- China

- /

- Infrastructure

- /

- SHSE:600035

Hubei Chutian Smart Communication Co.,Ltd.'s (SHSE:600035) Subdued P/E Might Signal An Opportunity

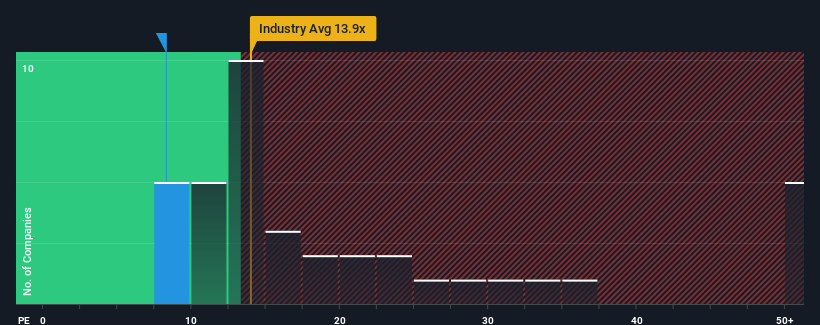

Hubei Chutian Smart Communication Co.,Ltd.'s (SHSE:600035) price-to-earnings (or "P/E") ratio of 8.3x might make it look like a strong buy right now compared to the market in China, where around half of the companies have P/E ratios above 28x and even P/E's above 50x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Hubei Chutian Smart CommunicationLtd has been doing a good job lately as it's been growing earnings at a solid pace. One possibility is that the P/E is low because investors think this respectable earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

See our latest analysis for Hubei Chutian Smart CommunicationLtd

Is There Any Growth For Hubei Chutian Smart CommunicationLtd?

The only time you'd be truly comfortable seeing a P/E as depressed as Hubei Chutian Smart CommunicationLtd's is when the company's growth is on track to lag the market decidedly.

If we review the last year of earnings growth, the company posted a terrific increase of 22%. Pleasingly, EPS has also lifted 141% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 36% shows it's about the same on an annualised basis.

With this information, we find it odd that Hubei Chutian Smart CommunicationLtd is trading at a P/E lower than the market. It may be that most investors are not convinced the company can maintain recent growth rates.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Hubei Chutian Smart CommunicationLtd revealed its three-year earnings trends aren't contributing to its P/E as much as we would have predicted, given they look similar to current market expectations. When we see average earnings with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued if recent medium-term earnings trends continue, but investors seem to think future earnings could see some volatility.

You should always think about risks. Case in point, we've spotted 2 warning signs for Hubei Chutian Smart CommunicationLtd you should be aware of.

You might be able to find a better investment than Hubei Chutian Smart CommunicationLtd. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Hubei Chutian Smart CommunicationLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600035

Hubei Chutian Smart CommunicationLtd

Hubei Chutian Smart Communication Co.,Ltd.

Average dividend payer with low risk.

Market Insights

Community Narratives