- Germany

- /

- Auto Components

- /

- XTRA:SHA0

Schaeffler (XTRA:SHA0) Earnings Forecast to Surge 135.4% Annually, Challenging Bearish Sentiment

Reviewed by Simply Wall St

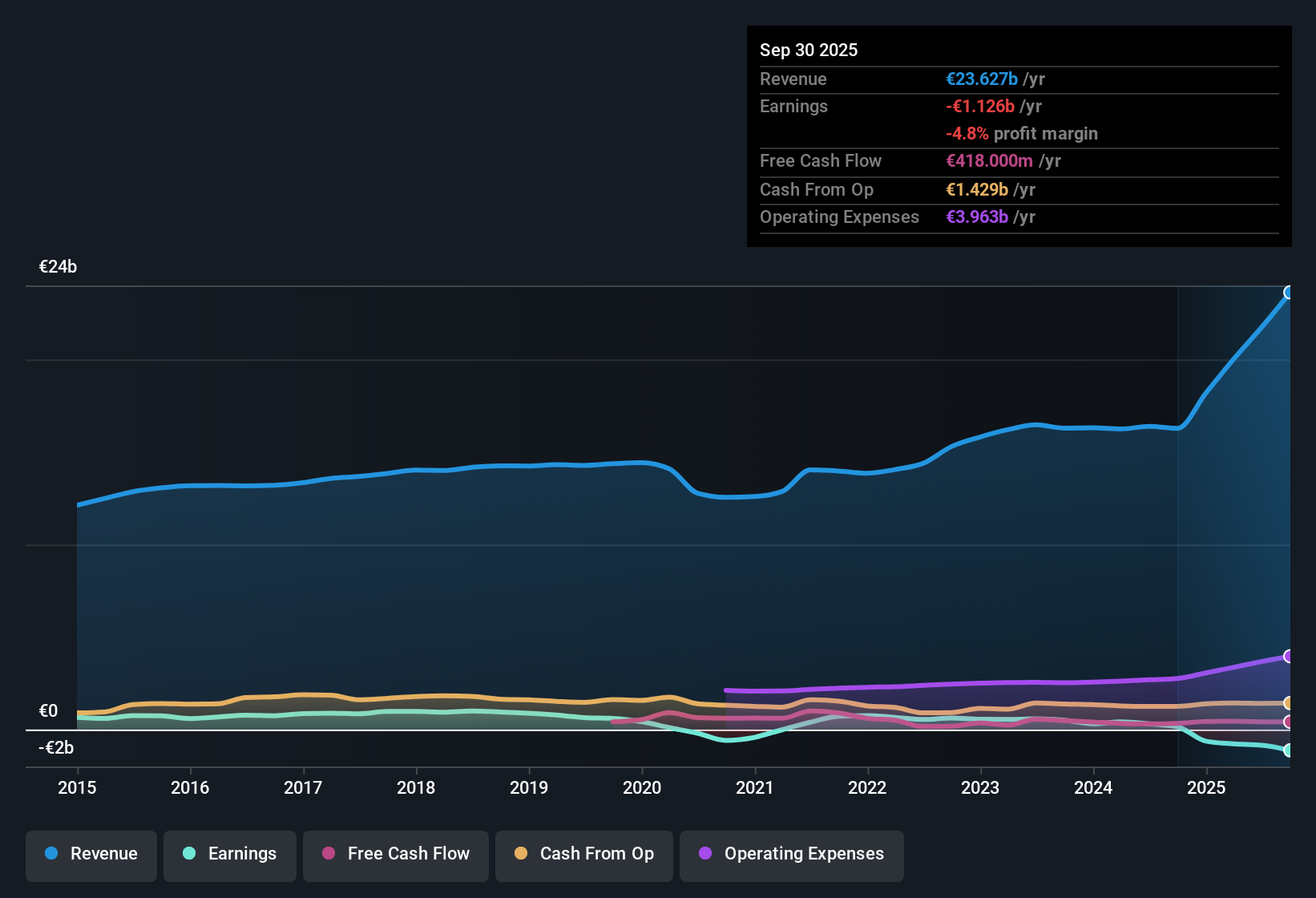

Schaeffler (XTRA:SHA0) currently faces rising losses, with net losses having grown 28.8% per year over the last five years and no reported improvement in net profit margin over the past twelve months. However, the company’s revenue is forecast to grow 3.6% per year, which trails the German market’s pace of 6.1%. Expectations are for a striking turnaround, with earnings projected to grow 135.4% annually and a return to profitability within three years. As investors weigh risks around financial stability and dividend sustainability, the company’s rapid profit growth outlook provides a focal point for the market’s attention.

See our full analysis for Schaeffler.Next up, we will put these latest numbers in context by comparing them directly with the key narratives that investors are watching. Some expectations might be reinforced, while others may get put to the test.

See what the community is saying about Schaeffler

Margins Projected to Rebound from -3.9% to 5.1%

- Analysts expect Schaeffler's profit margin to rise from -3.9% today to 5.1% within three years, with the target aligning with growing electrified mobility and premium segment product sales.

- According to the analysts' consensus view, strategic expansion in energy-efficient components and strong order intake for new E-Mobility and industrial contracts are set to diversify revenue streams and improve gross margin quality.

- The transformation toward E-Mobility and premium components is expected to support margin resilience as global customers shift to higher-value, more efficient products.

- Consensus narrative notes that the ability to execute synergies, achieve cost efficiencies at scale, and grow recurring aftermarket revenues will be vital for sustainable net margin improvement.

Restructuring and High Debt Still Limit Flexibility

- Ongoing restructuring costs and leverage above target remain hurdles. Integration expenses from the Vitesco merger and elevated debt continue to constrain Schaeffler's capacity to invest or boost dividends.

- According to the analysts' consensus view, this risk is compounded by continued heavy exposure to mature European automakers, mixed powertrain demand, and heightened R&D in stagnating legacy segments.

- Critics highlight that while electrified mobility is growing, legacy segment sales are declining, which pressures group profitability and restricts rapid deployment of capital.

- Consensus narrative underscores the need for Schaeffler to quickly scale new business lines to offset margin dilution and reinvestment limitations caused by ongoing elevated costs.

Shares Trade at Steep Discount to DCF Fair Value

- Schaeffler’s current share price of €6.77 is well below its DCF fair value estimate of €19.47. This also places it at a Price-to-Sales Ratio of 0.3x, beneath both peer and industry averages.

- The analysts' consensus view contends that this discount reflects a balance between optimism about future earnings growth and skepticism regarding the company’s ability to deliver amid structural industry shifts.

- Consensus sees the stock as fairly priced near its consensus target of €6.43, indicating that the market is weighing execution risks as much as profit recovery potential.

- The narrow gap between price and target highlights how investor conviction depends on Schaeffler achieving both scale in E-Mobility and transformation in margins to justify any potential upside.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Schaeffler on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do the results tell a different story to you? Take a moment to shape your unique perspective and quickly build a narrative: Do it your way.

A great starting point for your Schaeffler research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Schaeffler’s heavy restructuring costs and elevated debt continue to restrict flexibility for investment, limiting the company’s ability to boost dividends or weather setbacks.

If financial health is your priority, check out solid balance sheet and fundamentals stocks screener (1981 results) to focus on companies with stronger balance sheets and greater capacity to withstand market pressures.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SHA0

Schaeffler

Develops, manufactures, and sells components and systems for industrial applications in Europe, the Americas, China, and the Asia Pacific.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives