Stock Analysis

- China

- /

- Renewable Energy

- /

- SZSE:000767

Further weakness as Jinneng Holding Shanxi Electric PowerLTD (SZSE:000767) drops 5.6% this week, taking three-year losses to 27%

One simple way to benefit from a rising market is to buy an index fund. In contrast individual stocks will provide a wide range of possible returns, and may fall short. The Jinneng Holding Shanxi Electric Power Co.,LTD. (SZSE:000767) is such an example; over three years its share price is down 27% versus a marketdecline of 24%. And the ride hasn't got any smoother in recent times over the last year, with the price 23% lower in that time. Shareholders have had an even rougher run lately, with the share price down 15% in the last 90 days.

If the past week is anything to go by, investor sentiment for Jinneng Holding Shanxi Electric PowerLTD isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

Check out our latest analysis for Jinneng Holding Shanxi Electric PowerLTD

Because Jinneng Holding Shanxi Electric PowerLTD made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually desire strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last three years, Jinneng Holding Shanxi Electric PowerLTD saw its revenue grow by 16% per year, compound. That's a fairly respectable growth rate. Shareholders have endured a share price decline of 8% per year. So the market has definitely lost some love for the stock. With revenue growing at a solid clip, now might be the time to focus on the possibility that it will have a brighter future.

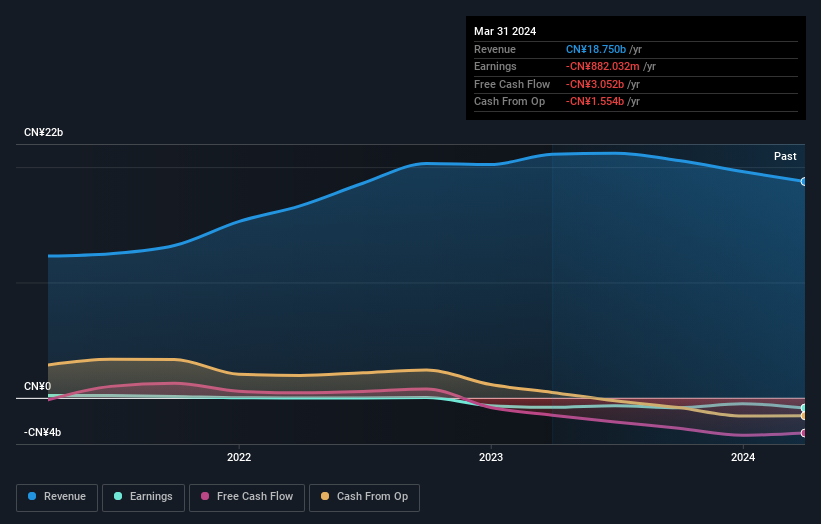

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

We regret to report that Jinneng Holding Shanxi Electric PowerLTD shareholders are down 23% for the year. Unfortunately, that's worse than the broader market decline of 14%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 3% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Jinneng Holding Shanxi Electric PowerLTD is showing 1 warning sign in our investment analysis , you should know about...

But note: Jinneng Holding Shanxi Electric PowerLTD may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Jinneng Holding Shanxi Electric PowerLTD is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Jinneng Holding Shanxi Electric PowerLTD is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000767

Jinneng Holding Shanxi Electric PowerLTD

Engages in the production and sale of electricity and heat products in China.

Slightly overvalued with imperfect balance sheet.