Volkswagen (XTRA:VOW3) Earnings: €4.4B One-Off Loss Reinforces Margin Pressure Narrative

Reviewed by Simply Wall St

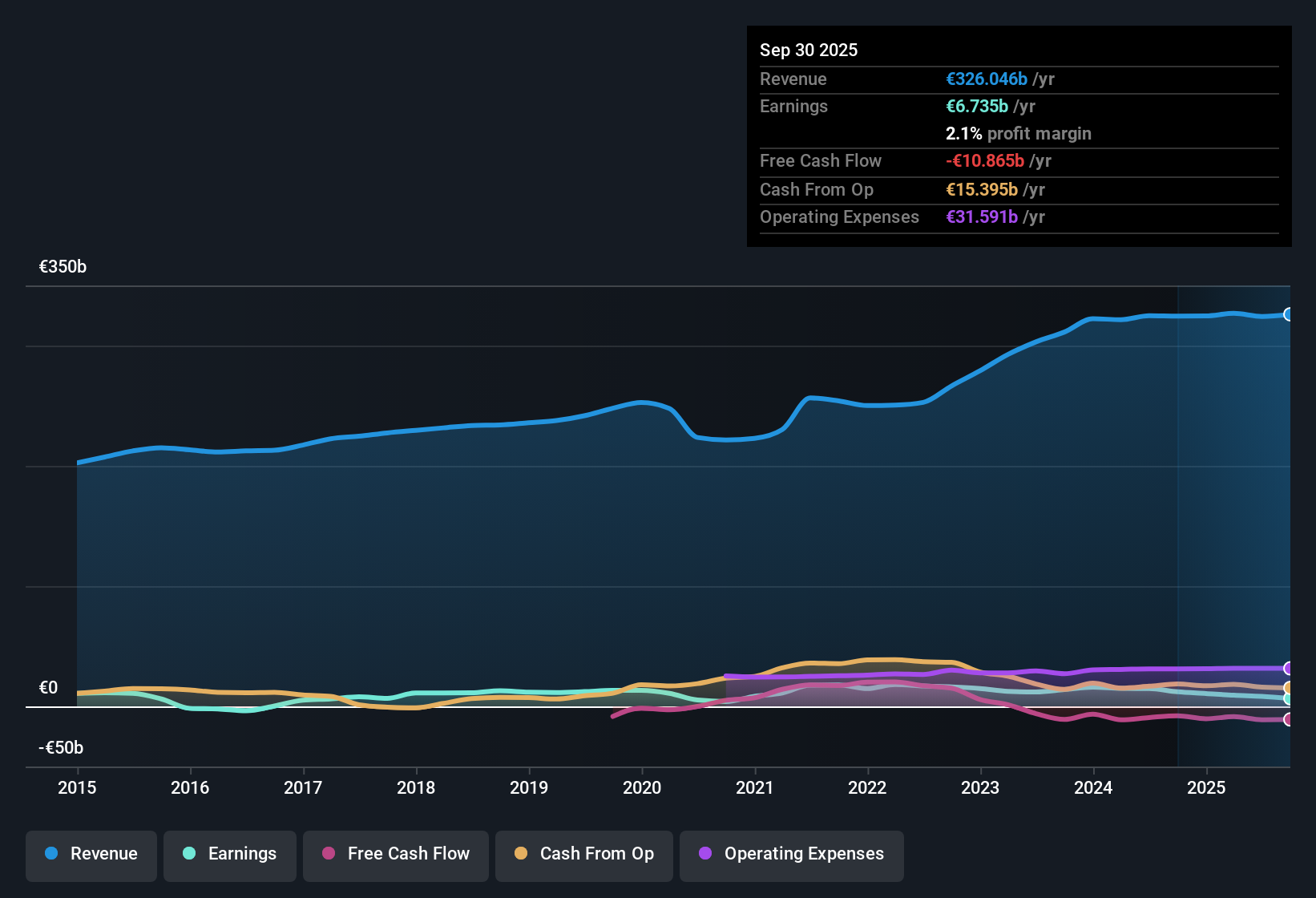

Volkswagen (XTRA:VOW3) posted a 3.6% annual decline in earnings over the past five years, with a significant one-off loss of €4.4 billion dragging down its latest figures as of 30th September, 2025. Net profit margins dropped to 2.2% from last year’s 3.7%, while revenue is projected to grow 2.6% annually, trailing the broader German market’s expected 6.1% pace. Looking ahead, analysts expect Volkswagen’s earnings to rebound at 27.1% per year, significantly above the German average of 16.7%. This sets the stage for potentially dramatic improvement if forecasts hold.

See our full analysis for Volkswagen.Now, let’s see how Volkswagen’s reported results compare to the prevailing narratives. Some expectations may be confirmed, while others could see a shakeup.

See what the community is saying about Volkswagen

Margins Projected to Recover as Cost Cuts Take Hold

- Analysts expect Volkswagen's net profit margins to rise from 2.6% today to 4.5% in three years, reversing the pressure from the recent drop to 2.2%.

- Analysts' consensus view points to ongoing fixed cost reductions and increased operating leverage as material drivers for expected margin gains.

- Restructuring efforts, including streamlining headcount and focusing on premium, high-return markets, are expected to support long-term profitability even as short-term earnings were hurt by a €4.4 billion one-off loss.

- New digital service and subscription revenues, such as mobility offerings and advanced software (CARIAD), are set to improve gross margin resilience in the face of industry disruption.

- To see how the latest narrative stacks up to the numbers, read the full consensus breakdown. 📊 Read the full Volkswagen Consensus Narrative.

Undervalued Price Relative to Sector and Peer Multiples

- Volkswagen trades at a Price-To-Earnings ratio of 6.3x, less than half of the global auto sector average (18.3x) and its peers (18.2x). The current share price of €90.22 remains below the DCF fair value of €458.53.

- Analysts' consensus view notes this deep valuation discount positions Volkswagen as a classic value play if forecasts are achieved.

- Investors weighing the analyst price target of €111.13 (about 23% above the current share price) will want to check if the forecasted improvements in profitability and margins justify the discount, especially given the 27.1% expected annual earnings growth rate.

- Consensus acknowledges that despite the discount, persistent concerns about organizational complexity and ongoing margin pressure may be baked into the price, making execution on restructuring all the more critical.

Heavy Investment Threatens Free Cash Flow But Expands Future Growth

- Volkswagen’s continued outlays for restructuring, electrification, and partnerships, such as with Rivian, are cited as risks for near-term free cash flow and net liquidity.

- According to analysts' consensus view, these heavy capital commitments are a double-edged sword: they are needed for long-term margin recovery and technological competitiveness, but near term, they reduce strategic flexibility.

- While BEV expansion and cost-optimized manufacturing aim to defend market share, ongoing high capex is expected to pressure available cash for dividends and share buybacks.

- Consensus highlights that unless operating efficiencies from these investments emerge quickly, Volkswagen could lag peers in both returns on capital and adaptability.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Volkswagen on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at this data from another angle? Use the insights above to develop your own perspective in just a few minutes. Do it your way.

A great starting point for your Volkswagen research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

See What Else Is Out There

Volkswagen’s heavy capital spending and margin volatility threaten near-term cash flow and limit flexibility compared to more financially resilient peers.

If you want to reduce your exposure to these challenges, discover solid balance sheet and fundamentals stocks screener (1983 results) that offer stronger balance sheets and robust financial health.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:VOW3

Volkswagen

Manufactures and sells automobiles in Germany, other European countries, North America, South America, the Asia-Pacific, and internationally.

Very undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives