As global markets navigate a landscape shaped by potential rate cuts and evolving economic indicators, Asian stock markets have shown resilience, with mainland Chinese indices achieving notable gains amid improved U.S.-China trade relations. In this dynamic environment, identifying promising small-cap stocks in Asia requires a keen eye for companies that demonstrate strong fundamentals and the ability to capitalize on regional economic trends.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Asian Terminals | 26.58% | 10.87% | 15.82% | ★★★★★★ |

| MSC | 30.39% | 6.56% | 14.62% | ★★★★★★ |

| Xinjiang Torch Gas | 6.52% | 16.74% | 14.45% | ★★★★★☆ |

| Qingdao CHOHO IndustrialLtd | 38.36% | 12.96% | 8.25% | ★★★★★☆ |

| ShenZhen QiangRui Precision Technology | 18.68% | 41.36% | 14.12% | ★★★★★☆ |

| ITCENGLOBAL | 66.11% | 16.65% | 1.99% | ★★★★★☆ |

| SBS Philippines | 29.71% | 3.10% | -49.78% | ★★★★★☆ |

| Ogaki Kyoritsu Bank | 100.29% | 3.05% | 10.51% | ★★★★☆☆ |

| Huang Hsiang Construction | 238.47% | 13.06% | 7.67% | ★★★★☆☆ |

| Wuhan Huakang Century Clean Technology | 57.04% | 17.95% | 6.20% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

China Foods (SEHK:506)

Simply Wall St Value Rating: ★★★★★★

Overview: China Foods Limited is an investment holding company that focuses on manufacturing, distributing, marketing, and selling Coca-Cola products in the People’s Republic of China with a market cap of approximately HK$11.66 billion.

Operations: The primary revenue stream for China Foods Limited is the processing, bottling, and distribution of sparkling and still beverages, generating approximately CN¥21.49 billion.

China Foods, a modest player in the beverage sector, seems to offer a compelling value proposition. Trading at 85.7% below its estimated fair value, it appears attractively priced compared to peers. Over the past year, earnings grew by 3.4%, outpacing the industry's 2.3% growth rate, suggesting robust performance within its niche market. The company is debt-free now versus five years ago when it had an 8.3% debt-to-equity ratio, reflecting improved financial health and flexibility for future investments or dividends like the recent RMB 0.153 per share payout approved in June 2025 at their AGM meeting held on June 11th this year.

- Dive into the specifics of China Foods here with our thorough health report.

Gain insights into China Foods' historical performance by reviewing our past performance report.

Suzhou Hesheng Special Material (SZSE:002290)

Simply Wall St Value Rating: ★★★★★★

Overview: Suzhou Hesheng Special Material Co., Ltd. operates in the home appliance composite materials industry and has a market capitalization of CN¥8.77 billion.

Operations: Hesheng generates revenue primarily from the home appliance composite materials industry, amounting to CN¥2.48 billion.

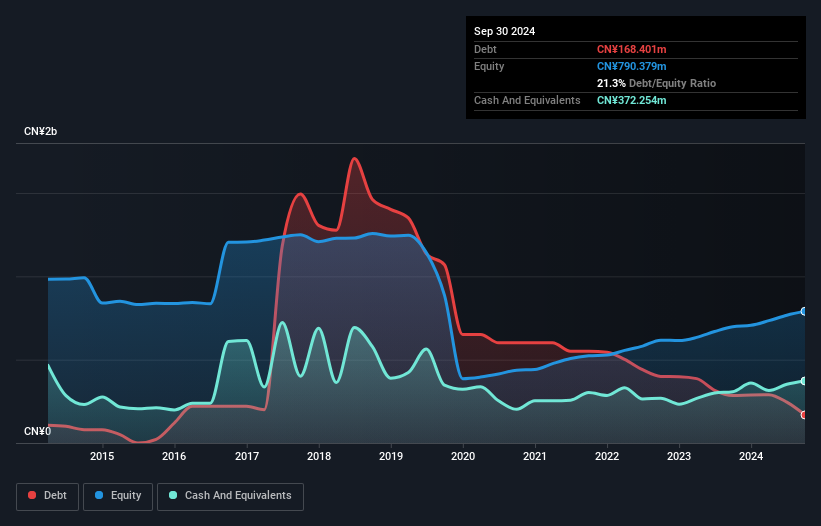

Suzhou Hesheng Special Material, a smaller player in the metals and mining sector, shows impressive financial health with earnings growth of 52.8% over the past year, outpacing the industry's -3.8%. The company boasts high-quality earnings and maintains a solid cash position exceeding its total debt. Recent results for the first half of 2025 reflect net income reaching CNY 97 million, up from CNY 61.27 million last year, with basic earnings per share rising to CNY 0.39 from CNY 0.25. Additionally, its debt-to-equity ratio improved significantly from 145% to just under 20% over five years.

Flaircomm Microelectronics (SZSE:301600)

Simply Wall St Value Rating: ★★★★★☆

Overview: Flaircomm Microelectronics, Inc. develops and sells wireless communication modules, embedded software, and turnkey system solutions for automotive and M2M applications in China with a market cap of CN¥13.50 billion.

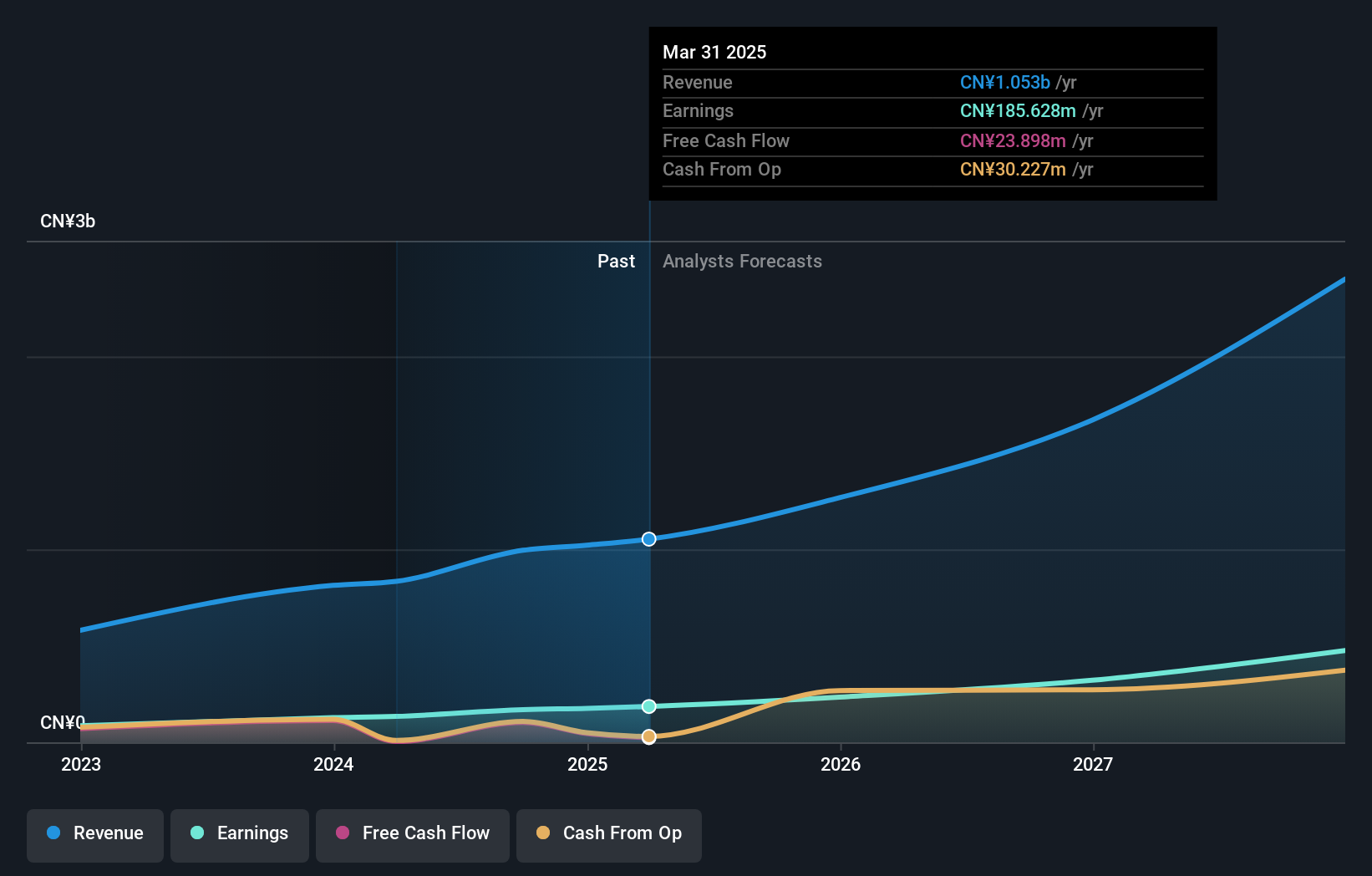

Operations: Flaircomm generates revenue primarily from its wireless communications equipment segment, which contributes CN¥1.05 billion. The company's cost structure and financial performance details are not specified beyond this revenue figure.

Flaircomm Microelectronics, with its nimble market presence, has shown impressive earnings growth of 38% over the past year, outpacing the Communications industry average. The company's price-to-earnings ratio of 72.7x is attractively below the industry norm of 79.7x, suggesting potential value for investors. With a debt to equity ratio rising from 0.2% to 3.1% over five years, it seems Flaircomm is leveraging more but still holds more cash than total debt—a positive sign for financial stability. Recent board changes and amendments in company bylaws may indicate strategic shifts aimed at sustaining this momentum in future growth prospects.

Next Steps

- Discover the full array of 2406 Asian Undiscovered Gems With Strong Fundamentals right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:506

China Foods

An investment holding company, manufactures, distributes, markets, and sells Coca-Cola series products in the People’s Republic of China.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives