- Japan

- /

- Auto Components

- /

- TSE:3116

Dividend Stocks To Consider In October 2024

Reviewed by Simply Wall St

As global markets navigate the complexities of rising U.S. Treasury yields and tepid economic growth, investors are keeping a close eye on how these factors influence equity performance, particularly in the U.S., where large-cap stocks have shown resilience despite broader market pressures. In this environment, dividend stocks can offer a compelling option for those seeking stability and income, as they often provide consistent returns through dividends even when market conditions are challenging.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.94% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.08% | ★★★★★★ |

| Globeride (TSE:7990) | 4.02% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.93% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.90% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.60% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.00% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.35% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.87% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.93% | ★★★★★★ |

Click here to see the full list of 2013 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

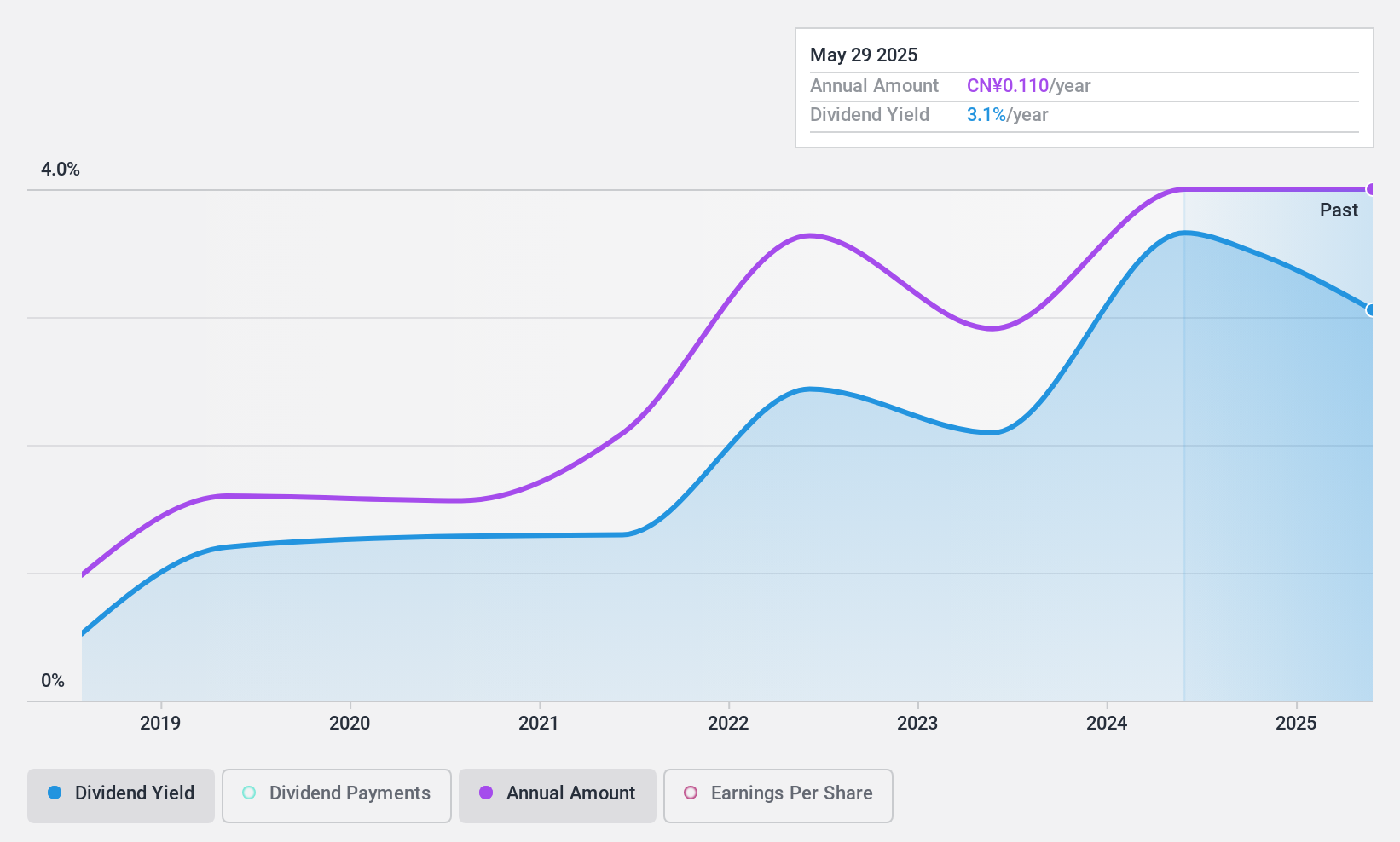

Jiaze Renewables (SHSE:601619)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jiaze Renewables Corporation Limited is involved in the development, construction, sale, operation, and maintenance of new energy projects with a market cap of CN¥7.81 billion.

Operations: Jiaze Renewables Corporation Limited generates revenue through its activities in the development, construction, sale, operation, and maintenance of new energy projects.

Dividend Yield: 3.3%

Jiaze Renewables has maintained a dividend yield of 3.28%, placing it in the top 25% of Chinese market dividend payers, though its track record is unstable with volatility over six years. Despite this, dividends are well covered by earnings and cash flows, with a payout ratio of 41.3% and cash payout ratio of 57%. However, recent earnings show a decline in net income to CNY 550.76 million for the first nine months of 2024 from CNY 649.2 million previously, highlighting potential challenges for sustaining dividends amidst high debt levels.

- Get an in-depth perspective on Jiaze Renewables' performance by reading our dividend report here.

- Our valuation report unveils the possibility Jiaze Renewables' shares may be trading at a premium.

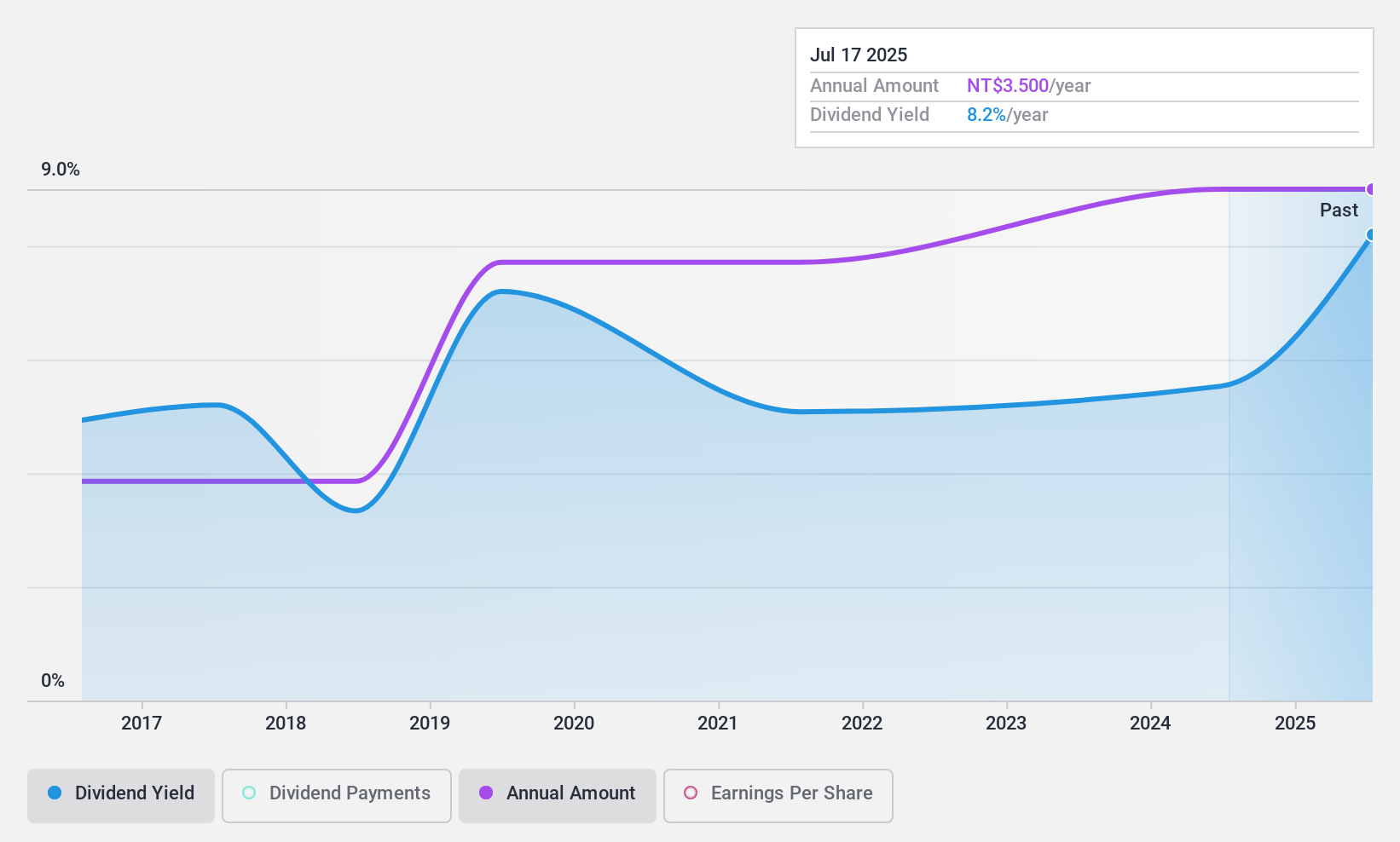

Li Ming Development Construction (TPEX:6212)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Li Ming Development Construction Co., Ltd. (TPEX:6212) operates in the construction industry and has a market capitalization of NT$62.32 billion.

Operations: Li Ming Development Construction Co., Ltd. generates its revenue primarily from Real Estate Development, amounting to NT$7.58 billion.

Dividend Yield: 5.7%

Li Ming Development Construction's dividend yield is in the top 25% of the Taiwanese market, yet its nine-year history shows volatility with payments dropping over 20% annually. Despite this, dividends are well-covered by earnings and cash flows, with payout ratios of 45.4% and 9.2%, respectively. Recent earnings surged by TWD 217.82 million for the first half of 2024 compared to TWD 71.01 million last year, but profit margins have decreased significantly amidst high debt levels.

- Dive into the specifics of Li Ming Development Construction here with our thorough dividend report.

- The valuation report we've compiled suggests that Li Ming Development Construction's current price could be quite moderate.

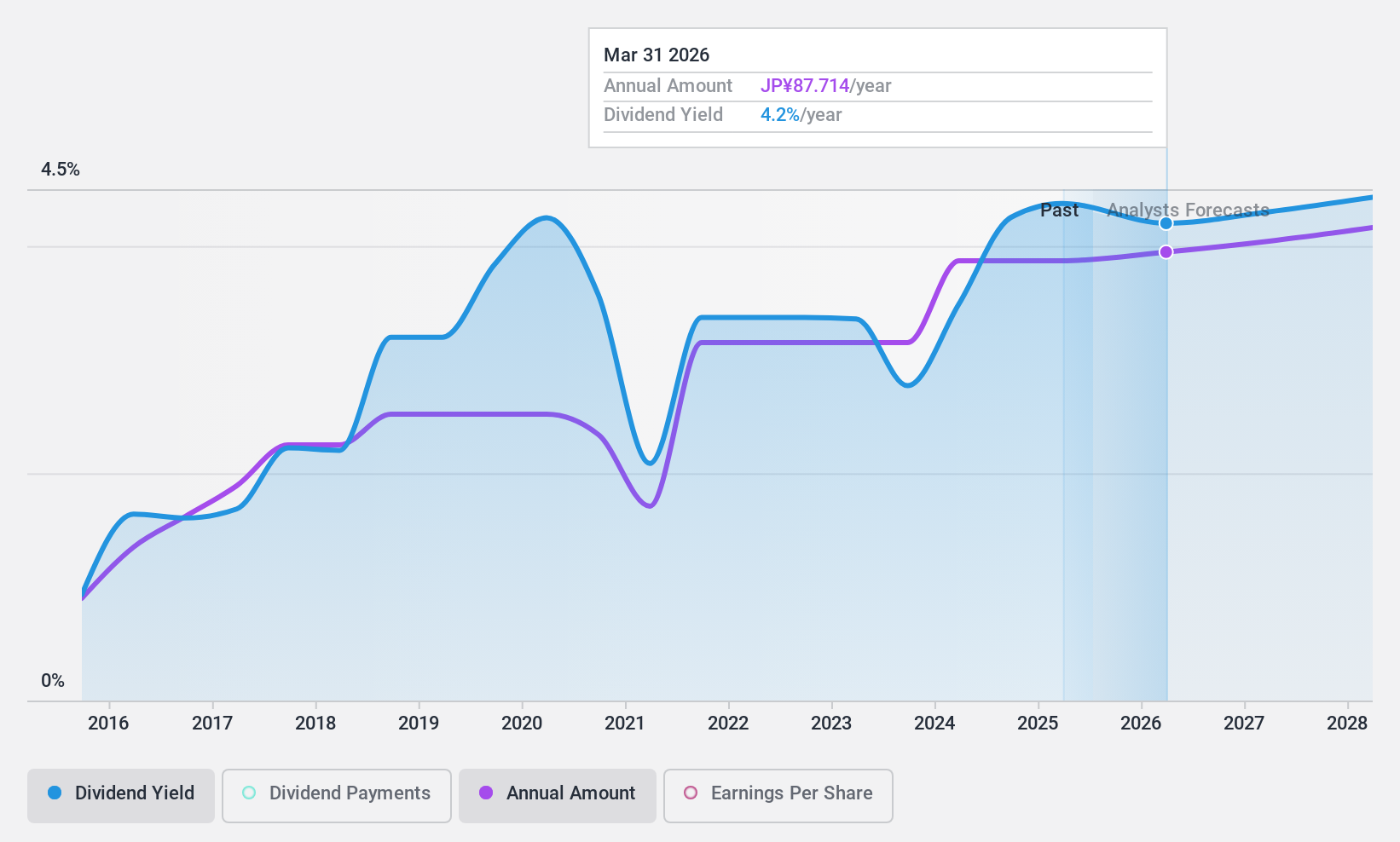

Toyota Boshoku (TSE:3116)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Toyota Boshoku Corporation develops, manufactures, and sells automotive interior systems globally, with a market cap of ¥352.21 billion.

Operations: Toyota Boshoku Corporation's revenue segments are comprised of ¥917.95 billion from Japan, ¥523.59 billion from North, Central and South America, ¥280.87 billion from Asia, ¥226.44 billion from China, and ¥128.65 billion from Europe and Africa.

Dividend Yield: 4.2%

Toyota Boshoku's dividend yield ranks in the top 25% of Japan's market, supported by low payout ratios of 29.2% for earnings and 18.8% for cash flows, indicating strong coverage. However, dividends have been unstable over the past decade despite recent growth. The company declared an interim dividend of ¥43 per share, consistent with last year. Trading below estimated fair value suggests potential undervaluation relative to peers and industry benchmarks.

- Click here to discover the nuances of Toyota Boshoku with our detailed analytical dividend report.

- The analysis detailed in our Toyota Boshoku valuation report hints at an deflated share price compared to its estimated value.

Next Steps

- Investigate our full lineup of 2013 Top Dividend Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toyota Boshoku might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3116

Toyota Boshoku

Develops, manufactures, and sells automotive interior systems in Japan, the United States, China, and internationally.

Flawless balance sheet, undervalued and pays a dividend.