- China

- /

- Wireless Telecom

- /

- SZSE:300959

Why Investors Shouldn't Be Surprised By Wuxi Online Offline Communication Information Technology Co., Ltd.'s (SZSE:300959) 27% Share Price Surge

Wuxi Online Offline Communication Information Technology Co., Ltd. (SZSE:300959) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 6.9% over the last year.

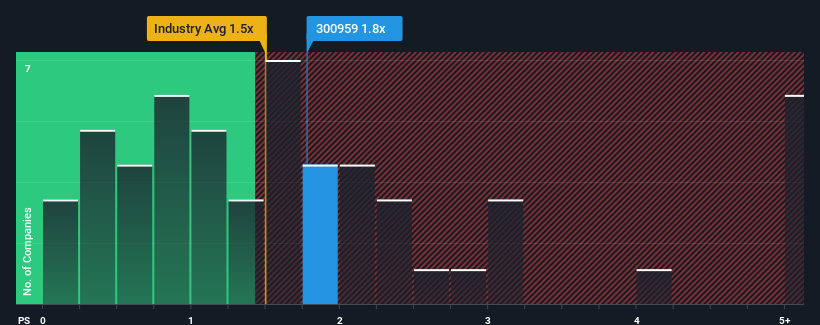

Although its price has surged higher, there still wouldn't be many who think Wuxi Online Offline Communication Information Technology's price-to-sales (or "P/S") ratio of 1.8x is worth a mention when the median P/S in China's Wireless Telecom industry is similar at about 1.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Wuxi Online Offline Communication Information Technology

How Has Wuxi Online Offline Communication Information Technology Performed Recently?

As an illustration, revenue has deteriorated at Wuxi Online Offline Communication Information Technology over the last year, which is not ideal at all. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Wuxi Online Offline Communication Information Technology's earnings, revenue and cash flow.How Is Wuxi Online Offline Communication Information Technology's Revenue Growth Trending?

Wuxi Online Offline Communication Information Technology's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a frustrating 27% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 23% overall rise in revenue. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Comparing that to the industry, which is predicted to deliver 7.0% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

In light of this, it's understandable that Wuxi Online Offline Communication Information Technology's P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on assuming the company will continue keeping a low profile.

The Final Word

Wuxi Online Offline Communication Information Technology appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we've seen, Wuxi Online Offline Communication Information Technology's three-year revenue trends seem to be contributing to its P/S, given they look similar to current industry expectations. Currently, with a past revenue trend that aligns closely wit the industry outlook, shareholders are confident the company's future revenue outlook won't contain any major surprises. Given the current circumstances, it seems improbable that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

Before you take the next step, you should know about the 5 warning signs for Wuxi Online Offline Communication Information Technology (2 can't be ignored!) that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Wuxi Online Offline Communication Information Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300959

Wuxi Online Offline Communication Information Technology

Wuxi Online Offline Communication Information Technology Co., Ltd.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives