- China

- /

- Renewable Energy

- /

- SZSE:000767

Further Upside For Jinneng Holding Shanxi Electric Power Co.,LTD. (SZSE:000767) Shares Could Introduce Price Risks After 28% Bounce

Jinneng Holding Shanxi Electric Power Co.,LTD. (SZSE:000767) shares have continued their recent momentum with a 28% gain in the last month alone. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

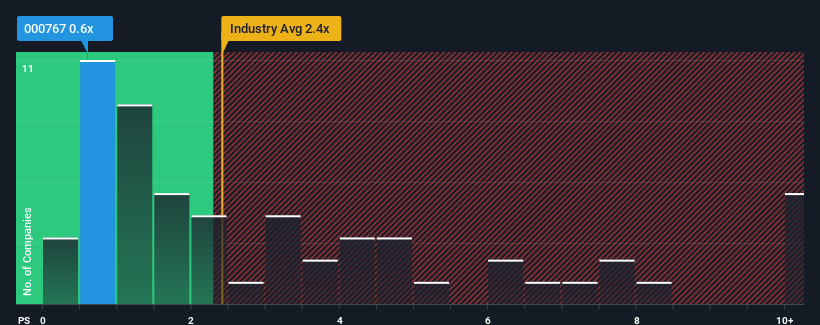

Although its price has surged higher, Jinneng Holding Shanxi Electric PowerLTD may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.6x, considering almost half of all companies in the Renewable Energy industry in China have P/S ratios greater than 2.4x and even P/S higher than 5x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Jinneng Holding Shanxi Electric PowerLTD

What Does Jinneng Holding Shanxi Electric PowerLTD's Recent Performance Look Like?

For example, consider that Jinneng Holding Shanxi Electric PowerLTD's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Jinneng Holding Shanxi Electric PowerLTD will help you shine a light on its historical performance.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Jinneng Holding Shanxi Electric PowerLTD's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 20%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 24% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 9.1% shows it's about the same on an annualised basis.

With this in consideration, we find it intriguing that Jinneng Holding Shanxi Electric PowerLTD's P/S falls short of its industry peers. It may be that most investors are not convinced the company can maintain recent growth rates.

What We Can Learn From Jinneng Holding Shanxi Electric PowerLTD's P/S?

Jinneng Holding Shanxi Electric PowerLTD's stock price has surged recently, but its but its P/S still remains modest. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

The fact that Jinneng Holding Shanxi Electric PowerLTD currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. When we see industry-like revenue growth but a lower than expected P/S, we assume potential risks are what might be placing downward pressure on the share price. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions should normally provide more support to the share price.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Jinneng Holding Shanxi Electric PowerLTD that you should be aware of.

If these risks are making you reconsider your opinion on Jinneng Holding Shanxi Electric PowerLTD, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000767

Jinneng Holding Shanxi Electric PowerLTD

Engages in the production and sale of electricity and heat products in China.

Slightly overvalued with questionable track record.

Market Insights

Community Narratives