- China

- /

- Transportation

- /

- SZSE:000557

The total return for Ningxia Western Venture IndustrialLtd (SZSE:000557) investors has risen faster than earnings growth over the last five years

Stock pickers are generally looking for stocks that will outperform the broader market. And in our experience, buying the right stocks can give your wealth a significant boost. For example, the Ningxia Western Venture Industrial Co.,Ltd. (SZSE:000557) share price is up 29% in the last 5 years, clearly besting the market return of around 11% (ignoring dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 4.7% in the last year.

Since the long term performance has been good but there's been a recent pullback of 6.1%, let's check if the fundamentals match the share price.

Check out our latest analysis for Ningxia Western Venture IndustrialLtd

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

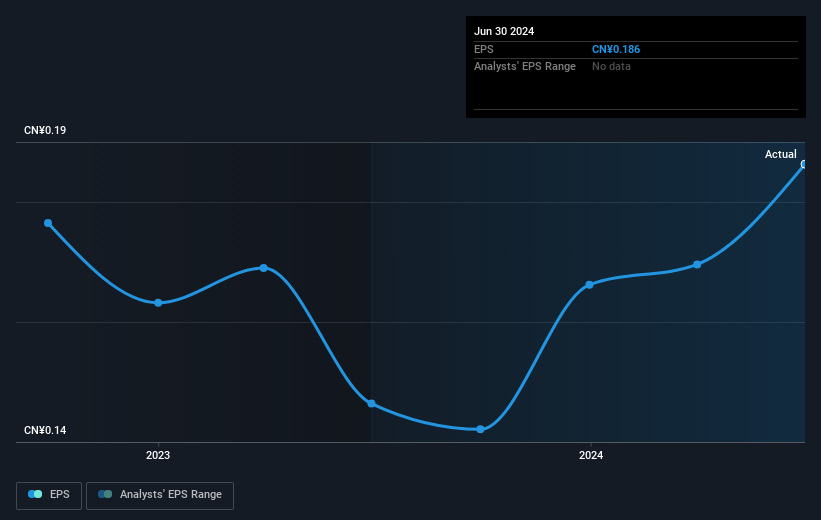

Over half a decade, Ningxia Western Venture IndustrialLtd managed to grow its earnings per share at 11% a year. This EPS growth is higher than the 5% average annual increase in the share price. So it seems the market isn't so enthusiastic about the stock these days.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

We're pleased to report that Ningxia Western Venture IndustrialLtd shareholders have received a total shareholder return of 4.7% over one year. However, the TSR over five years, coming in at 5% per year, is even more impressive. Before forming an opinion on Ningxia Western Venture IndustrialLtd you might want to consider these 3 valuation metrics.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Ningxia Western Venture IndustrialLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000557

Ningxia Western Venture IndustrialLtd

Ningxia Western Venture Industrial Co.,Ltd.

Flawless balance sheet with solid track record.