- China

- /

- Interactive Media and Services

- /

- SZSE:301262

Exploring February 2025's Undiscovered Gems on None

Reviewed by Simply Wall St

As global markets navigate the complexities of tariff uncertainties and mixed economic signals, small-cap stocks have shown resilience despite recent declines in major indices like the S&P 500. With U.S. job growth cooling and manufacturing activity expanding for the first time in over two years, investors are keenly observing how these factors might influence smaller companies that often serve as bellwethers for broader economic trends. In this environment, identifying undiscovered gems—stocks with strong fundamentals and growth potential—becomes crucial for investors looking to capitalize on opportunities amidst market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Nihon Parkerizing | 0.31% | 2.12% | 6.94% | ★★★★★★ |

| Ohashi Technica | NA | 4.58% | -14.04% | ★★★★★★ |

| Otec | 8.17% | 3.43% | 1.06% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Komori | 9.28% | 8.79% | 64.70% | ★★★★★☆ |

| CMC | 1.42% | 1.60% | 10.14% | ★★★★★☆ |

| Marusan Securities | 5.46% | 0.83% | 4.55% | ★★★★★☆ |

| Nippon Ski Resort DevelopmentLtd | 43.84% | 7.58% | 32.78% | ★★★★★☆ |

| Mr Max Holdings | 54.12% | 0.97% | 4.23% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Scantech (HANGZHOU) (SHSE:688583)

Simply Wall St Value Rating: ★★★★★☆

Overview: Scantech (HANGZHOU) Co., Ltd. focuses on the research, development, production, and sale of 3D vision digital products in China and has a market capitalization of CN¥7.71 billion.

Operations: The company generates revenue through the sale of 3D vision digital products. It has a market capitalization of CN¥7.71 billion.

Scantech (HANGZHOU) recently completed an IPO raising CNY 568.82 million, offering a significant opportunity for growth. The company's earnings surged by 40% in the past year, outpacing the tech industry's average growth of 3%, highlighting its competitive edge. Despite limited financial data over six months old and highly illiquid shares, Scantech's financial health seems robust with more cash than total debt and high-quality earnings. This positions it well for future endeavors in the tech sector, though investors should be mindful of its liquidity constraints when considering this promising yet volatile player.

- Get an in-depth perspective on Scantech (HANGZHOU)'s performance by reading our health report here.

Evaluate Scantech (HANGZHOU)'s historical performance by accessing our past performance report.

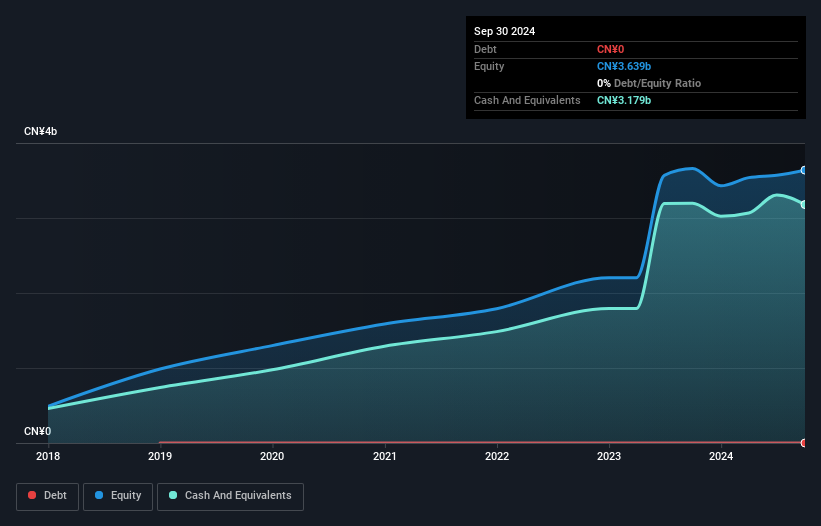

Hicon Network Technology (Shandong)Ltd (SZSE:301262)

Simply Wall St Value Rating: ★★★★★★

Overview: Hicon Network Technology (Shandong) Co., Ltd. operates in the technology sector with a market capitalization of CN¥11.72 billion.

Operations: Hicon Network Technology (Shandong) Co., Ltd. generates revenue through its technology sector operations, with a market capitalization of CN¥11.72 billion. The company's financial performance is characterized by a focus on optimizing its cost structure to enhance profitability.

Earnings for Hicon Network Technology surged by 15% last year, surpassing industry growth of 1.7%, highlighting its robust performance. With a price-to-earnings ratio of 25.8x, it offers good value against the broader CN market's 36.7x. The company enjoys a debt-free status for five years and maintains high-quality earnings, ensuring no concerns over interest coverage or cash runway. Recently approved dividends reflect stable financial health with CNY 3.50 per 10 shares set for distribution in January 2025, underscoring shareholder returns and potential appeal to investors seeking consistent income streams within the tech sector.

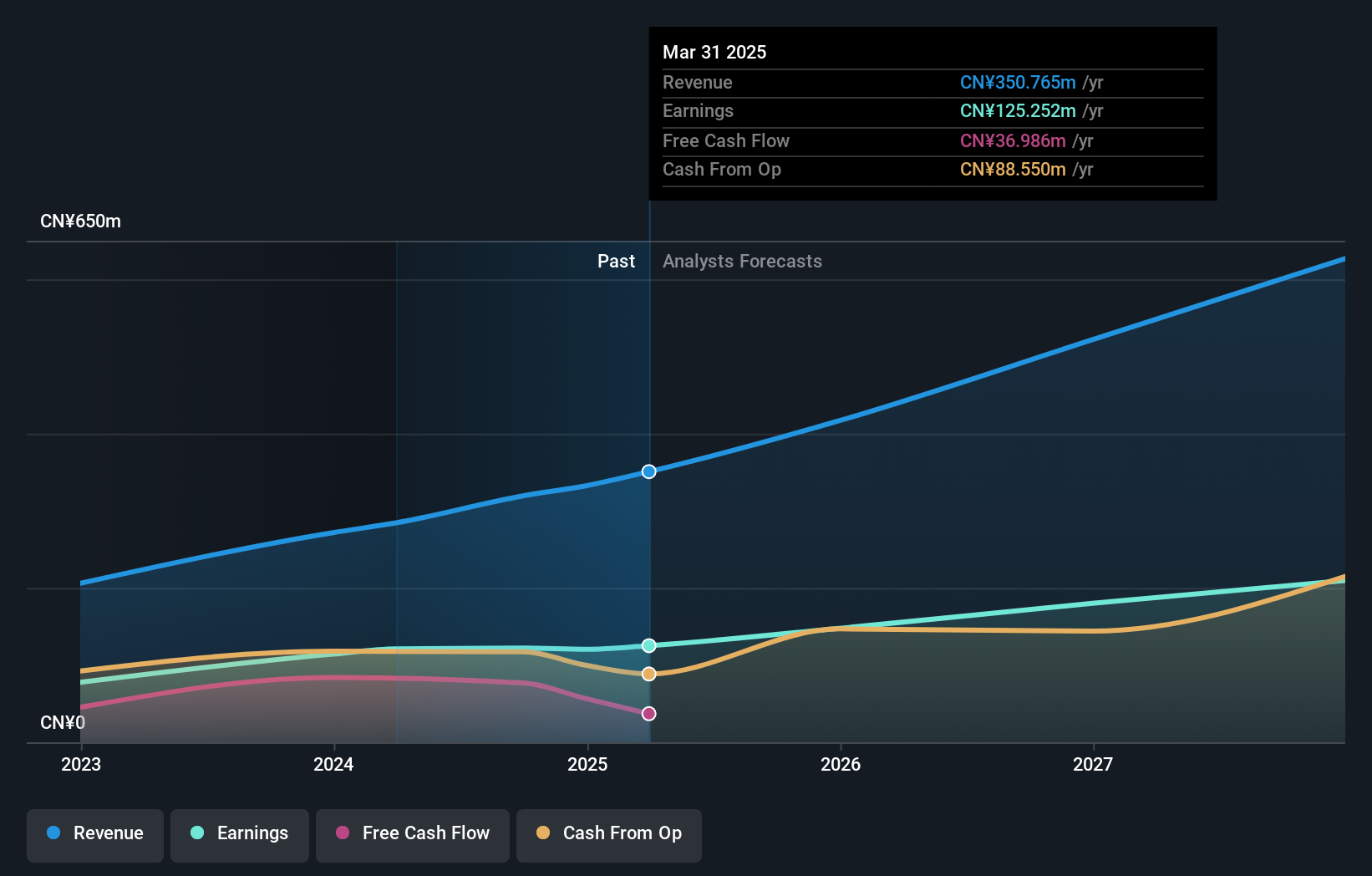

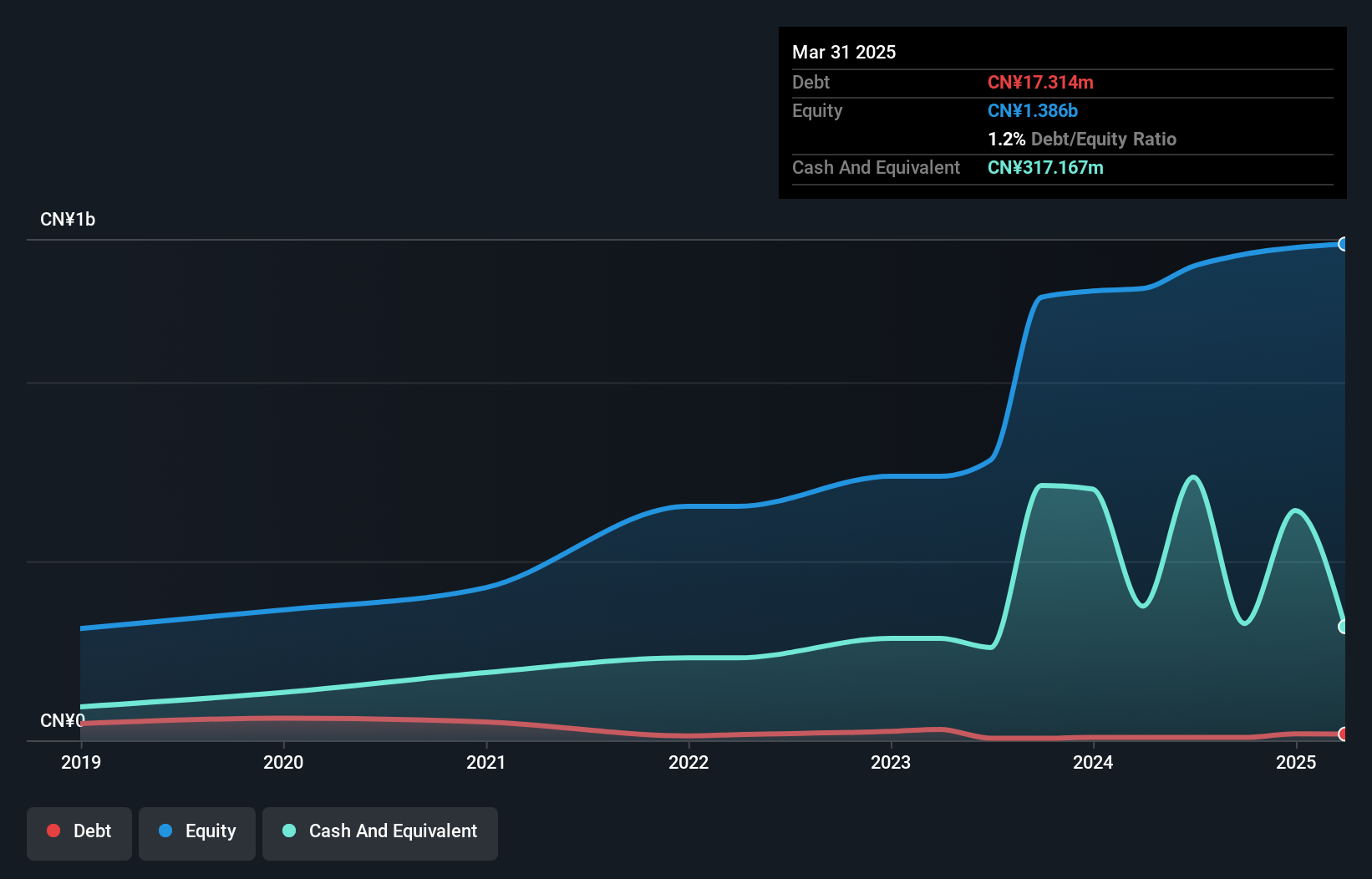

Googol Technology (SZSE:301510)

Simply Wall St Value Rating: ★★★★★☆

Overview: Googol Technology Co., Ltd. is involved in the research, development, manufacturing, and sale of motion control products both in China and internationally, with a market capitalization of CN¥12.23 billion.

Operations: Googol Technology generates revenue primarily from the Industrial Automatic Control System Equipment Manufacturing segment, totaling CN¥421.52 million.

Googol Technology has shown impressive growth with earnings rising by 24.8% over the past year, outpacing the Electronic industry’s 3% benchmark. The company seems financially robust, with its debt to equity ratio dropping from 16.6% to 0.6% in five years, indicating a strong balance sheet position as cash exceeds total debt. However, a one-off gain of CN¥21M impacted recent financial results, suggesting some volatility in earnings quality. Despite this bump, Googol's share price has been highly volatile recently but remains intriguing for investors looking at emerging opportunities within the tech sector in China.

- Click here to discover the nuances of Googol Technology with our detailed analytical health report.

Understand Googol Technology's track record by examining our Past report.

Summing It All Up

- Navigate through the entire inventory of 4690 Undiscovered Gems With Strong Fundamentals here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hicon Network Technology (Shandong)Ltd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301262

Hicon Network Technology (Shandong)Ltd

Hicon Network Technology (Shandong) Co.,Ltd.

Flawless balance sheet second-rate dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)