- China

- /

- Electric Utilities

- /

- SHSE:600505

Revenues Tell The Story For Sichuan Xichang Electric Power Co.,Ltd. (SHSE:600505) As Its Stock Soars 26%

Despite an already strong run, Sichuan Xichang Electric Power Co.,Ltd. (SHSE:600505) shares have been powering on, with a gain of 26% in the last thirty days. The last 30 days bring the annual gain to a very sharp 40%.

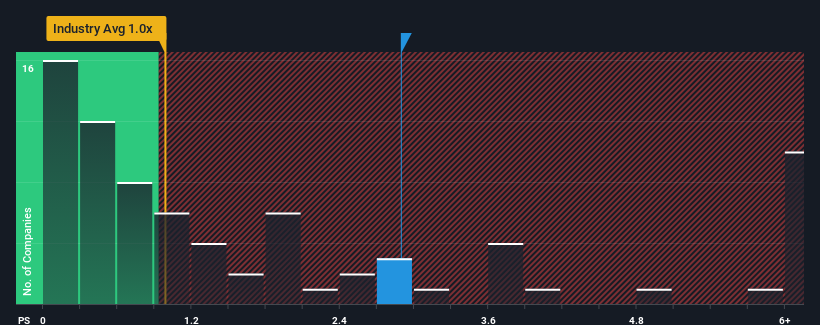

Since its price has surged higher, when almost half of the companies in China's Electric Utilities industry have price-to-sales ratios (or "P/S") below 1.6x, you may consider Sichuan Xichang Electric PowerLtd as a stock probably not worth researching with its 2.9x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Sichuan Xichang Electric PowerLtd

What Does Sichuan Xichang Electric PowerLtd's Recent Performance Look Like?

The revenue growth achieved at Sichuan Xichang Electric PowerLtd over the last year would be more than acceptable for most companies. One possibility is that the P/S ratio is high because investors think this respectable revenue growth will be enough to outperform the broader industry in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Sichuan Xichang Electric PowerLtd will help you shine a light on its historical performance.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Sichuan Xichang Electric PowerLtd's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 7.6%. Pleasingly, revenue has also lifted 44% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 6.5% shows it's noticeably more attractive.

In light of this, it's understandable that Sichuan Xichang Electric PowerLtd's P/S sits above the majority of other companies. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Final Word

Sichuan Xichang Electric PowerLtd shares have taken a big step in a northerly direction, but its P/S is elevated as a result. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It's no surprise that Sichuan Xichang Electric PowerLtd can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

Before you settle on your opinion, we've discovered 3 warning signs for Sichuan Xichang Electric PowerLtd (2 don't sit too well with us!) that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600505

Sichuan Xichang Electric PowerLtd

Engages in generation, supply, distribution, and sale of hydropower power in Liangshan prefecture, Sichuan province, China.

Low risk and overvalued.

Market Insights

Community Narratives