- China

- /

- Renewable Energy

- /

- SHSE:601778

These 4 Measures Indicate That Jinko Power Technology (SHSE:601778) Is Using Debt In A Risky Way

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Jinko Power Technology Co., Ltd. (SHSE:601778) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Jinko Power Technology

How Much Debt Does Jinko Power Technology Carry?

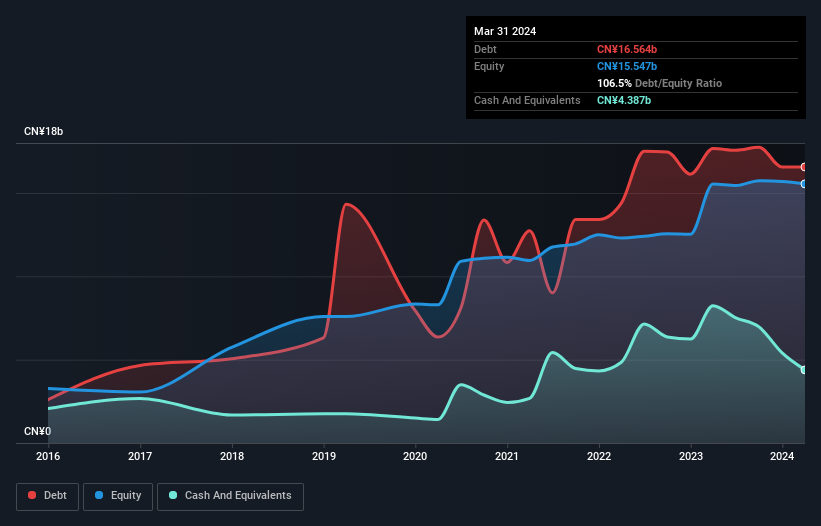

The image below, which you can click on for greater detail, shows that Jinko Power Technology had debt of CN¥16.6b at the end of March 2024, a reduction from CN¥17.7b over a year. On the flip side, it has CN¥4.39b in cash leading to net debt of about CN¥12.2b.

A Look At Jinko Power Technology's Liabilities

The latest balance sheet data shows that Jinko Power Technology had liabilities of CN¥9.01b due within a year, and liabilities of CN¥17.1b falling due after that. Offsetting these obligations, it had cash of CN¥4.39b as well as receivables valued at CN¥7.23b due within 12 months. So its liabilities total CN¥14.5b more than the combination of its cash and short-term receivables.

The deficiency here weighs heavily on the CN¥7.97b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt. At the end of the day, Jinko Power Technology would probably need a major re-capitalization if its creditors were to demand repayment.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

With a net debt to EBITDA ratio of 6.1, it's fair to say Jinko Power Technology does have a significant amount of debt. But the good news is that it boasts fairly comforting interest cover of 2.5 times, suggesting it can responsibly service its obligations. Even more troubling is the fact that Jinko Power Technology actually let its EBIT decrease by 7.8% over the last year. If it keeps going like that paying off its debt will be like running on a treadmill -- a lot of effort for not much advancement. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Jinko Power Technology's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, Jinko Power Technology burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

To be frank both Jinko Power Technology's conversion of EBIT to free cash flow and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. And furthermore, its interest cover also fails to instill confidence. We think the chances that Jinko Power Technology has too much debt a very significant. To our minds, that means the stock is rather high risk, and probably one to avoid; but to each their own (investing) style. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 2 warning signs for Jinko Power Technology (1 is concerning) you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601778

Jinko Power Technology

Operates as an clean energy supplier and service provider.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives