- China

- /

- Electric Utilities

- /

- SHSE:605162

Zhejiang Xinzhonggang Thermal Power Co., LTD.'s (SHSE:605162) Price Is Right But Growth Is Lacking After Shares Rocket 26%

Those holding Zhejiang Xinzhonggang Thermal Power Co., LTD. (SHSE:605162) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 7.6% in the last twelve months.

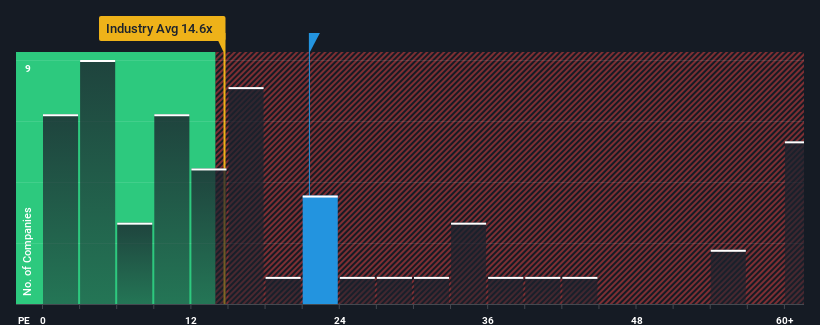

Even after such a large jump in price, Zhejiang Xinzhonggang Thermal Power's price-to-earnings (or "P/E") ratio of 21.5x might still make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 31x and even P/E's above 56x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Zhejiang Xinzhonggang Thermal Power has been doing a good job lately as it's been growing earnings at a solid pace. One possibility is that the P/E is low because investors think this respectable earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

View our latest analysis for Zhejiang Xinzhonggang Thermal Power

How Is Zhejiang Xinzhonggang Thermal Power's Growth Trending?

In order to justify its P/E ratio, Zhejiang Xinzhonggang Thermal Power would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings growth, the company posted a terrific increase of 28%. Still, incredibly EPS has fallen 24% in total from three years ago, which is quite disappointing. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 39% shows it's an unpleasant look.

With this information, we are not surprised that Zhejiang Xinzhonggang Thermal Power is trading at a P/E lower than the market. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

What We Can Learn From Zhejiang Xinzhonggang Thermal Power's P/E?

Despite Zhejiang Xinzhonggang Thermal Power's shares building up a head of steam, its P/E still lags most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Zhejiang Xinzhonggang Thermal Power maintains its low P/E on the weakness of its sliding earnings over the medium-term, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Having said that, be aware Zhejiang Xinzhonggang Thermal Power is showing 2 warning signs in our investment analysis, and 1 of those is concerning.

If you're unsure about the strength of Zhejiang Xinzhonggang Thermal Power's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Xinzhonggang Thermal Power might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:605162

Zhejiang Xinzhonggang Thermal Power

Zhejiang Xinzhonggang Thermal Power Co., LTD.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives