- China

- /

- Entertainment

- /

- SZSE:002354

Jiangsu Wanlin Modern Logistics And 2 Other Promising Penny Stocks For Your Watchlist

Reviewed by Simply Wall St

As global markets experience a mix of gains and fluctuations, with small-cap indices like the Russell 2000 Index outperforming larger counterparts, investors are increasingly exploring diverse opportunities. Penny stocks, though often perceived as relics from past market eras, continue to hold potential for those seeking affordability combined with growth prospects. In this context, we examine several penny stocks that exhibit financial strength and may offer intriguing possibilities for investors interested in smaller or newer companies.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.60 | MYR2.96B | ★★★★★★ |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.20 | MYR340.59M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.74 | MYR139.44M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.77 | HK$495.14M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.055 | £796.84M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.905 | MYR305.39M | ★★★★★★ |

| Zhejiang Giuseppe Garment (SZSE:002687) | CN¥4.23 | CN¥2.08B | ★★★★★★ |

| Hume Cement Industries Berhad (KLSE:HUMEIND) | MYR3.58 | MYR2.59B | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £4.245 | £433.13M | ★★★★☆☆ |

| Embark Early Education (ASX:EVO) | A$0.805 | A$127.64M | ★★★★☆☆ |

Click here to see the full list of 5,786 stocks from our Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Jiangsu Wanlin Modern Logistics (SHSE:603117)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Jiangsu Wanlin Modern Logistics Co., Ltd. operates in the logistics industry, providing comprehensive logistics services, and has a market cap of CN¥2.95 billion.

Operations: The company generates its revenue primarily from China, amounting to CN¥292.78 million.

Market Cap: CN¥2.95B

Jiangsu Wanlin Modern Logistics, with a market cap of CN¥2.95 billion, has shown financial stability despite being unprofitable and experiencing declining earnings over the past five years. Its cash reserves exceed total debt, providing a sufficient runway for more than three years due to positive free cash flow growth. The company recently completed a share buyback program worth CN¥150.09 million, indicating confidence in its valuation as it trades significantly below estimated fair value. However, challenges remain with an inexperienced board and negative return on equity amid ongoing profitability issues in the logistics sector.

- Take a closer look at Jiangsu Wanlin Modern Logistics' potential here in our financial health report.

- Explore historical data to track Jiangsu Wanlin Modern Logistics' performance over time in our past results report.

Tianyu Digital Technology (Dalian) Group (SZSE:002354)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tianyu Digital Technology (Dalian) Group Co., Ltd. operates in the digital technology sector and has a market cap of CN¥5.68 billion.

Operations: The company generates its revenue primarily from China, with CN¥1.51 billion, and a smaller portion from overseas markets, totaling CN¥12.27 million.

