China Express AirlinesLTD (SZSE:002928) shareholders are up 7.6% this past week, but still in the red over the last three years

This month, we saw the China Express Airlines Co.,LTD (SZSE:002928) up an impressive 48%. But that doesn't change the fact that the returns over the last three years have been less than pleasing. After all, the share price is down 23% in the last three years, significantly under-performing the market.

Although the past week has been more reassuring for shareholders, they're still in the red over the last three years, so let's see if the underlying business has been responsible for the decline.

See our latest analysis for China Express AirlinesLTD

China Express AirlinesLTD wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually desire strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years, China Express AirlinesLTD saw its revenue grow by 11% per year, compound. That's a pretty good rate of top-line growth. Shareholders have endured a share price decline of 7% per year. So the market has definitely lost some love for the stock. However, that's in the past now, and it's the future is more important - and the future looks brighter (based on revenue, anyway).

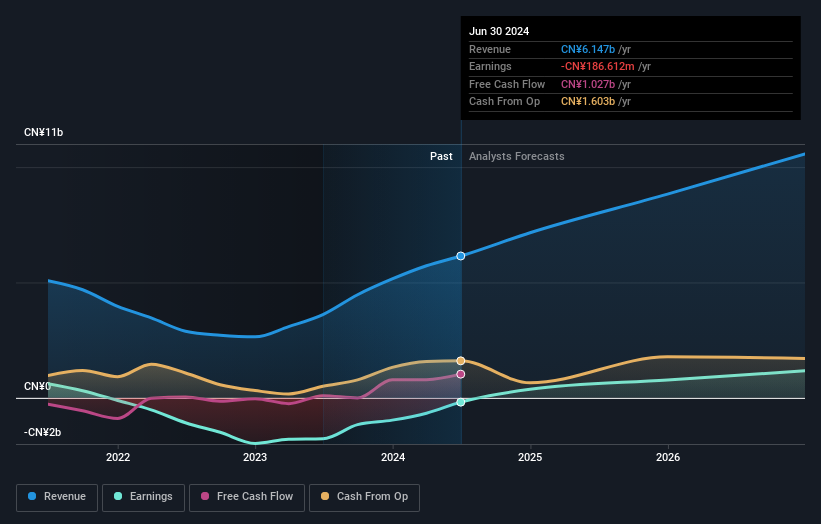

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

We're pleased to report that China Express AirlinesLTD shareholders have received a total shareholder return of 19% over one year. That's better than the annualised return of 1.2% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002928

China Express AirlinesLTD

Engages in the air passenger and cargo transportation business in China.

Exceptional growth potential with imperfect balance sheet.