- China

- /

- Electronic Equipment and Components

- /

- SHSE:688183

High Growth Tech Stocks To Watch For Potential Portfolio Strengthening

Reviewed by Simply Wall St

Amid ongoing trade policy discussions and fluctuating inflation rates, global markets have shown mixed performances with U.S. stocks rebounding despite some late-week selling pressure, while smaller-cap indexes posted positive returns. As investors navigate these uncertain conditions, identifying high-growth tech stocks that demonstrate resilience and adaptability can be crucial for strengthening portfolios in the current economic climate.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 30.80% | 45.66% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.40% | 23.42% | ★★★★★★ |

| KebNi | 21.51% | 66.96% | ★★★★★★ |

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| Pharma Mar | 29.61% | 44.92% | ★★★★★★ |

| Nanya New Material TechnologyLtd | 22.72% | 63.29% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| Rakovina Therapeutics | 40.75% | 16.49% | ★★★★★★ |

| Elliptic Laboratories | 36.33% | 78.99% | ★★★★★★ |

| JNTC | 54.24% | 87.93% | ★★★★★★ |

Let's explore several standout options from the results in the screener.

Shengyi Electronics (SHSE:688183)

Simply Wall St Growth Rating: ★★★★★★

Overview: Shengyi Electronics Co., Ltd. focuses on the research, development, production, and sales of printed circuit boards in China with a market capitalization of approximately CN¥26.03 billion.

Operations: Shengyi Electronics specializes in the production and sale of printed circuit boards, catering to various sectors within China. The company leverages its research and development capabilities to enhance its product offerings in this domain.

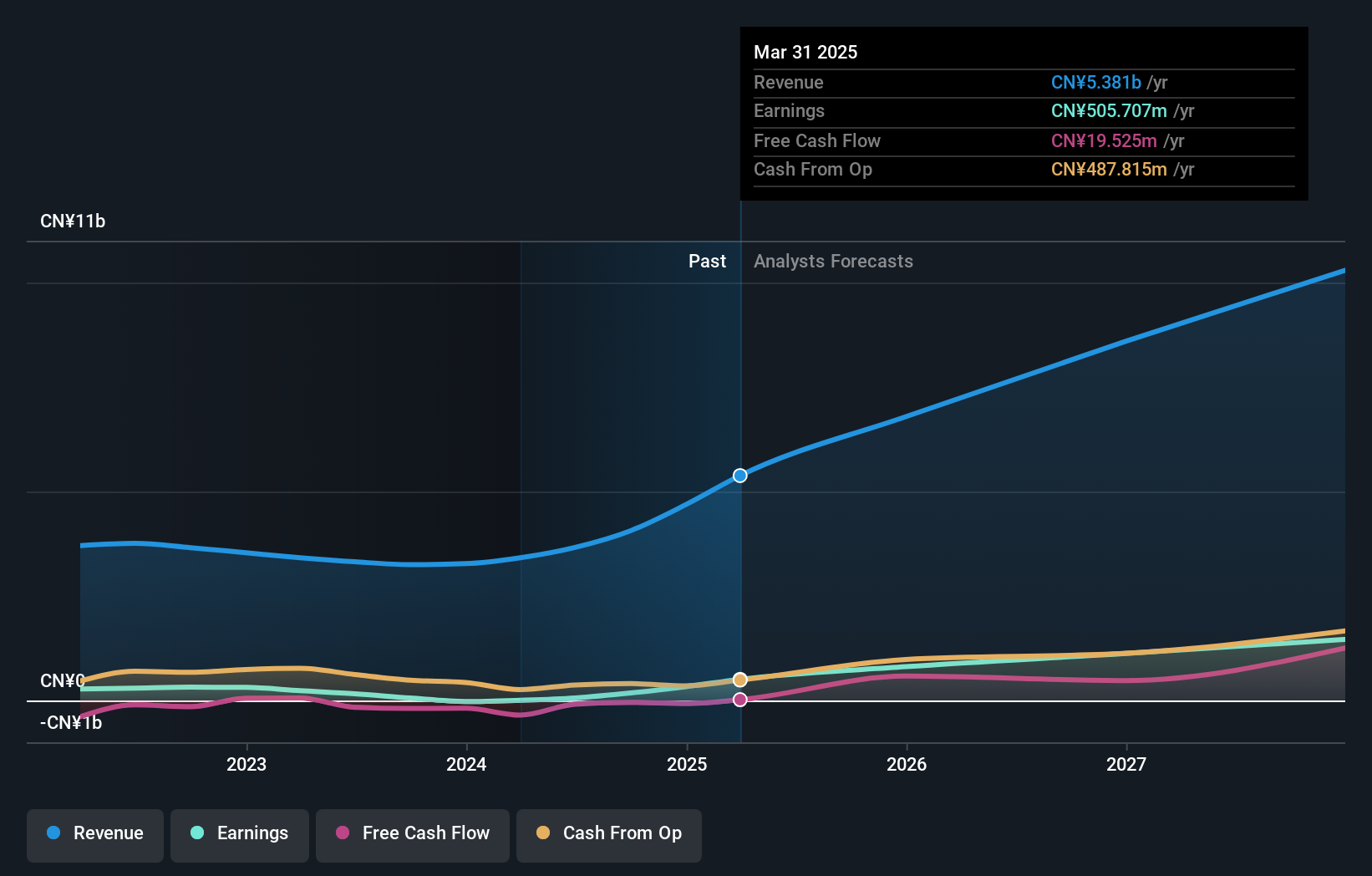

Shengyi Electronics has demonstrated robust financial performance, with a staggering 9156.8% increase in earnings over the past year and an impressive annual revenue growth rate of 23%. This growth trajectory is significantly above the Chinese market average of 12.4%. The company's commitment to innovation and development is evident from its recent announcement on April 18, 2025, detailing a share repurchase program valued at CNY 100 million to foster equity incentives. Additionally, Shengyi's strategic focus on R&D investments aligns with its rapid earnings growth forecast of 35.2% annually, outpacing the sector's average. These initiatives not only reflect Shengyi’s aggressive expansion strategy but also highlight its potential to sustain high performance by leveraging technological advancements and market opportunities.

- Unlock comprehensive insights into our analysis of Shengyi Electronics stock in this health report.

Explore historical data to track Shengyi Electronics' performance over time in our Past section.

Lens Technology (SZSE:300433)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lens Technology Co., Ltd. focuses on the research, development, production, and sale of structural parts and functional modules for complete machine assembly in China with a market cap of CN¥101.91 billion.

Operations: The company generates revenue primarily from electronic component manufacturing, amounting to CN¥71.46 billion.

Lens Technology, amid a competitive tech landscape, has shown promising growth with revenue increasing by 18.8% annually, outpacing the Chinese market average of 12.4%. This surge is supported by a robust earnings growth forecast of 25.1% per year, reflecting the company's effective strategy and operational efficiency. Recent initiatives include a significant share repurchase program announced on April 7, 2025, aimed at enhancing shareholder value through equity incentives valued at CNY 1 billion. Furthermore, Lens Technology's commitment to innovation is evident from its R&D investments which are pivotal in maintaining its technological edge and market position in high-growth sectors like advanced optics for consumer electronics.

- Click here to discover the nuances of Lens Technology with our detailed analytical health report.

Understand Lens Technology's track record by examining our Past report.

AVIC Chengdu Aircraft (SZSE:302132)

Simply Wall St Growth Rating: ★★★★★☆

Overview: AVIC Chengdu Aircraft Company Limited specializes in providing intelligent measurement and control products for both military and civilian sectors globally, with a market cap of CN¥206.31 billion.

Operations: The company generates revenue through the production and sale of intelligent measurement and control products, catering to both military and civilian markets in China and internationally. With a market cap of CN¥206.31 billion, it operates on a global scale, focusing on advanced technological solutions for diverse sectors.

AVIC Chengdu Aircraft has demonstrated a remarkable annual revenue growth rate of 47.4%, significantly outpacing the broader Chinese market's average of 12.4%. This growth is underpinned by an aggressive expansion in R&D, positioning the company well within the high-tech aerospace sector. Despite recent profitability challenges, earnings are projected to surge by approximately 56% annually over the next three years, signaling potential for future financial stability. Moreover, recent corporate actions including a substantial dividend payout and strategic amendments to its bylaws during its latest extraordinary general meetings reflect a proactive approach in governance and shareholder engagement. These factors collectively underscore AVIC Chengdu Aircraft's robust strategy aimed at cementing its position in an evolving industry landscape.

- Click to explore a detailed breakdown of our findings in AVIC Chengdu Aircraft's health report.

Assess AVIC Chengdu Aircraft's past performance with our detailed historical performance reports.

Next Steps

- Gain an insight into the universe of 747 Global High Growth Tech and AI Stocks by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688183

Shengyi Electronics

Engages in the research and development, production, and sales of various printed circuit boards in China.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives