Is There an Opportunity in Porsche After Shares Fall 23% in 2025?

Reviewed by Bailey Pemberton

- Wondering if Dr. Ing. h.c. F. Porsche stock is a hidden bargain or an overlooked trap? You are not alone, as questions about its real value are on the minds of many investors right now.

- The share price has moved sharply in recent months, falling 8.1% over the past week but recovering 4.6% in the last month. It remains down 23.3% year to date and 28.8% over the past year, signaling shifting sentiment and volatility around the stock.

- Recent headlines have spotlighted the wider auto sector, with discussions centering around shifting consumer demand and the company's ambitious moves into electric vehicles. These stories have added fresh context to Porsche’s stock swings, making it an especially interesting candidate for a valuation deep dive.

- Looking at the numbers, Dr. Ing. h.c. F. Porsche currently scores just 1 out of 6 on our undervaluation checks, so there is plenty to unpack when it comes to how the market is pricing this stock. Next, we will look at the main ways investors try to gauge value, and you can also discover a potentially smarter approach that could give you a real edge.

Dr. Ing. h.c. F. Porsche scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Dr. Ing. h.c. F. Porsche Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s true value by projecting its future cash flows and discounting them back to today’s value. This approach helps investors focus on the company’s ability to generate cash over time, regardless of near-term market fluctuations.

For Dr. Ing. h.c. F. Porsche, the current Free Cash Flow stands at around €1.16 billion. Analysts provide cash flow projections for the next five years, showing solid growth, while the years beyond are extrapolated by Simply Wall St. By 2029, Free Cash Flow is forecast to reach €3.22 billion, reflecting a strong upward trajectory.

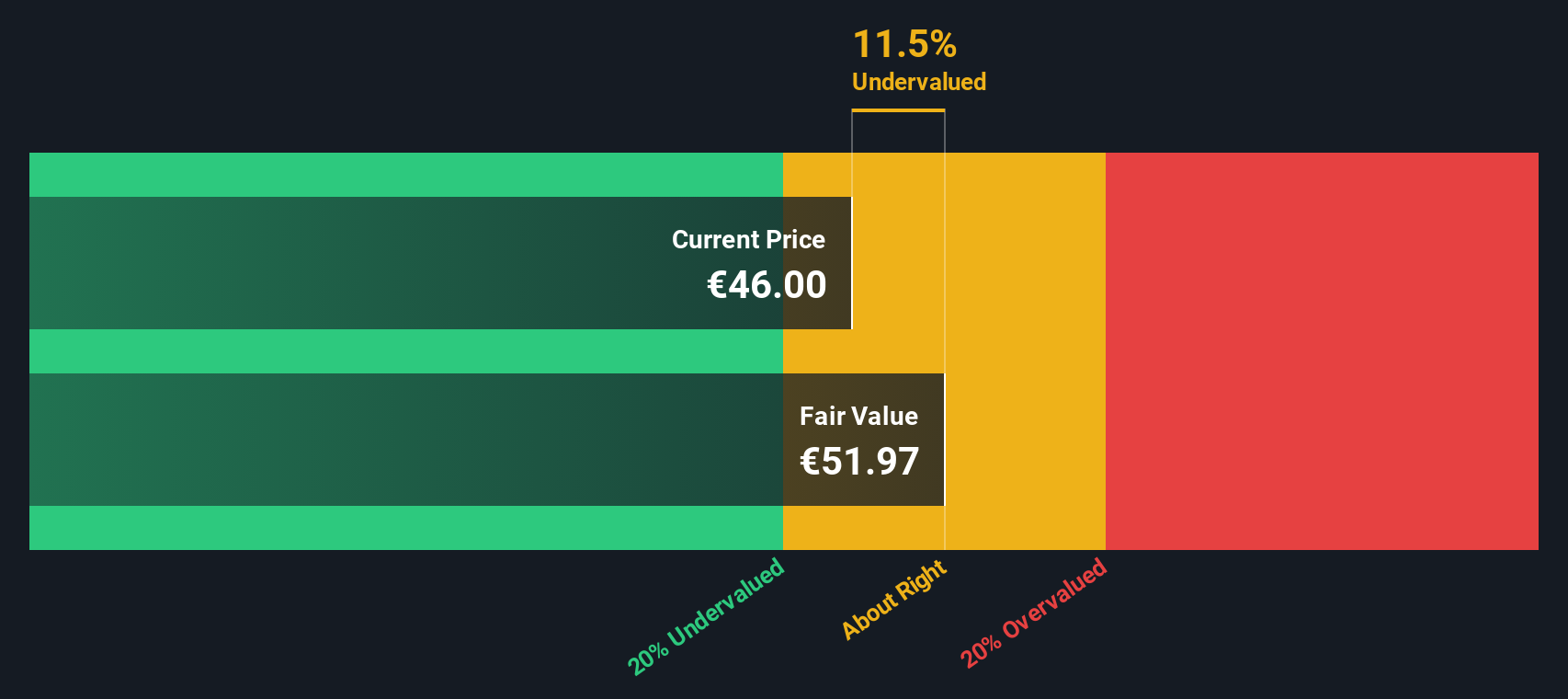

Using a two-stage Free Cash Flow to Equity model, the estimated intrinsic value per share is €52.09. With the stock currently trading at a 14.3% discount to this valuation, the market price suggests Dr. Ing. h.c. F. Porsche is undervalued based on its future cash-generating potential.

Overall, this model indicates investors may be receiving more value than the current price implies, which could appeal to those who prefer a margin of safety.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Dr. Ing. h.c. F. Porsche is undervalued by 14.3%. Track this in your watchlist or portfolio, or discover 842 more undervalued stocks based on cash flows.

Approach 2: Dr. Ing. h.c. F. Porsche Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used tool for valuing profitable companies because it reflects how much investors are willing to pay for each euro of earnings. For companies like Dr. Ing. h.c. F. Porsche that are generating steady profits, the PE ratio gives investors a quick snapshot of how the market values those earnings relative to industry peers and historical norms.

Growth expectations and risk levels are important when interpreting a "fair" PE ratio. Companies expecting stronger earnings growth or offering more stability often command higher PE ratios. In contrast, higher risk or slower growth usually result in lower multiples. The level of confidence investors have in a company's future profits plays a key role in this assessment.

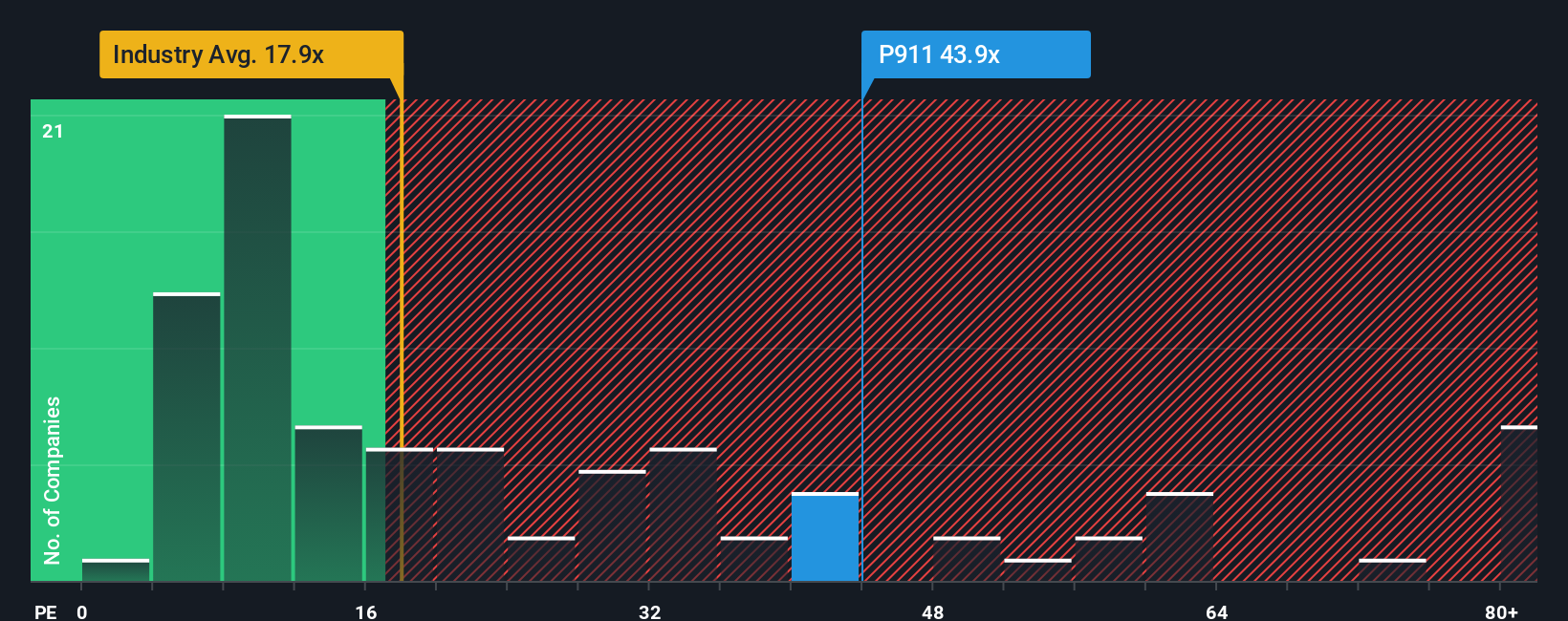

Dr. Ing. h.c. F. Porsche currently trades at a PE ratio of 42.74x, which is significantly above the auto industry average of 18.0x and the peer average of 9.03x. Simply Wall St, instead of just comparing raw numbers, uses a proprietary "Fair Ratio" metric, which in this case is 22.28x. This Fair Ratio takes into account Porsche’s unique growth outlook, profit margins, market cap, and risk profile and provides a more tailored benchmark than simply looking at industry or peer averages.

Comparing the current PE ratio to the Fair Ratio shows the stock is valued well above where it should be based on its fundamentals and outlook. This suggests Dr. Ing. h.c. F. Porsche may be overvalued at current levels according to this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1409 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Dr. Ing. h.c. F. Porsche Narrative

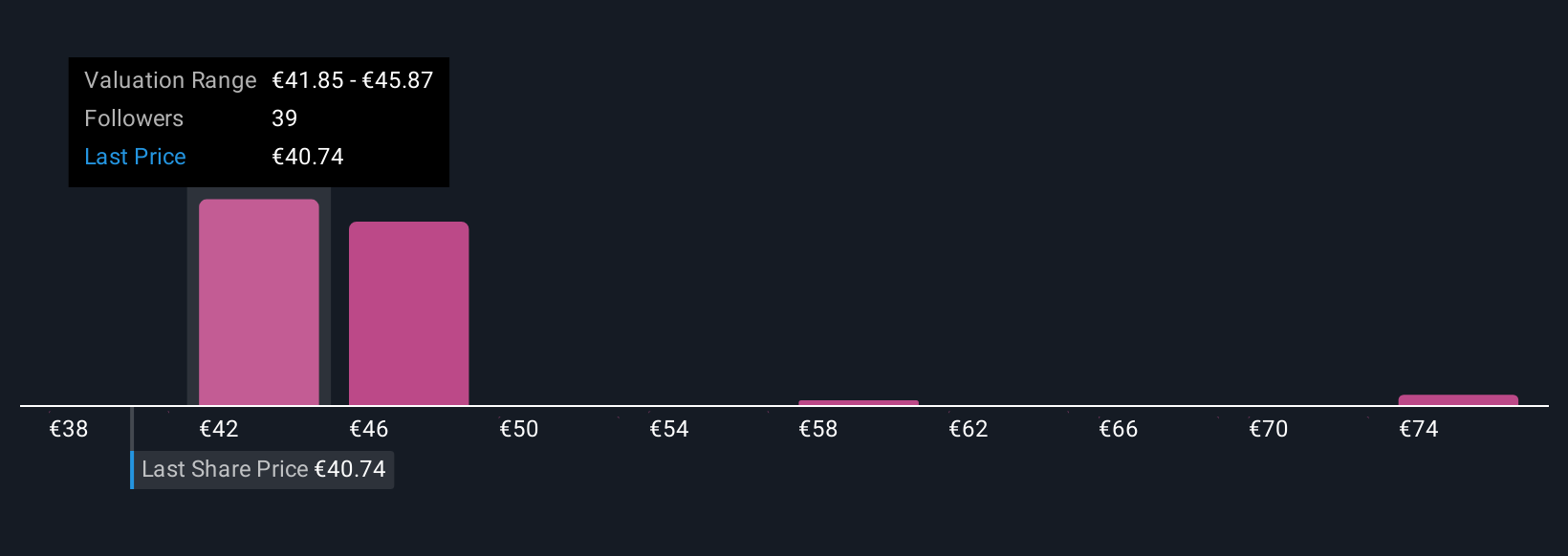

Earlier, we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, story-driven framework that helps you connect your personal view of Dr. Ing. h.c. F. Porsche’s future, such as its growth in electric models or the risks of market competition, with your expectations for its financials, like future revenue, earnings, and margins.

Narratives link a company’s story directly to a financial forecast, then map that forecast to a Fair Value. This enables you to see how your perspective matches up with the market price. On Simply Wall St, millions of investors build and share these dynamic Narratives within the Community page, making it easy for anyone to harness this powerful tool, even without an accounting or finance background.

With Narratives, you can make clearer decisions about when to buy or sell by comparing your calculated Fair Value to the current share price. Since Narratives update automatically whenever news or earnings data changes, you stay in sync with the latest developments.

For example, one investor might build a Narrative that sees electrification fueling rapid growth, justifying a higher Fair Value. Another may focus on competitive threats and assign a much lower Fair Value, each grounded in their own story and expectations for Porsche’s future.

Do you think there's more to the story for Dr. Ing. h.c. F. Porsche? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:P911

Dr. Ing. h.c. F. Porsche

Engages in automotive and financial services business in Germany, rest of Europe, North America, China, and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives