Market Participants Recognise Alkis H. Hadjikyriacos (Frou Frou Biscuits) Public Ltd.'s (CSE:FBI) Earnings Pushing Shares 26% Higher

Alkis H. Hadjikyriacos (Frou Frou Biscuits) Public Ltd. (CSE:FBI) shares have had a really impressive month, gaining 26% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 34%.

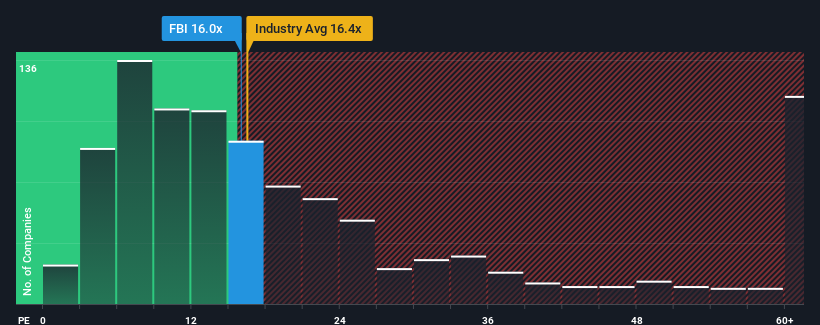

Following the firm bounce in price, Alkis H. Hadjikyriacos (Frou Frou Biscuits) may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 16x, since almost half of all companies in Cyprus have P/E ratios under 7x and even P/E's lower than 3x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Our free stock report includes 4 warning signs investors should be aware of before investing in Alkis H. Hadjikyriacos (Frou Frou Biscuits). Read for free now.Alkis H. Hadjikyriacos (Frou Frou Biscuits) has been doing a good job lately as it's been growing earnings at a solid pace. One possibility is that the P/E is high because investors think this respectable earnings growth will be enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Alkis H. Hadjikyriacos (Frou Frou Biscuits)

How Is Alkis H. Hadjikyriacos (Frou Frou Biscuits)'s Growth Trending?

The only time you'd be truly comfortable seeing a P/E as steep as Alkis H. Hadjikyriacos (Frou Frou Biscuits)'s is when the company's growth is on track to outshine the market decidedly.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 10% last year. Pleasingly, EPS has also lifted 642% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 20% shows it's noticeably more attractive on an annualised basis.

With this information, we can see why Alkis H. Hadjikyriacos (Frou Frou Biscuits) is trading at such a high P/E compared to the market. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

What We Can Learn From Alkis H. Hadjikyriacos (Frou Frou Biscuits)'s P/E?

Alkis H. Hadjikyriacos (Frou Frou Biscuits)'s P/E is flying high just like its stock has during the last month. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Alkis H. Hadjikyriacos (Frou Frou Biscuits) revealed its three-year earnings trends are contributing to its high P/E, given they look better than current market expectations. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. If recent medium-term earnings trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

Plus, you should also learn about these 4 warning signs we've spotted with Alkis H. Hadjikyriacos (Frou Frou Biscuits) (including 1 which is potentially serious).

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CSE:FBI

Alkis H. Hadjikyriacos (Frou Frou Biscuits)

Alkis H. Hadjikyriacos (Frou Frou Biscuits) Public Ltd.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives