- China

- /

- Renewable Energy

- /

- SZSE:000862

Investors who have held Ning Xia Yin Xing EnergyLtd (SZSE:000862) over the last year have watched its earnings decline along with their investment

Ning Xia Yin Xing Energy Co.,Ltd (SZSE:000862) shareholders should be happy to see the share price up 19% in the last month. But in truth the last year hasn't been good for the share price. In fact, the price has declined 19% in a year, falling short of the returns you could get by investing in an index fund.

Although the past week has been more reassuring for shareholders, they're still in the red over the last year, so let's see if the underlying business has been responsible for the decline.

See our latest analysis for Ning Xia Yin Xing EnergyLtd

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

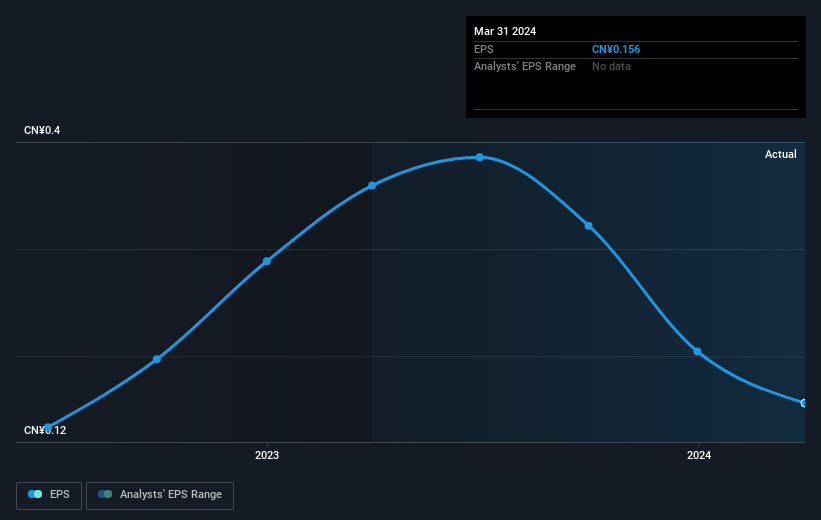

Unhappily, Ning Xia Yin Xing EnergyLtd had to report a 57% decline in EPS over the last year. The share price fall of 19% isn't as bad as the reduction in earnings per share. So the market may not be too worried about the EPS figure, at the moment -- or it may have expected earnings to drop faster.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Dive deeper into Ning Xia Yin Xing EnergyLtd's key metrics by checking this interactive graph of Ning Xia Yin Xing EnergyLtd's earnings, revenue and cash flow.

A Different Perspective

We regret to report that Ning Xia Yin Xing EnergyLtd shareholders are down 19% for the year. Unfortunately, that's worse than the broader market decline of 9.7%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Longer term investors wouldn't be so upset, since they would have made 1.4%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Ning Xia Yin Xing EnergyLtd is showing 4 warning signs in our investment analysis , and 1 of those is a bit unpleasant...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Ning Xia Yin Xing EnergyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000862

Ning Xia Yin Xing EnergyLtd

Engages in the energy power generation and equipment manufacturing businesses in China.

Slight and fair value.