- China

- /

- Electronic Equipment and Components

- /

- SZSE:301486

Three Hidden Asian Stocks With Promising Fundamentals

Reviewed by Simply Wall St

In recent weeks, Asian markets have faced a mixed landscape, with geopolitical tensions and trade-related concerns influencing investor sentiment. Amidst this backdrop, identifying stocks with strong fundamentals can offer potential opportunities for investors seeking stability and growth in uncertain times.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Standard Foods | 3.12% | -4.48% | -22.82% | ★★★★★★ |

| Wuxi Xinan Technology | NA | 11.99% | 4.45% | ★★★★★★ |

| Hefei Gocom Information TechnologyLtd | NA | 9.11% | -12.23% | ★★★★★★ |

| Pro-Hawk | 10.92% | -8.48% | -3.47% | ★★★★★★ |

| Shenzhen Coship Electronics | NA | 8.20% | 44.45% | ★★★★★★ |

| ISE Chemicals | 1.40% | 15.34% | 32.61% | ★★★★★★ |

| Unitech Computer | 29.32% | 2.56% | 1.58% | ★★★★★☆ |

| Firich Enterprises | 32.65% | -1.31% | 35.54% | ★★★★★☆ |

| HannStar Board | 68.83% | -2.82% | -3.15% | ★★★★☆☆ |

| Xinya Electronic | 60.42% | 30.49% | 3.46% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Tong Petrotech (SZSE:300164)

Simply Wall St Value Rating: ★★★★★★

Overview: Tong Petrotech Corp. specializes in providing perforation technology services for oilfield clients both in China and globally, with a market cap of CN¥3.57 billion.

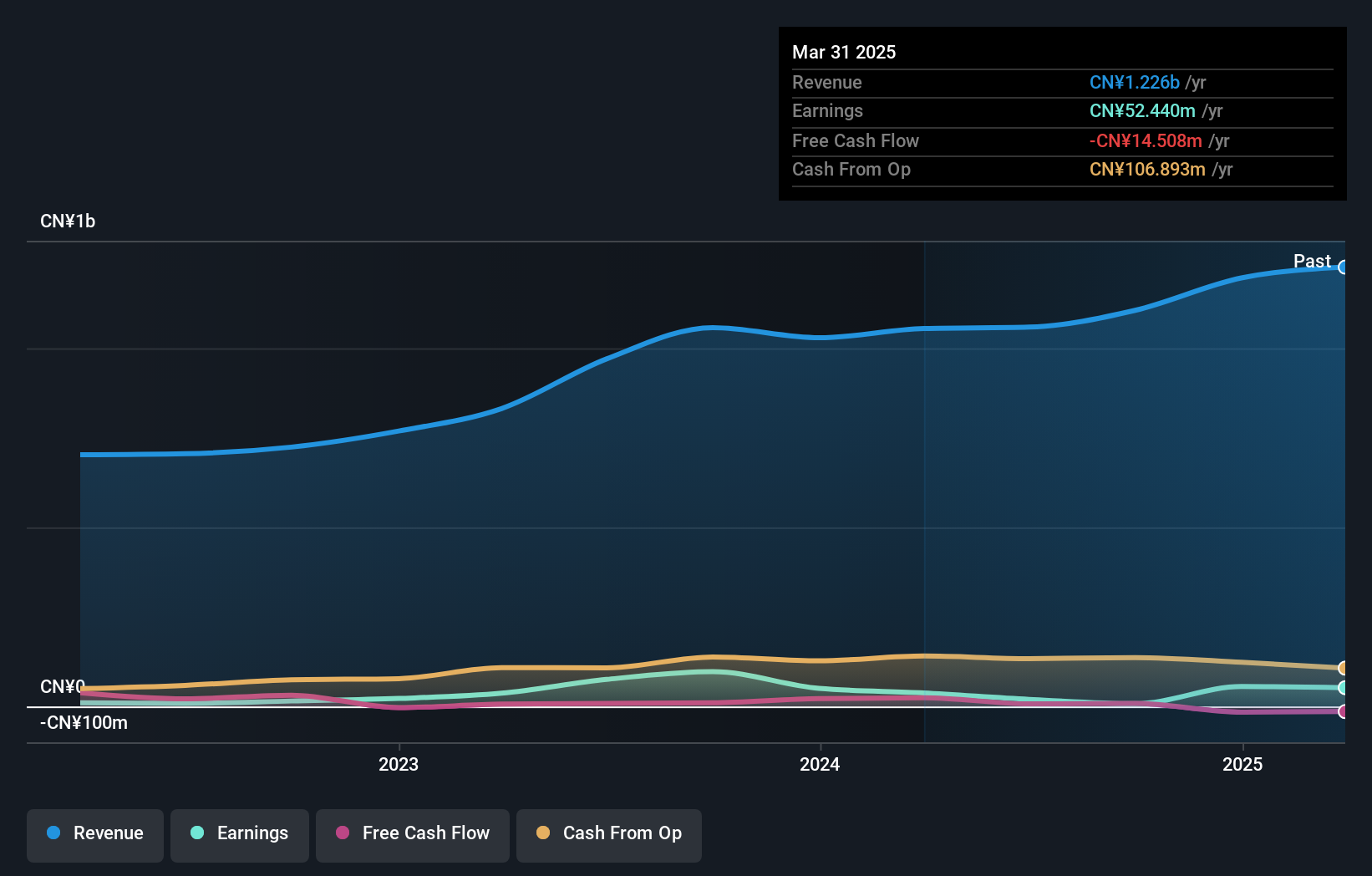

Operations: Tong Petrotech generates revenue primarily from its petroleum exploration development segment, which reported CN¥1.23 billion.

Tong Petrotech, a dynamic player in the energy sector, has shown impressive earnings growth of 39.1% over the past year, outpacing the industry's modest 1.6% rise. Despite its small size, it boasts high-quality earnings and maintains more cash than total debt, suggesting a strong financial footing. However, recent results show net income for Q1 2025 at CNY 0.78 million compared to CNY 3.99 million last year, indicating some challenges ahead. The company's debt-to-equity ratio improved from 26.9% to 18.7% over five years, reflecting prudent financial management amidst share price volatility recently observed in the market.

- Delve into the full analysis health report here for a deeper understanding of Tong Petrotech.

Understand Tong Petrotech's track record by examining our Past report.

Shenzhen Zesum Technology (SZSE:301486)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen Zesum Technology Co., Ltd. specializes in the research, design, development, manufacture, and sale of precision electronic components in China with a market capitalization of CN¥9.38 billion.

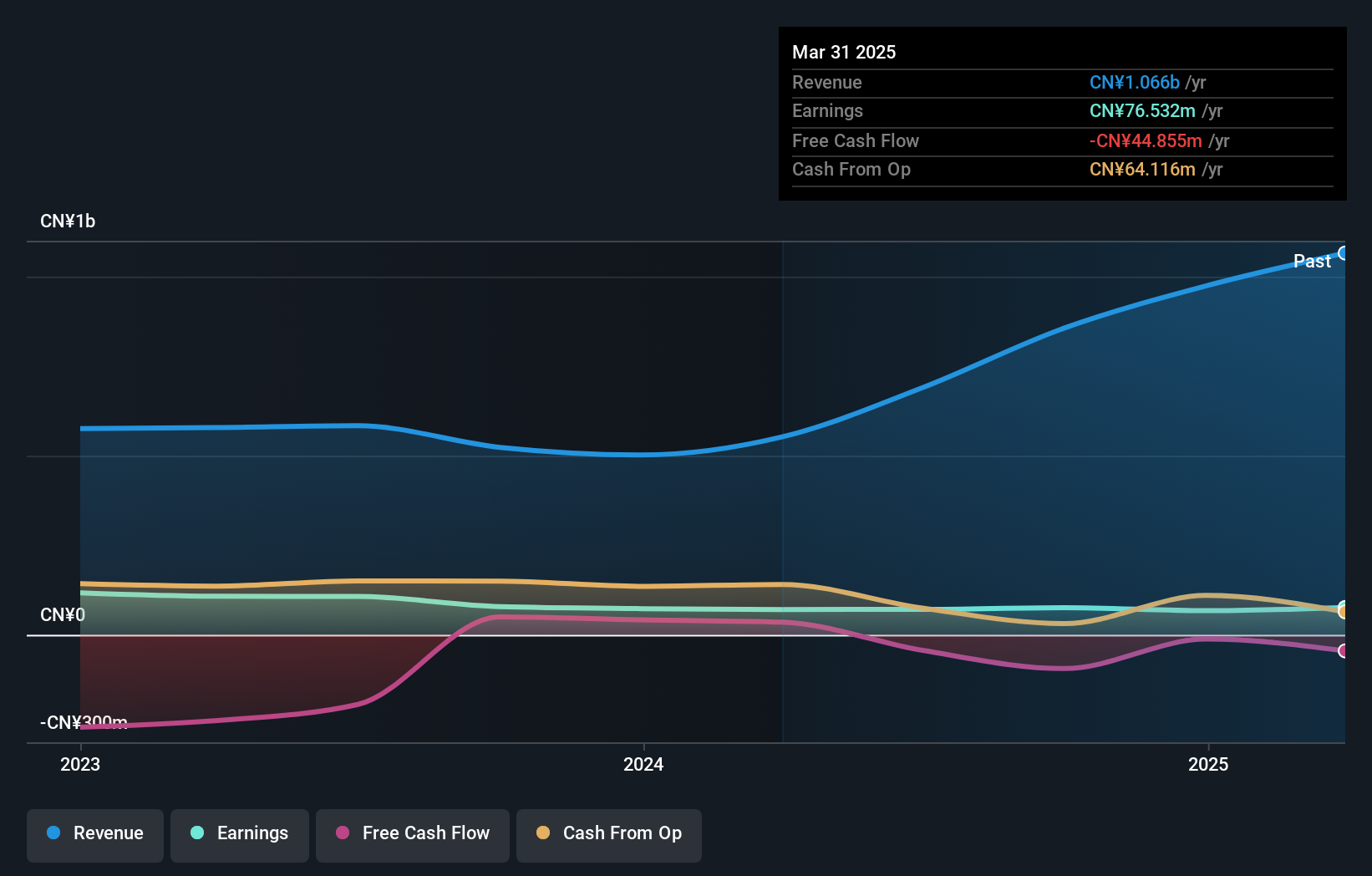

Operations: Shenzhen Zesum Technology generates revenue primarily from its electronic components and parts segment, amounting to CN¥1.07 billion. The company's market capitalization stands at CN¥9.38 billion.

Shenzhen Zesum Technology, a nimble player in the tech sector, has shown a commendable ability to manage its finances with zero debt currently, down from a 7.6% debt-to-equity ratio five years ago. Despite this financial prudence, net profit margins have slipped to 7.2% from last year's 12.8%. However, the company reported an impressive earnings growth of 8.4% over the past year, outpacing the broader electronic industry’s growth of 2.8%. Recent sales figures for Q1 2025 hit CNY 266 million compared to CNY 174 million in the previous year’s quarter, highlighting robust demand for its offerings.

LuxNet (TPEX:4979)

Simply Wall St Value Rating: ★★★★★★

Overview: LuxNet Corporation, along with its subsidiaries, is engaged in the manufacturing, processing, and sale of electric and optical communication components in Taiwan with a market capitalization of approximately NT$26.20 billion.

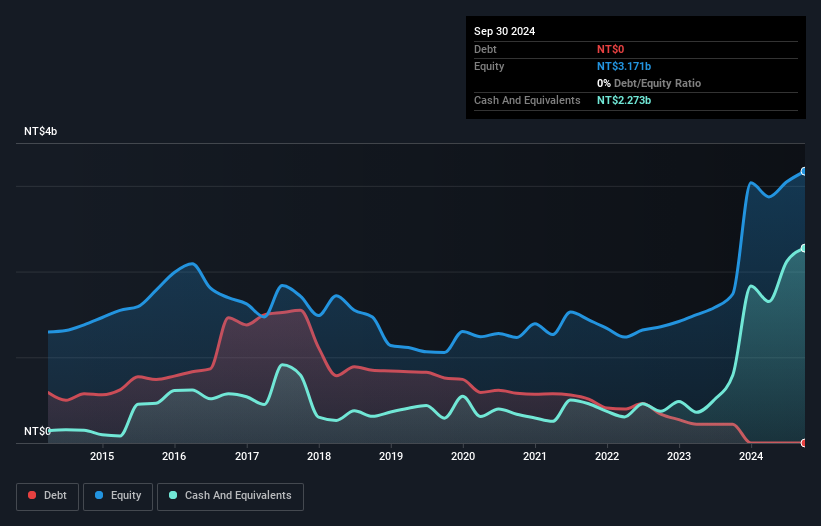

Operations: LuxNet generates revenue primarily from its Optical Communication System Active Components segment, amounting to NT$3.86 billion. The company's market capitalization stands at approximately NT$26.20 billion.

LuxNet, a nimble player in the communications sector, has been making waves with its impressive financial performance. Over the past year, earnings surged by 26.9%, outpacing the industry average of -1.2%. The company’s debt management is commendable, with a reduction in its debt-to-equity ratio from 47.6% to 22.2% over five years and more cash than total debt on hand. Recent results show net income jumping to TWD 213 million from TWD 104 million year-on-year for Q1 2025, highlighting robust growth despite share price volatility over three months—an indicator of high-quality earnings potential going forward.

- Click here to discover the nuances of LuxNet with our detailed analytical health report.

Review our historical performance report to gain insights into LuxNet's's past performance.

Seize The Opportunity

- Embark on your investment journey to our 2614 Asian Undiscovered Gems With Strong Fundamentals selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301486

Shenzhen Zesum Technology

Engages in the research, design, development, manufacture, and sale of precision electronic components in China.

Flawless balance sheet slight.

Market Insights

Community Narratives