Market Cap: CN¥5.68B

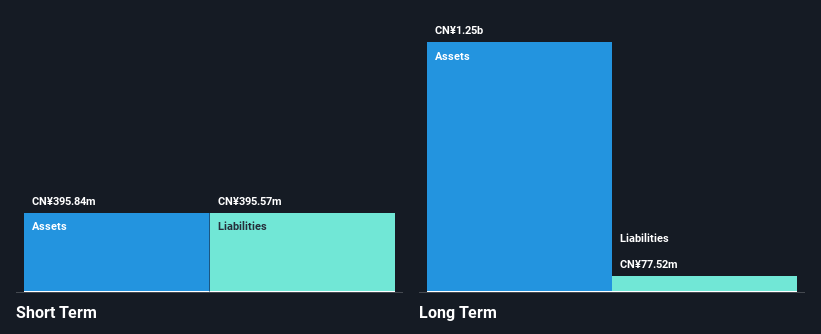

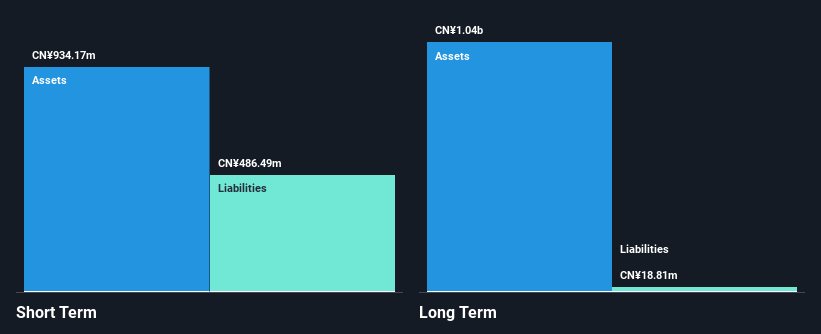

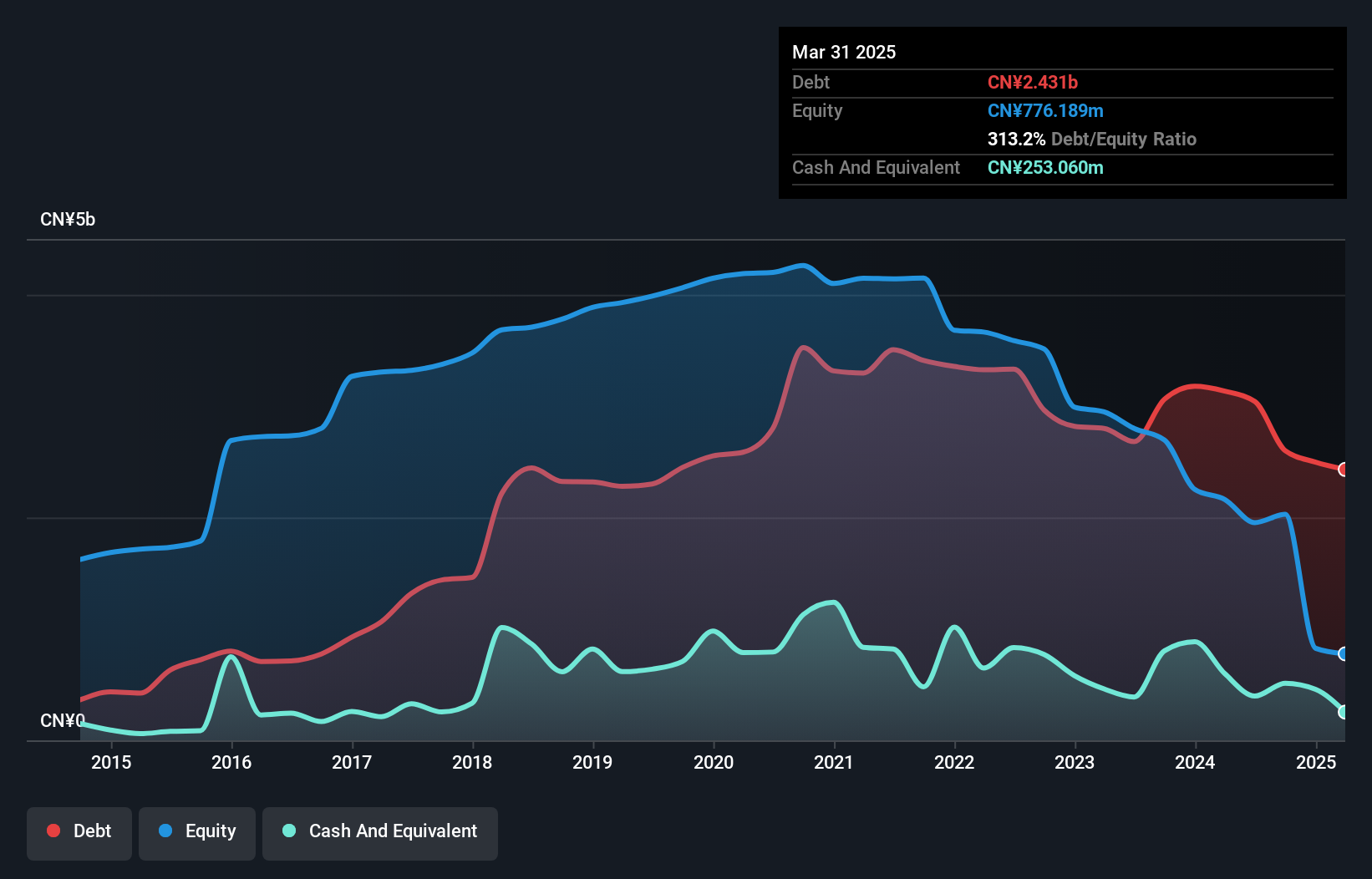

Tianyu Digital Technology (Dalian) Group, with a market cap of CN¥5.68 billion, has faced financial challenges as it remains unprofitable despite reducing losses by 59.1% annually over five years. The company reported a net loss of CN¥6.68 million for the first half of 2024, contrasting with a net income from the previous year. Tianyu benefits from an experienced management team and board, and its cash reserves exceed total debt, ensuring more than three years of runway if free cash flow continues to improve. Short-term assets significantly cover both short- and long-term liabilities, reflecting strong liquidity management.

- Click to explore a detailed breakdown of our findings in Tianyu Digital Technology (Dalian) Group's financial health report.

- Gain insights into Tianyu Digital Technology (Dalian) Group's past trends and performance with our report on the company's historical track record.

China Zhonghua Geotechnical Engineering Group (SZSE:002542)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: China Zhonghua Geotechnical Engineering Group Co., Ltd. operates in the geotechnical engineering sector and has a market cap of CN¥3.76 billion.

Operations: The company generates its revenue from geotechnical engineering services, with total revenue amounting to CN¥2.17 billion.

Market Cap: CN¥3.76B

China Zhonghua Geotechnical Engineering Group, with a market cap of CN¥3.76 billion, is navigating financial difficulties as it remains unprofitable, with losses increasing by 62.9% annually over five years. The company's recent earnings report shows a decline in sales to CN¥721.37 million for the first half of 2024 from CN¥1.03 billion the previous year and a net loss widening to CN¥259.08 million. Despite high net debt to equity (135.3%), short-term assets of CN¥5.3 billion cover both short- and long-term liabilities, offering some financial stability amid ongoing challenges in profitability and debt management.

- Jump into the full analysis health report here for a deeper understanding of China Zhonghua Geotechnical Engineering Group.

- Examine China Zhonghua Geotechnical Engineering Group's past performance report to understand how it has performed in prior years.

Turning Ideas Into Actions

- Access the full spectrum of 5,786 Penny Stocks by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tianyu Digital Technology (Dalian) Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002354

Tianyu Digital Technology (Dalian) Group

Tianyu Digital Technology (Dalian) Group Co., Ltd.

Flawless balance sheet and slightly overvalued.