Porsche (XTRA:P911): A Fresh Look at Valuation After Recent Share Price Volatility

Reviewed by Simply Wall St

See our latest analysis for Dr. Ing. h.c. F. Porsche.

Despite some volatility in the past week, Dr. Ing. h.c. F. Porsche’s recent 1-day and 7-day share price declines have been set against a stronger 1-month share price return of nearly 5%. That said, shares are still down sharply over the past year, with a 12-month total shareholder return of -23.57%, reflecting shifting investor sentiment toward both growth potential and perceived risks in the auto sector.

If Porsche’s recent price action has you watching the sector more closely, now could be the perfect time to discover See the full list for free.

With shares trading roughly 15 percent below intrinsic value estimates, but only slightly under the latest analyst target, the key question is whether Porsche is overlooked right now or if the market has already factored in growth ahead.

Most Popular Narrative: 0.4% Undervalued

Porsche’s narrative fair value stands at €44.53, landing almost exactly at the latest close of €44.35. This close alignment puts a spotlight on the factors shaping today’s consensus, setting up a debate on the drivers and risks that underpin the current price.

The company’s strategic emphasis on product individualization, high-margin exclusivity programs (such as Sonderwunsch and paint-to-sample), and bespoke digital offerings, especially in key affluent markets like China, are likely to support higher average selling prices and revenue diversification. These efforts may provide a buffer to volumes and help to stabilize net margins.

Want to know what forecasts are hiding behind this near-perfect fair value match? There’s a set of bold profit margin and growth assumptions at the core of this consensus. Some of these projections will surprise you, compared to what the company has achieved in the past. Dig in to see which ambitious targets and industry benchmarks the consensus is betting on to keep Porsche’s valuation stable.

Result: Fair Value of €44.53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in China and slower luxury EV adoption could challenge these expectations. This could potentially pressure Porsche's revenue growth and future earnings recovery.

Find out about the key risks to this Dr. Ing. h.c. F. Porsche narrative.

Another View: Earnings Multiples Raise Questions

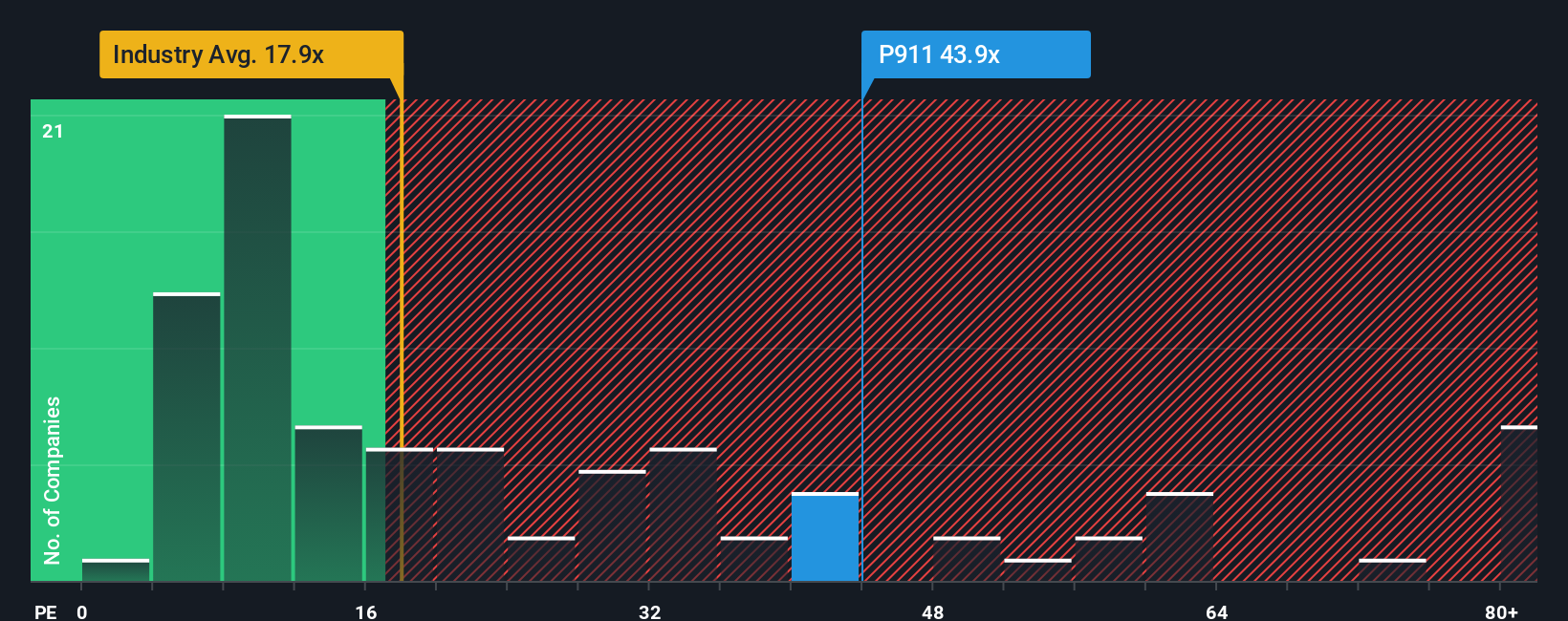

While the consensus fair value lands Porsche near its market price, the price-to-earnings ratio tells a different story. At 42.4x, Porsche’s ratio is much higher than its peer average of 19.4x and also above the fair ratio of 22.2x. This substantial premium suggests investors may be taking on valuation risk if future growth falls short. Could the market be expecting too much?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Dr. Ing. h.c. F. Porsche Narrative

If you see things differently or want to run the numbers your own way, you can build a narrative from scratch in just a few minutes. Do it your way

A great starting point for your Dr. Ing. h.c. F. Porsche research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let today’s opportunities pass you by when the next great investment could be just a screener away. Move confidently beyond Porsche and see where potential leads you:

- Unlock high yields and steady income streams by reviewing these 18 dividend stocks with yields > 3% offering yields above 3% for income-focused investors.

- Jump ahead of market trends by checking out these 27 AI penny stocks featuring emerging leaders in artificial intelligence and next-generation tech.

- Spot undervalued gems primed for breakout growth as you scan through these 906 undervalued stocks based on cash flows using cash flow metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:P911

Dr. Ing. h.c. F. Porsche

Engages in automotive and financial services business in Germany, rest of Europe, North America, China, and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives