- China

- /

- Gas Utilities

- /

- SHSE:603053

Top Three Dividend Stocks In China For July 2024

Reviewed by Simply Wall St

As of late, the Chinese market has shown signs of weakening, with major indices like the Shanghai Composite and CSI 300 experiencing slight declines amidst economic slowdown concerns. This backdrop sets a cautious stage for investors looking at dividend stocks in China. In such an environment, identifying stocks that not only offer dividends but also demonstrate resilience and potential for steady performance becomes crucial.

Top 10 Dividend Stocks In China

| Name | Dividend Yield | Dividend Rating |

| Shandong Wit Dyne HealthLtd (SZSE:000915) | 6.74% | ★★★★★★ |

| Midea Group (SZSE:000333) | 4.76% | ★★★★★★ |

| Changhong Meiling (SZSE:000521) | 4.05% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.56% | ★★★★★★ |

| Inner Mongolia Yili Industrial Group (SHSE:600887) | 4.65% | ★★★★★★ |

| Ping An Bank (SZSE:000001) | 6.97% | ★★★★★★ |

| Huangshan NovelLtd (SZSE:002014) | 5.61% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.33% | ★★★★★★ |

| Chacha Food Company (SZSE:002557) | 3.53% | ★★★★★★ |

| Zhejiang Jiaxin SilkLtd (SZSE:002404) | 5.64% | ★★★★★★ |

Click here to see the full list of 235 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Chengdu Gas Group (SHSE:603053)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chengdu Gas Group Corporation Ltd. operates in the urban gas supply sector in China, with a market capitalization of approximately CN¥8.83 billion.

Operations: Chengdu Gas Group Corporation Ltd. generates its revenue primarily from the urban gas supply sector in China.

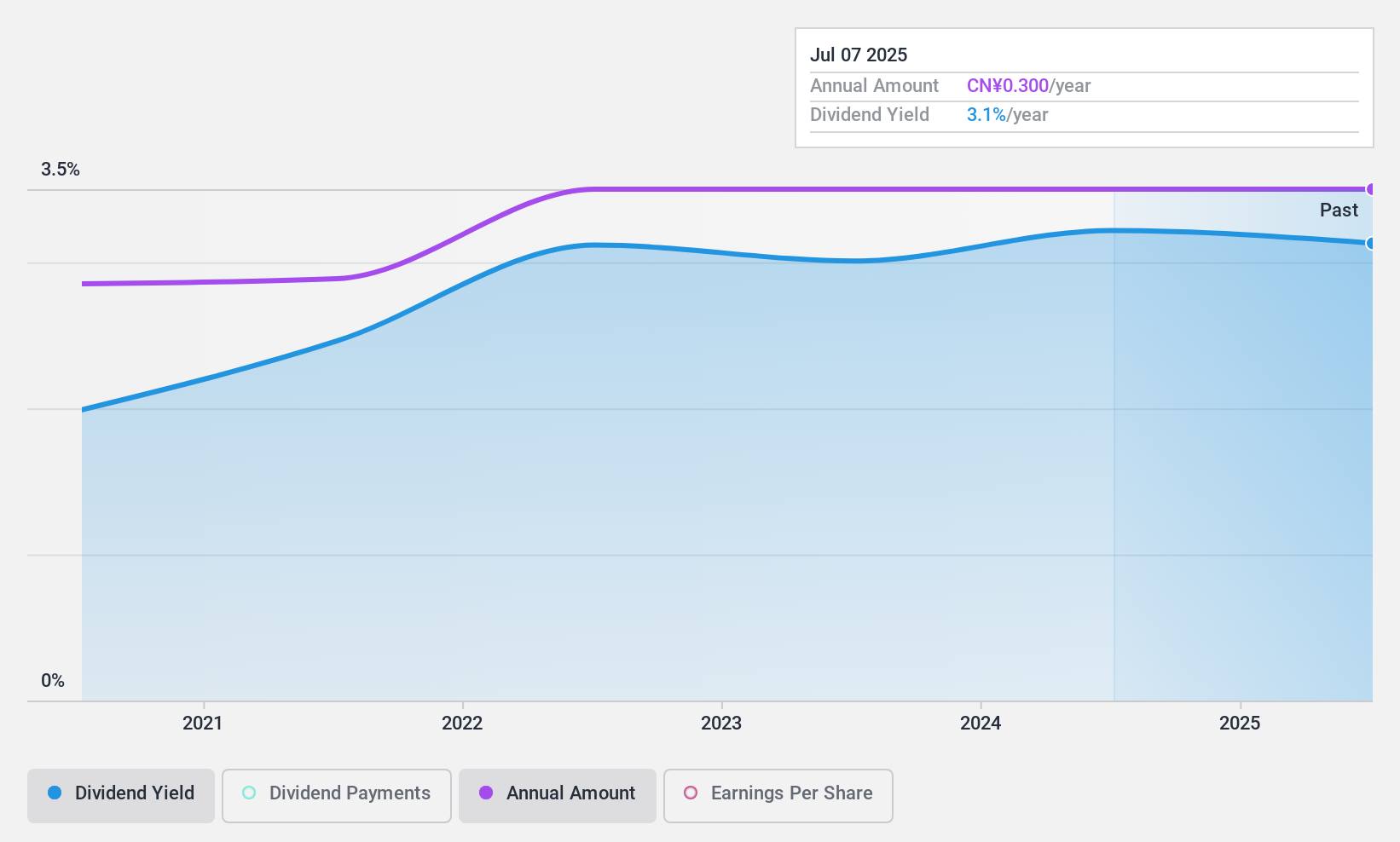

Dividend Yield: 3%

Chengdu Gas Group's recent earnings show a modest increase in net income to CNY 195.81 million and revenue reaching CNY 1,693.75 million for Q1 2024, reflecting steady growth. Despite a short dividend history of less than ten years, the company has managed to grow its dividend payments annually and maintains a healthy payout with earnings covering 50.1% and cash flows at 28.8%. Trading significantly below estimated fair value, it offers potential upside while maintaining a competitive yield among top Chinese dividend stocks at 3.02%.

- Click to explore a detailed breakdown of our findings in Chengdu Gas Group's dividend report.

- Our comprehensive valuation report raises the possibility that Chengdu Gas Group is priced lower than what may be justified by its financials.

Jiang Su Suyan JingshenLtd (SHSE:603299)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jiang Su Suyan Jingshen Co., Ltd. is a Chinese company involved in the mining, research, production, distribution, and sale of salt and salt chemicals with a market capitalization of CN¥7.77 billion.

Operations: Jiang Su Suyan Jingshen Co., Ltd.'s revenue is derived from its operations in the mining, research, production, distribution, and sale of salt and related chemical products.

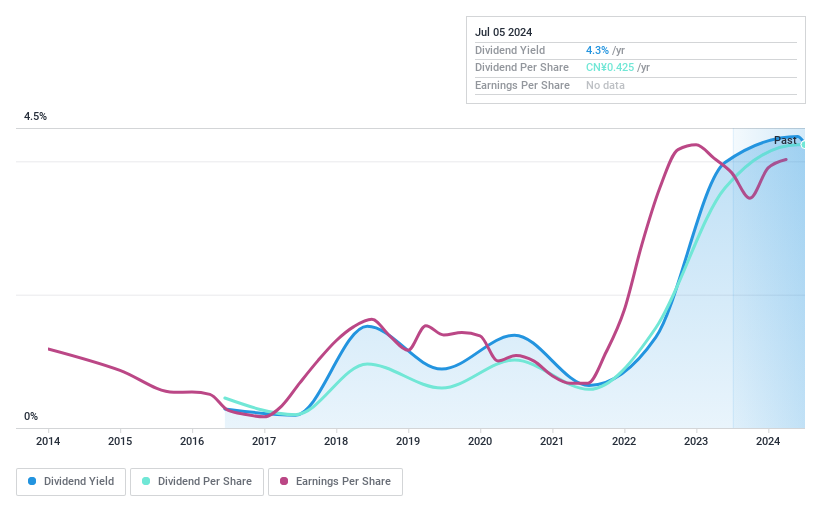

Dividend Yield: 4.3%

Jiang Su Suyan JingshenLtd reported a decrease in Q1 2024 sales to CNY 1.39 billion from CNY 1.54 billion year-over-year, though net income rose to CNY 226.85 million from CNY 205.8 million, with EPS increasing accordingly. Despite a volatile dividend history over the past eight years and only recent initiation into dividend payments, the company's dividends are well-supported by both earnings and cash flows, with payout ratios of 43.2% and 32.6%, respectively. The stock is trading at a significant discount to its estimated fair value, suggesting potential for appreciation while offering a competitive yield within the top quartile of Chinese dividend payers.

- Click here to discover the nuances of Jiang Su Suyan JingshenLtd with our detailed analytical dividend report.

- The analysis detailed in our Jiang Su Suyan JingshenLtd valuation report hints at an deflated share price compared to its estimated value.

Shandong Sunway Chemical Group (SZSE:002469)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shandong Sunway Chemical Group Co., Ltd. operates in China, offering engineering services to the petrochemical and coal chemical industries, with a market capitalization of approximately CN¥3.82 billion.

Operations: Shandong Sunway Chemical Group Co., Ltd. generates its revenue primarily through engineering services within the petrochemical and coal chemical sectors in China.

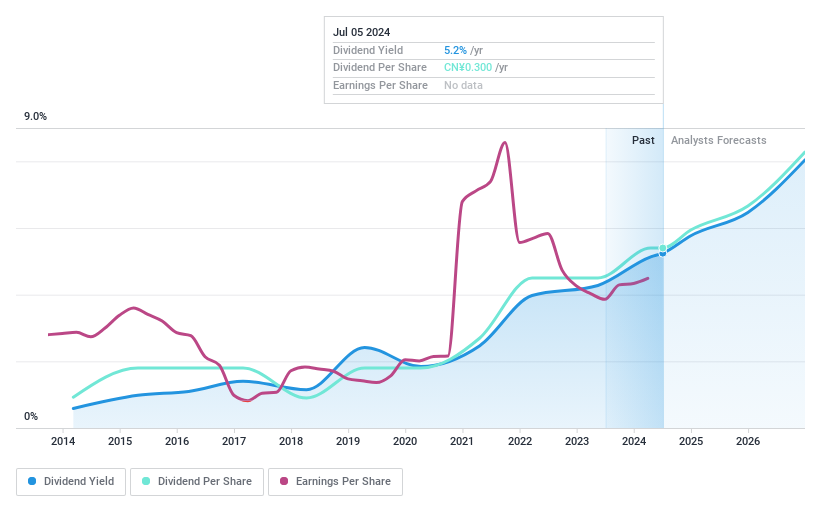

Dividend Yield: 5.1%

Shandong Sunway Chemical Group Co., Ltd. recently increased its annual dividend to CNY 3.00 per 10 shares for 2023, reflecting a commitment to shareholder returns despite a dip in Q1 2024 sales to CNY 518.92 million from CNY 598.41 million year-over-year. However, the company's net income improved to CNY 57.58 million from CNY 45.4 million, supporting a sustainable dividend with an earnings coverage ratio of 66.9% and cash payout ratio of 32.9%. The firm's dividends have shown growth but remain volatile over the past decade, indicating potential risks for investors seeking stable returns.

- Delve into the full analysis dividend report here for a deeper understanding of Shandong Sunway Chemical Group.

- In light of our recent valuation report, it seems possible that Shandong Sunway Chemical Group is trading behind its estimated value.

Summing It All Up

- Reveal the 235 hidden gems among our Top Dividend Stocks screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603053

Flawless balance sheet average dividend payer.