Are Volkswagen Shares a Bargain After 5.3% Price Dip This Week?

Reviewed by Bailey Pemberton

- If you have ever wondered whether Volkswagen stock is a genuine bargain or just another headline grabber, you are in the right place.

- Volkswagen shares are up 23.0% over the past year, though the stock has dipped 5.3% this past week, offering both intrigue and some possible caution for investors tracking momentum and risk.

- Recent headlines have highlighted Volkswagen’s strategic push into electric vehicles and expanded global partnerships, supporting investor optimism with tangible shifts in the company’s business roadmap. Speculation around supply chain improvements and innovative product launches has added further fuel to recent price movements.

- By our scorecard, Volkswagen notches a 5 out of 6 on key valuation checks, suggesting there is more value here than meets the eye. However, before you decide, let’s look at how valuation is measured and why there might be an even better way to size up the stock at the end of this article.

Approach 1: Volkswagen Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to their present value. This approach provides a practical way to assess what Volkswagen could be worth based on its ability to generate cash in coming years.

Volkswagen’s latest reported Free Cash Flow (FCF) was -€10.94 billion, reflecting a challenging period for the company. However, analyst projections show a rapid turnaround, with FCF rising to €3.68 billion in 2026, €7.28 billion in 2027, and ultimately reaching an estimated €31.04 billion in 2035. After the first five years, further growth forecasts are extrapolated by Simply Wall St, providing a broader long-term picture.

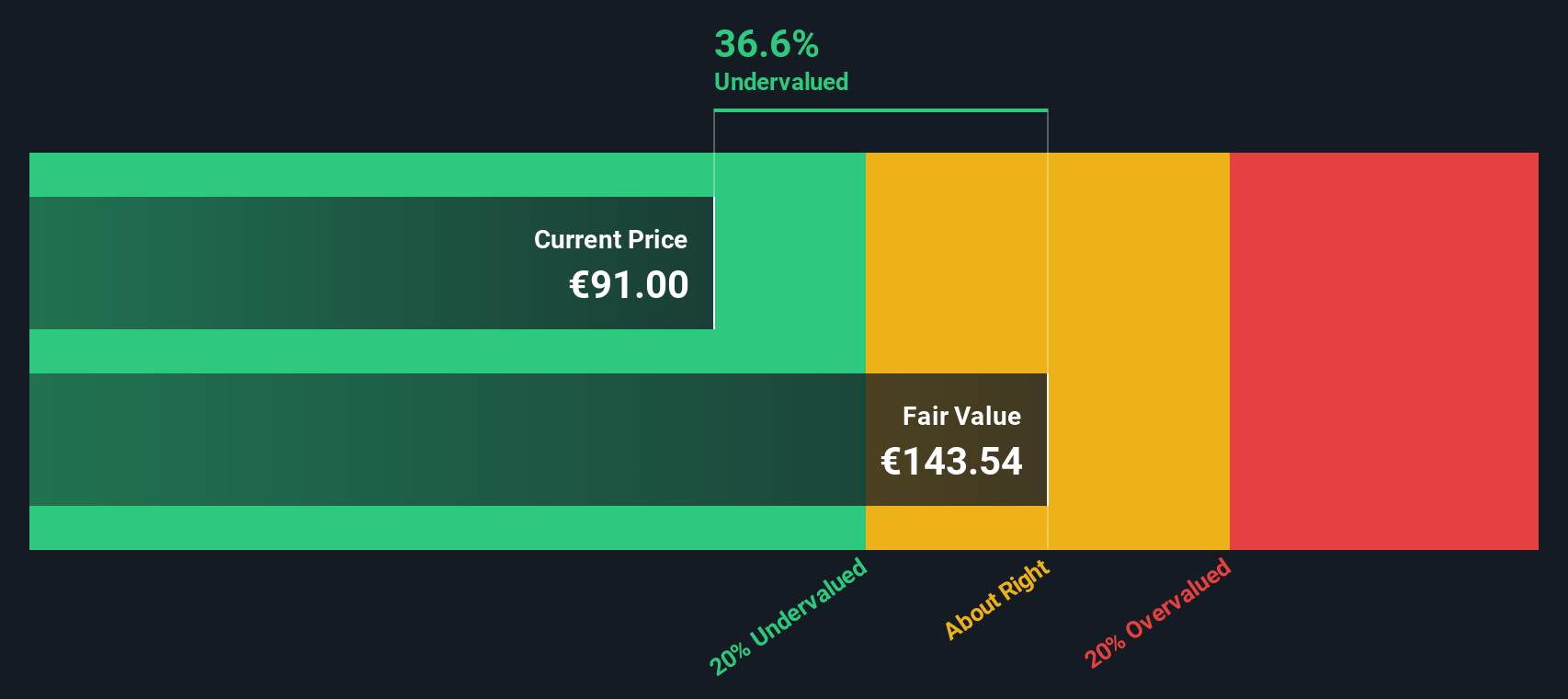

According to the DCF model, the estimated intrinsic value of Volkswagen is €486.43 per share. This suggests the stock could be trading at an 80.7% discount to its real worth at current market prices. This significant gap implies Volkswagen is deeply undervalued according to DCF analysis and may offer substantial upside for investors seeking value among auto stocks.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Volkswagen is undervalued by 80.7%. Track this in your watchlist or portfolio, or discover 916 more undervalued stocks based on cash flows.

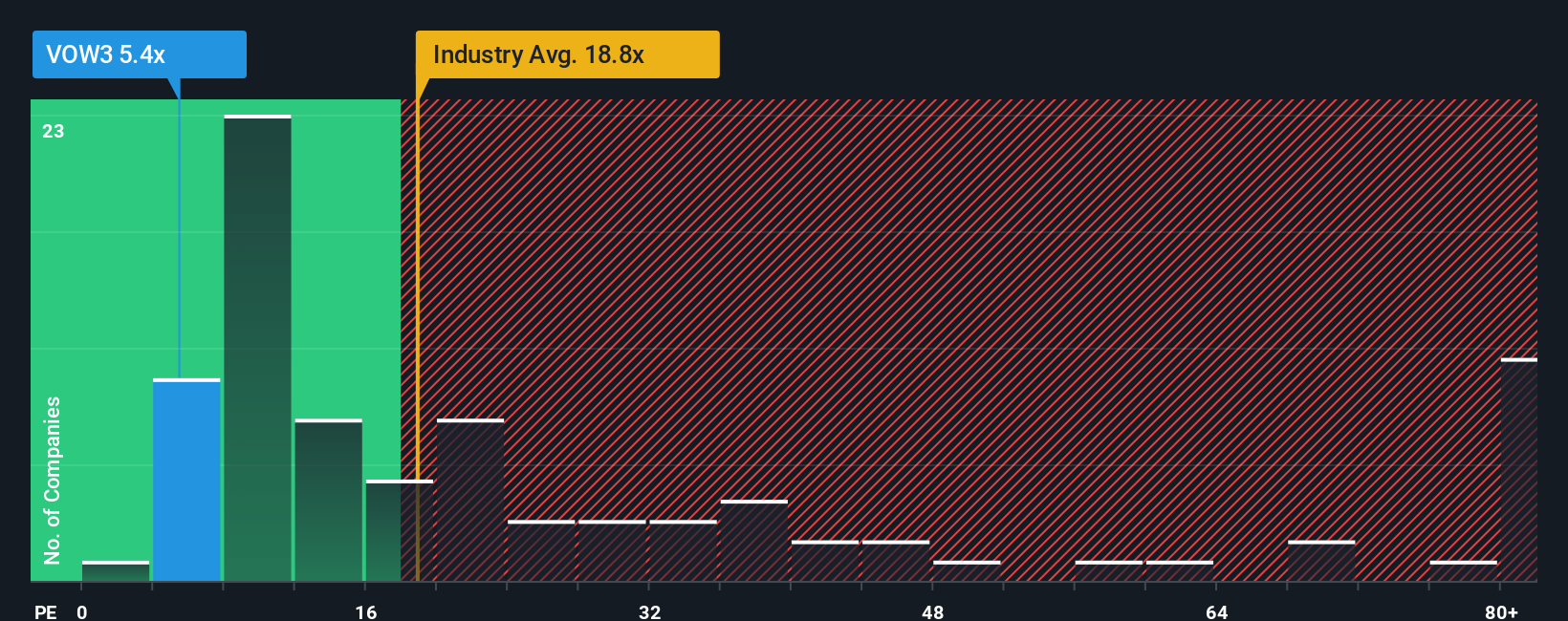

Approach 2: Volkswagen Price vs Earnings

The Price-to-Earnings (PE) ratio is a popular way to value profitable companies like Volkswagen because it shows how much investors are willing to pay per euro of earnings. This metric is especially handy for firms with stable profits, as it helps compare Volkswagen with peers on a consistent basis.

"Fair" PE ratios are not one-size-fits-all. They are shaped by expectations for growth, profitability, and risk. Fast-growing or lower-risk companies typically justify higher PE ratios, while riskier or slower-growing businesses tend to see lower ones.

Right now, Volkswagen trades at a PE ratio of just 7.0x. That stands out against the wider Auto industry average of 17.8x and a peer average of 17.0x, signaling the stock is valued at a substantial discount to most of its competitors.

This is where Simply Wall St’s "Fair Ratio" comes into play. The Fair Ratio, currently at 17.8x for Volkswagen, reflects the PE you might reasonably expect based on specific company factors such as earnings growth, profit margins, market cap, and industry dynamics, instead of relying only on broad peer or industry numbers. This makes it a more useful and tailored benchmark for assessing a company’s true valuation.

Comparing the Fair Ratio of 17.8x with Volkswagen’s actual PE of 7.0x, the shares look meaningfully undervalued by this measure.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1423 companies where insiders are betting big on explosive growth.

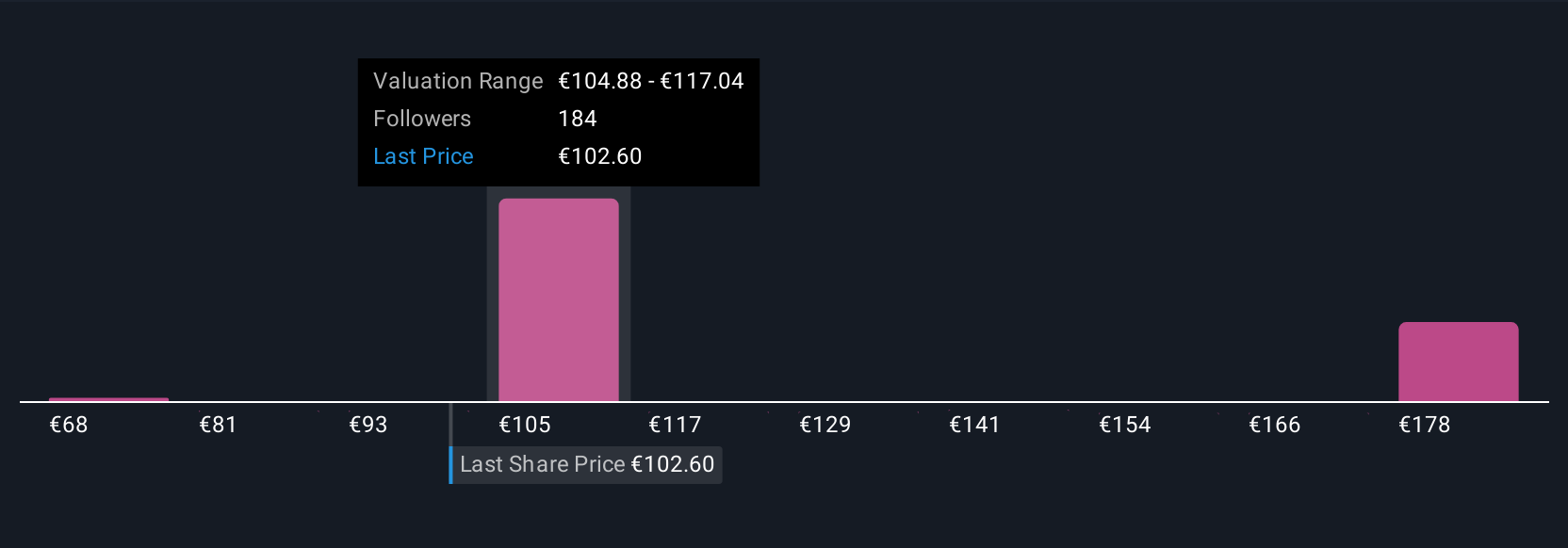

Upgrade Your Decision Making: Choose your Volkswagen Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your unique perspective or story about a company, combining your assumptions about Volkswagen’s future revenue, earnings, profit margins, and fair value with the actual business developments you notice. Narratives connect the dots between what you believe is likely to happen, a financial forecast, and an estimated fair value, making stock analysis more personal and relevant.

On Simply Wall St's Community page, Narratives are an easy and accessible tool used by millions of investors to set their expectations, track their logic, and compare their fair value to the current share price. This helps them decide when to buy or sell. Because they automatically update when fresh news, financial results, or new data arrives, Narratives help you stay nimble and confident even as market conditions change.

For example, recent user Narratives for Volkswagen range from deeply skeptical, focusing on structural challenges and giving a fair value of €68.40 per share, to strongly optimistic, with bullish investors estimating a fair value near €112.08 based on the company’s progress in electrification and improving margins. Narratives make these contrasting viewpoints transparent and allow you to anchor your decisions in both data and conviction.

For Volkswagen, we’ll make it really easy for you with previews of two leading Volkswagen Narratives:

Fair Value: €112.08

Current Price vs. Narrative Fair Value: 16.3% undervalued

Revenue Growth (forecast): 3.0%

- Volkswagen is positioned for growth through expansion in electrified vehicles and digital services. Strategic restructuring and a shift to premium, high-return markets are expected to support both sales and profitability.

- Investments in local production, partnerships, and cost optimization are reducing exposure to geopolitical risks and bolstering future earnings resilience, especially as recurring revenue streams from tech and mobility services expand.

- Analyst consensus sees a price target moderately above the current share price, but advises ongoing monitoring of risks including trade wars, BEV competition, luxury brand headwinds, and organizational complexity.

Fair Value: €68.40

Current Price vs. Narrative Fair Value: 37.1% overvalued

Revenue Growth (forecast): 1.0%

- Despite a dominant home market share, Volkswagen faces major global challenges due to past missteps, including emissions scandals, delays in electrification, and excessive reliance on China and Mexico.

- The latest financial results revealed profit declines, stagnant international market share, cautious guidance, and management delays in delivering on margin improvement goals. This has raised investor concerns.

- While new model announcements offer some hope, operational weaknesses and strategic miscalculations have resulted in a negative short- to medium-term outlook for the company's prospects.

Do you think there's more to the story for Volkswagen? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:VOW3

Volkswagen

Manufactures and sells automobiles in Germany, other European countries, North America, South America, the Asia-Pacific, and internationally.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives