Stock Analysis

As June 2024 unfolds, the German market shows a promising uptick with the DAX index climbing by 0.90%, reflecting a broader European market recovery amid easing political uncertainties and a more favorable outlook for monetary policy. In this context, considering dividend stocks could be particularly interesting for investors looking for potential stability and steady returns in a landscape where major indices are performing well. A good dividend stock typically offers not just regular income but also the potential for capital appreciation. Given the current economic environment, companies with strong fundamentals and a history of resilient performance in varying market conditions could stand out as attractive candidates.

Top 10 Dividend Stocks In Germany

| Name | Dividend Yield | Dividend Rating |

| Allianz (XTRA:ALV) | 5.32% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 4.91% | ★★★★★★ |

| Brenntag (XTRA:BNR) | 3.27% | ★★★★★☆ |

| Talanx (XTRA:TLX) | 3.18% | ★★★★★☆ |

| Südzucker (XTRA:SZU) | 6.52% | ★★★★★☆ |

| MLP (XTRA:MLP) | 4.72% | ★★★★★☆ |

| Deutsche Telekom (XTRA:DTE) | 3.37% | ★★★★★☆ |

| DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 6.25% | ★★★★★☆ |

| Mercedes-Benz Group (XTRA:MBG) | 8.33% | ★★★★★☆ |

| Deutsche Lufthansa (XTRA:LHA) | 5.24% | ★★★★☆☆ |

Click here to see the full list of 31 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Bayerische Motoren Werke (XTRA:BMW)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bayerische Motoren Werke Aktiengesellschaft (BMW) operates globally, focusing on the development, manufacture, and sale of automobiles and motorcycles, along with spare parts and accessories, with a market capitalization of approximately €54.90 billion.

Operations: Bayerische Motoren Werke Aktiengesellschaft (BMW) generates revenue primarily through its Automotive segment at €131.95 billion, Motorcycles at €3.15 billion, and Financial Services at €36.93 billion.

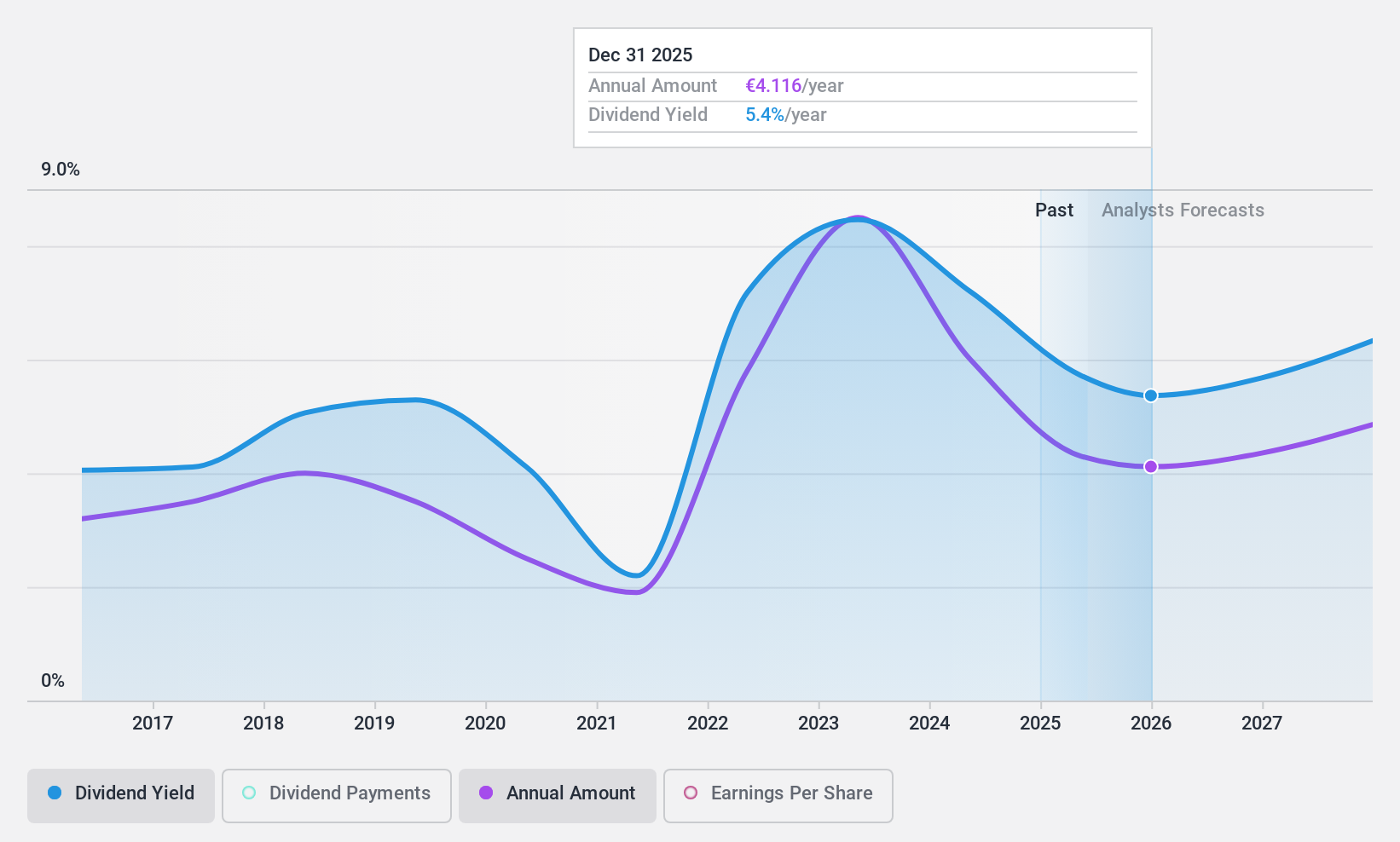

Dividend Yield: 6.9%

Bayerische Motoren Werke (BMW) offers a dividend yield higher than many German peers, positioned in the top 25% of dividend payers within the market. Despite this, its dividends have shown volatility over the past decade and are not consistently covered by cash flows or earnings, indicating potential sustainability issues. Recently, BMW has actively engaged in share buybacks and strategic investments to strengthen its position in the electric vehicle sector. However, analysts suggest that BMW's stock is trading below target prices with expectations for growth.

- Click to explore a detailed breakdown of our findings in Bayerische Motoren Werke's dividend report.

- Upon reviewing our latest valuation report, Bayerische Motoren Werke's share price might be too pessimistic.

Deutsche Lufthansa (XTRA:LHA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Deutsche Lufthansa AG is a global aviation company with a market capitalization of approximately €6.85 billion.

Operations: Deutsche Lufthansa AG generates revenue primarily through its Passenger Airlines segment at €28.69 billion, followed by Maintenance, Repair and Overhaul Services at €6.78 billion, Logistics at €2.85 billion, and Additional Businesses and Group Functions contributing €0.97 billion.

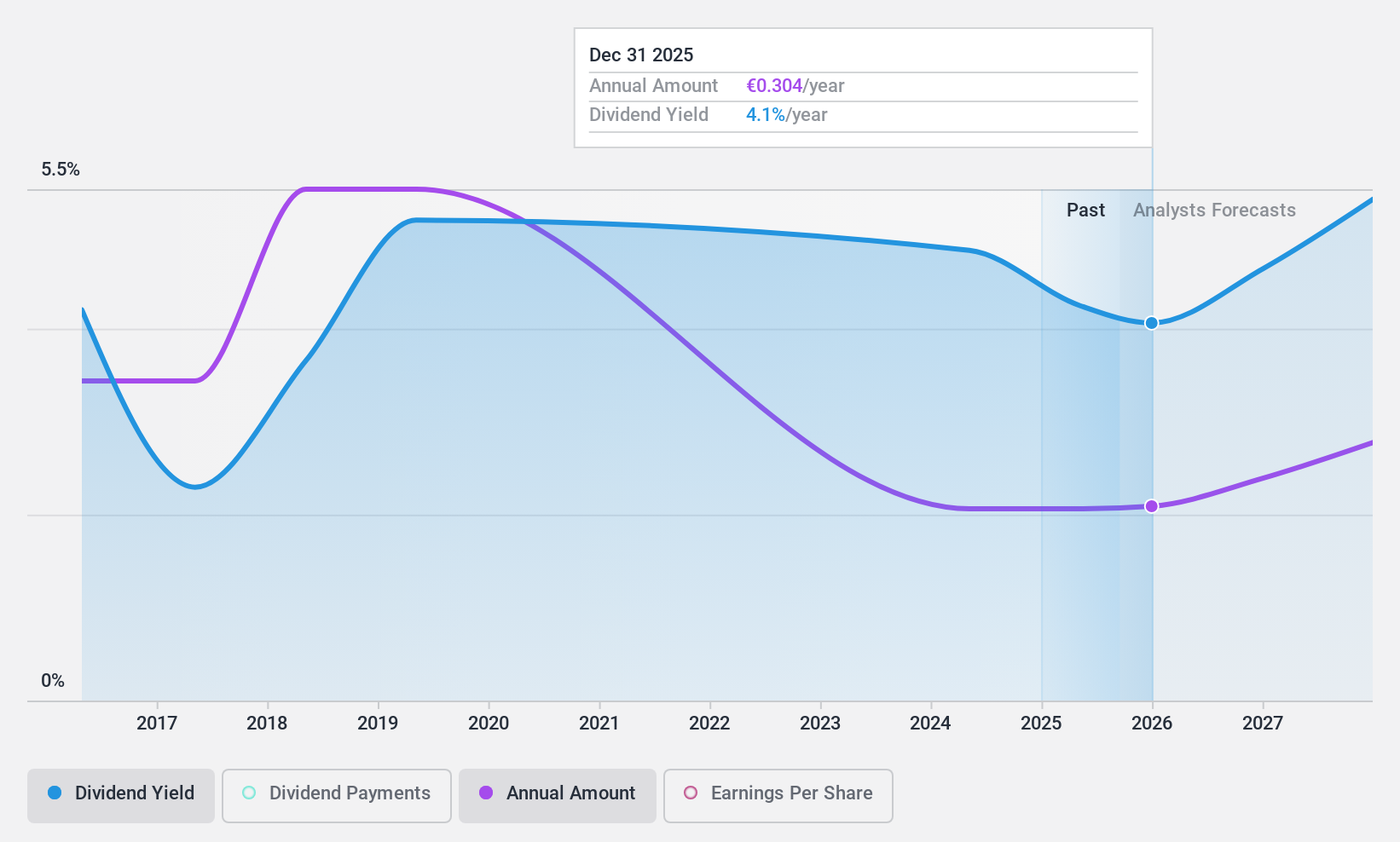

Dividend Yield: 5.2%

Deutsche Lufthansa AG recently proposed a €0.30 dividend per share, despite reporting a significant first-quarter net loss of €734 million, deepening from the previous year. The company's dividend history is marked by instability, with payments showing variability over the past decade. However, current dividends are supported by earnings and cash flows, with a payout ratio of 22.3% and a cash payout ratio of 50.3%, suggesting some level of sustainability amid financial challenges.

- Dive into the specifics of Deutsche Lufthansa here with our thorough dividend report.

- Our expertly prepared valuation report Deutsche Lufthansa implies its share price may be lower than expected.

Novem Group (XTRA:NVM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Novem Group S.A., based in Luxembourg, specializes in developing and supplying trim elements and decorative function elements for car interiors globally, with a market capitalization of approximately €240.97 million.

Operations: Novem Group S.A. generates €635.50 million from its Auto Parts & Accessories segment.

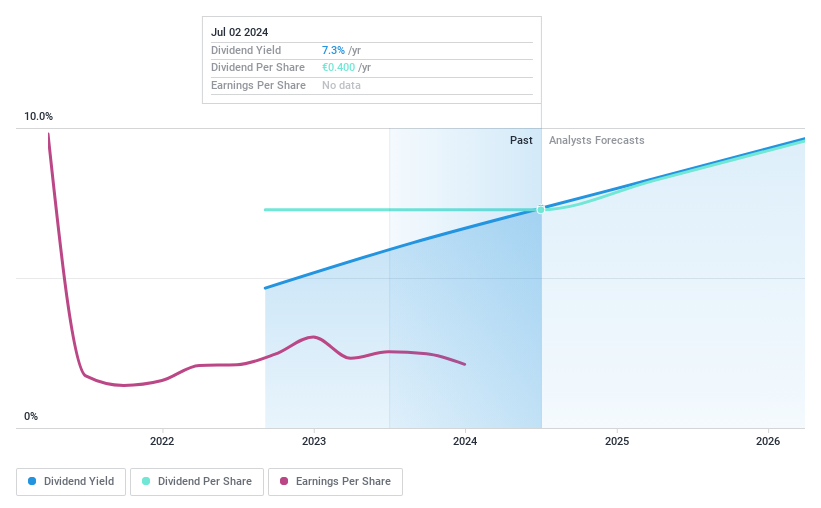

Dividend Yield: 7.1%

Novem Group S.A. experienced a decline in annual sales to €635.5 million and net income to €34.8 million, reflecting reduced fourth-quarter performance with sales at €149.7 million and net income at €3.4 million. Despite this, the company offers a competitive dividend yield of 7.14%, supported by low payout ratios of 37.7% for earnings and 36.1% for cash flows, indicating sustainability in its dividend payments amid financial setbacks and high debt levels.

- Navigate through the intricacies of Novem Group with our comprehensive dividend report here.

- Our valuation report here indicates Novem Group may be undervalued.

Where To Now?

- Get an in-depth perspective on all 31 Top Dividend Stocks by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Deutsche Lufthansa is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:LHA

Undervalued with proven track record and pays a dividend.