- China

- /

- Electronic Equipment and Components

- /

- SZSE:301556

High Growth Tech Stocks In Asia Including Sichuan Jiuyuan Yinhai Software Co Ltd

Reviewed by Simply Wall St

Amid a mixed performance in global markets, with the U.S. experiencing a narrow tech-driven rally and China navigating trade truce optimism, investors are keenly observing the high-growth tech sector in Asia for potential opportunities. As economic indicators fluctuate and market sentiment shifts, identifying promising stocks often involves assessing their ability to leverage technological advancements and adapt to evolving consumer demands within this dynamic landscape.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 27.82% | 34.58% | ★★★★★★ |

| Suzhou TFC Optical Communication | 33.73% | 34.36% | ★★★★★★ |

| Zhongji Innolight | 27.12% | 28.48% | ★★★★★★ |

| PharmaEssentia | 34.00% | 50.89% | ★★★★★★ |

| Fositek | 36.14% | 47.79% | ★★★★★★ |

| ASROCK Incorporation | 30.39% | 32.50% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| ISU Petasys | 21.11% | 32.81% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Below we spotlight a couple of our favorites from our exclusive screener.

Sichuan Jiuyuan Yinhai Software.Co.Ltd (SZSE:002777)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sichuan Jiuyuan Yinhai Software.Co.,Ltd offers medical insurance, digital government affairs, and smart cities services to government departments and industry ecosystem entities in China, with a market cap of CN¥7.87 billion.

Operations: Jiuyuan Yinhai Software specializes in delivering technology solutions for medical insurance, digital governance, and smart city initiatives across China. The company's offerings cater to government bodies and industry partners, contributing to its substantial market presence.

Sichuan Jiuyuan Yinhai Software has demonstrated robust growth, with its earnings surging by 43.3% over the past year, significantly outpacing the software industry's average. This momentum is underpinned by a strong revenue increase to CNY 687.07 million from CNY 668.15 million year-over-year as of September 2025, reflecting a growth rate of 13.8%. The company's commitment to innovation is evident from its R&D spending trends which are aligned with its revenue growth, ensuring continuous improvement in offerings and market competitiveness. Moreover, recent amendments to corporate governance structures suggest proactive management adapting to evolving business environments, potentially enhancing operational efficiencies and stakeholder confidence in long-term strategies.

- Take a closer look at Sichuan Jiuyuan Yinhai Software.Co.Ltd's potential here in our health report.

Understand Sichuan Jiuyuan Yinhai Software.Co.Ltd's track record by examining our Past report.

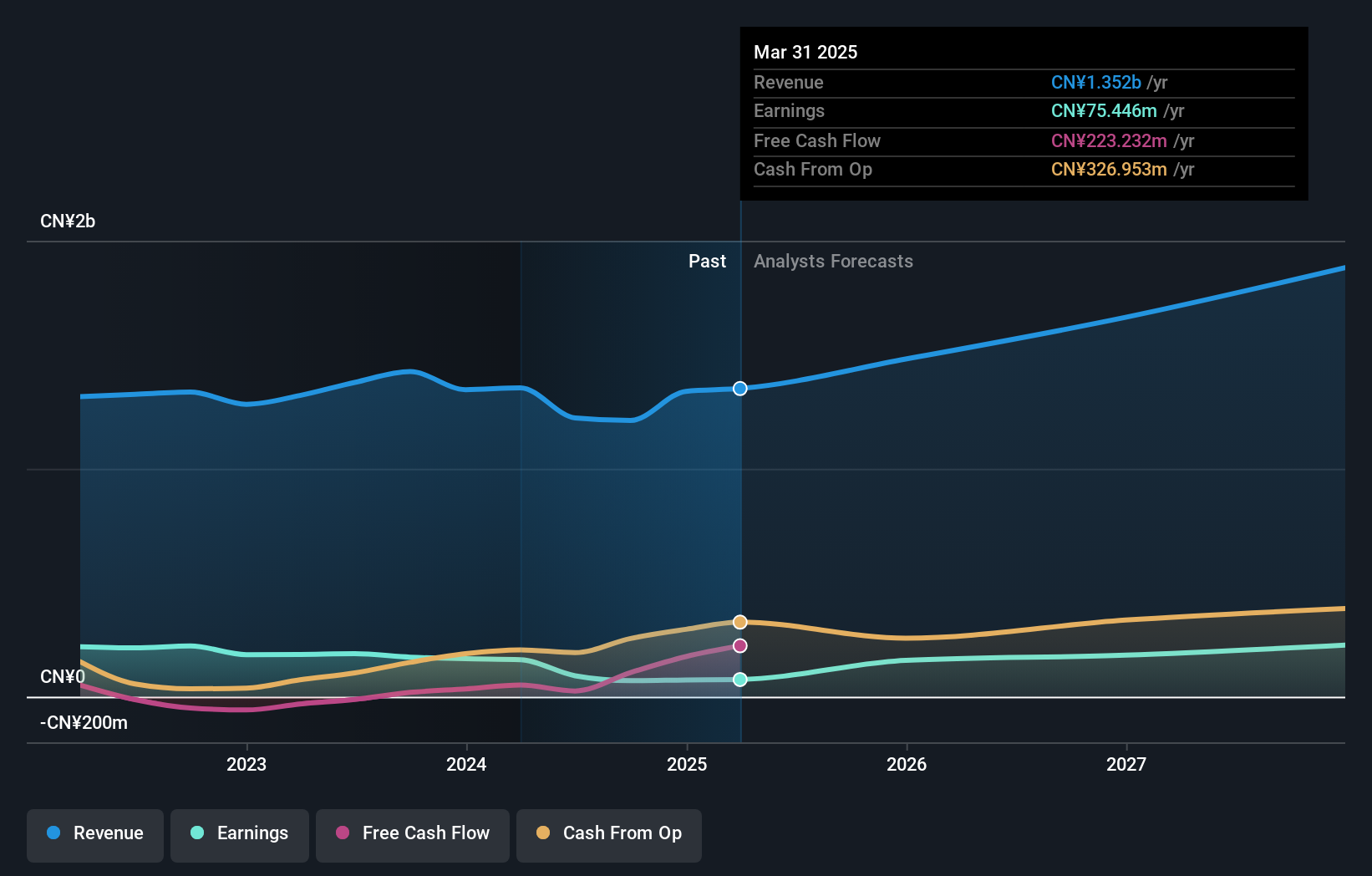

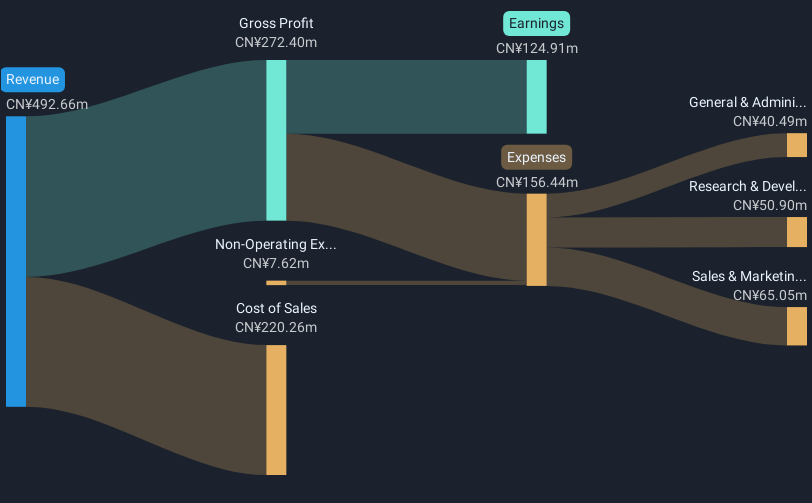

Zhejiang Top Cloud-agri TechnologyLtd (SZSE:301556)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zhejiang Top Cloud-agri Technology Co., Ltd. operates in the agricultural technology sector, focusing on innovative solutions to enhance agricultural productivity, with a market capitalization of CN¥8.60 billion.

Operations: Zhejiang Top Cloud-agri Technology Co., Ltd. specializes in agricultural technology, providing innovative solutions to boost productivity. The company generates revenue through its technological offerings aimed at enhancing agricultural efficiency and performance.

Zhejiang Top Cloud-agri TechnologyLtd, a player in the high-tech agriculture sector, has demonstrated impressive financial performance with revenue growth of 27.9% annually and earnings growth at 29.7%. This robust expansion is supported by significant R&D investment, aligning with its revenue to foster innovation in agri-tech solutions. Recent corporate actions include affirmations of interim dividends and amendments to company bylaws, reflecting proactive governance aimed at sustaining growth amidst dynamic market conditions. These strategic moves not only underscore the company's commitment to shareholder value but also enhance its competitive stance in a rapidly evolving industry.

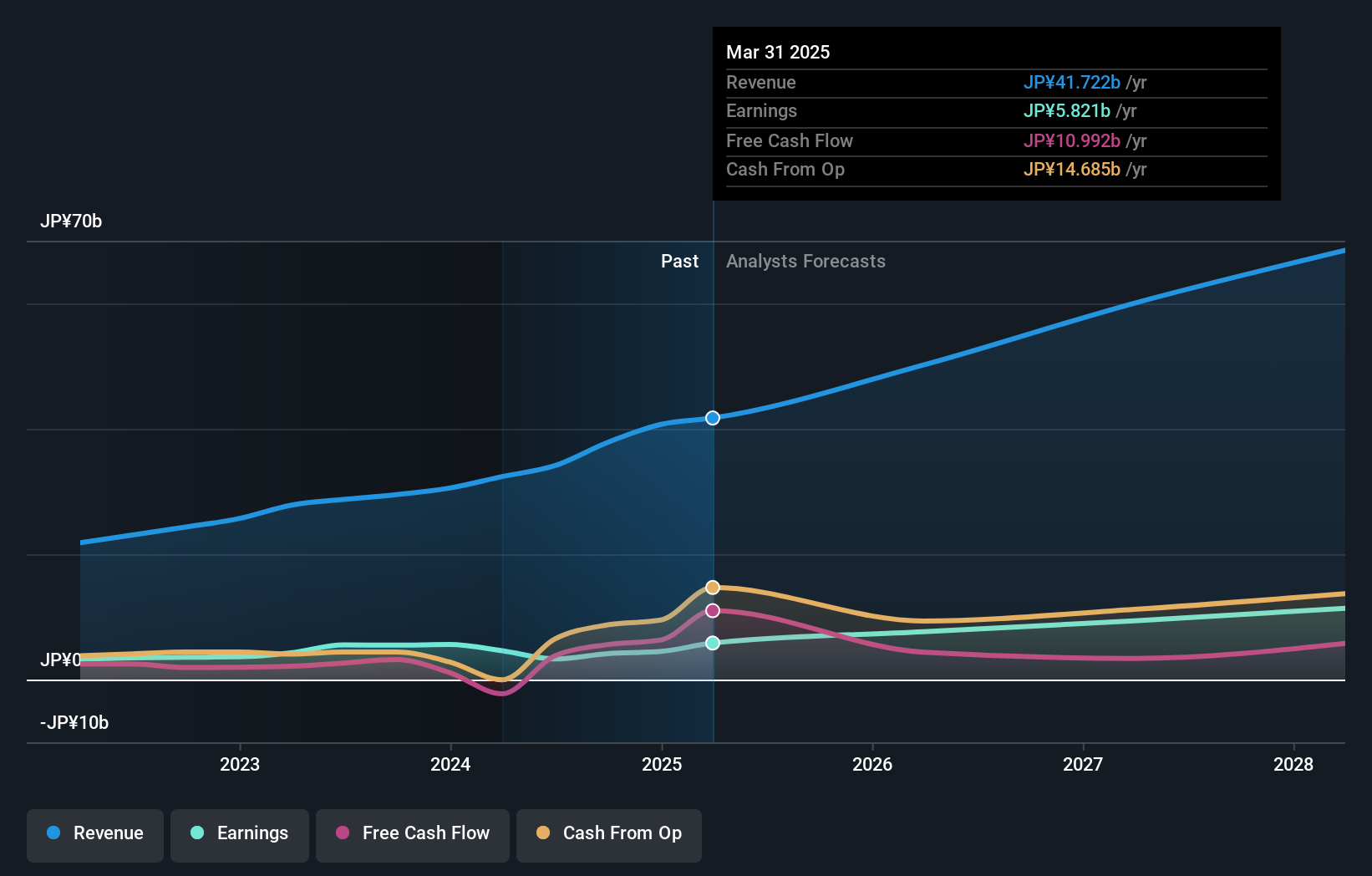

JMDC (TSE:4483)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: JMDC Inc. offers medical statistics data services in Japan and has a market capitalization of approximately ¥320.36 billion.

Operations: The company generates revenue primarily from its Healthcare-Big Data segment, contributing ¥38.24 billion, and Tele-Medicine services at ¥6.14 billion.

JMDC, a standout in Asia's tech landscape, has shown a robust financial trajectory with an annual revenue growth of 15.0% and earnings surging by 20.6% each year. This growth is underpinned by substantial investments in R&D, which are crucial for maintaining its competitive edge in healthcare technology solutions. Notably, the company's commitment to innovation is evident from its R&D spending which aligns closely with revenue increases, ensuring sustained advancements in its offerings. Recent strategic moves include share repurchases that underscore confidence in the firm’s future prospects and signal strength to investors looking for stability combined with growth potential within the volatile tech sector.

- Get an in-depth perspective on JMDC's performance by reading our health report here.

Assess JMDC's past performance with our detailed historical performance reports.

Make It Happen

- Embark on your investment journey to our 179 Asian High Growth Tech and AI Stocks selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Top Cloud-agri TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301556

Zhejiang Top Cloud-agri TechnologyLtd

Zhejiang Top Cloud-agri Technology Co.,Ltd.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives