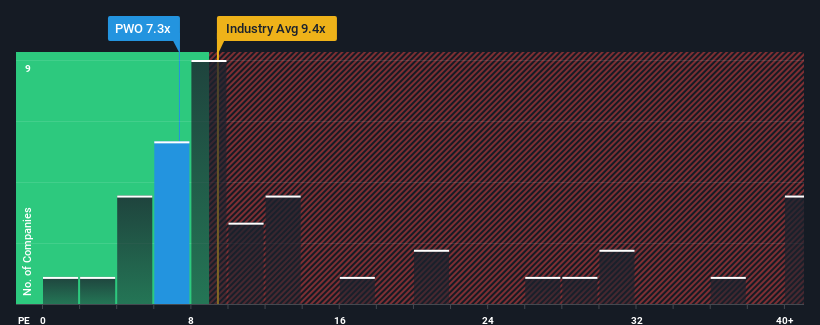

PWO AG's (ETR:PWO) price-to-earnings (or "P/E") ratio of 7.3x might make it look like a strong buy right now compared to the market in Germany, where around half of the companies have P/E ratios above 16x and even P/E's above 29x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

While the market has experienced earnings growth lately, PWO's earnings have gone into reverse gear, which is not great. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for PWO

Is There Any Growth For PWO?

In order to justify its P/E ratio, PWO would need to produce anemic growth that's substantially trailing the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 3.9%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 74% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Shifting to the future, estimates from the only analyst covering the company suggest earnings should grow by 25% over the next year. That's shaping up to be materially higher than the 22% growth forecast for the broader market.

In light of this, it's peculiar that PWO's P/E sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of PWO's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

You need to take note of risks, for example - PWO has 3 warning signs (and 1 which is potentially serious) we think you should know about.

If these risks are making you reconsider your opinion on PWO, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:PWO

PWO

Develops, produces, and sells metal components and systems for the mobility industry in Germany, Czechia, Canada, Mexico, Serbia, and China.

Established dividend payer and good value.

Market Insights

Community Narratives