- China

- /

- Infrastructure

- /

- SHSE:600020

The Market Doesn't Like What It Sees From Henan Zhongyuan Expressway Company Limited's (SHSE:600020) Earnings Yet

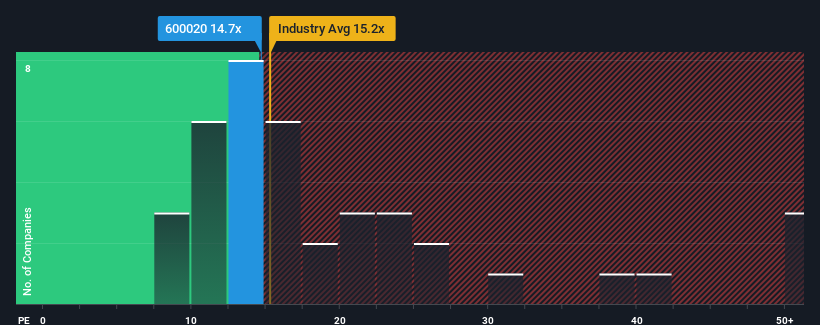

When close to half the companies in China have price-to-earnings ratios (or "P/E's") above 33x, you may consider Henan Zhongyuan Expressway Company Limited (SHSE:600020) as a highly attractive investment with its 14.7x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

It looks like earnings growth has deserted Henan Zhongyuan Expressway recently, which is not something to boast about. One possibility is that the P/E is low because investors think this benign earnings growth rate will likely underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Henan Zhongyuan Expressway

How Is Henan Zhongyuan Expressway's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as depressed as Henan Zhongyuan Expressway's is when the company's growth is on track to lag the market decidedly.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. This isn't what shareholders were looking for as it means they've been left with a 18% decline in EPS over the last three years in total. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Comparing that to the market, which is predicted to deliver 38% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

With this information, we are not surprised that Henan Zhongyuan Expressway is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Key Takeaway

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Henan Zhongyuan Expressway revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Henan Zhongyuan Expressway (at least 2 which can't be ignored), and understanding them should be part of your investment process.

Of course, you might also be able to find a better stock than Henan Zhongyuan Expressway. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Henan Zhongyuan Expressway might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600020

Henan Zhongyuan Expressway

Engages in investment, construction, operation, and management of expressways in China.

Solid track record average dividend payer.

Market Insights

Community Narratives