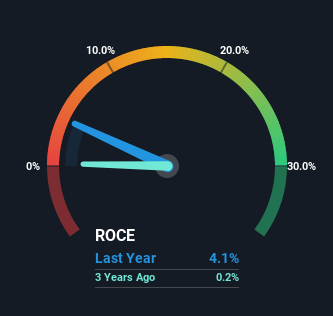

0.041 = €179m ÷ (€7.6b - €3.2b) (Based on the trailing twelve months to December 2022).

Thus, Vitesco Technologies Group has an ROCE of 4.1%. In absolute terms, that's a low return and it also under-performs the Auto Components industry average of 9.3%.

Check out our latest analysis for Vitesco Technologies Group

Above you can see how the current ROCE for Vitesco Technologies Group compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like to see what analysts are forecasting going forward, you should check out our free report for Vitesco Technologies Group.

How Are Returns Trending?

We're a bit concerned with the trends, because the business is applying 26% less capital than it was four years ago and returns on that capital have stayed flat. This indicates to us that assets are being sold and thus the business is likely shrinking, which you'll remember isn't the typical ingredients for an up-and-coming multi-bagger. In addition to that, since the ROCE doesn't scream "quality" at 4.1%, it's hard to get excited about these developments.

Another thing to note, Vitesco Technologies Group has a high ratio of current liabilities to total assets of 43%. This effectively means that suppliers (or short-term creditors) are funding a large portion of the business, so just be aware that this can introduce some elements of risk. While it's not necessarily a bad thing, it can be beneficial if this ratio is lower.

The Bottom Line On Vitesco Technologies Group's ROCE

Overall, we're not ecstatic to see Vitesco Technologies Group reducing the amount of capital it employs in the business. Although the market must be expecting these trends to improve because the stock has gained 89% over the last year. Ultimately, if the underlying trends persist, we wouldn't hold our breath on it being a multi-bagger going forward.

Vitesco Technologies Group does have some risks though, and we've spotted 1 warning sign for Vitesco Technologies Group that you might be interested in.

While Vitesco Technologies Group isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:VTSC

Vitesco Technologies Group

Develops and produces components and system solutions for power trains in hybrid vehicles, electric vehicles, and combustion engines in Germany and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives