- China

- /

- Electronic Equipment and Components

- /

- SZSE:301486

High Growth Tech Stocks In China With Promising Potential

Reviewed by Simply Wall St

As Chinese equities gain momentum with recent central bank support, the market is showing signs of resilience despite ongoing deflationary pressures and economic growth that slightly lags behind government targets. In this dynamic environment, identifying high-growth tech stocks in China involves looking for companies that demonstrate strong innovation potential and can capitalize on improving industrial production and retail sales trends.

Top 10 High Growth Tech Companies In China

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Xi'an NovaStar Tech | 27.95% | 31.01% | ★★★★★★ |

| Zhejiang Meorient Commerce Exhibition | 26.41% | 32.59% | ★★★★★★ |

| Suzhou TFC Optical Communication | 34.11% | 33.26% | ★★★★★★ |

| Zhongji Innolight | 32.01% | 32.19% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 23.53% | 29.96% | ★★★★★★ |

| Shanghai BOCHU Electronic Technology | 27.82% | 28.62% | ★★★★★★ |

| Cubic Sensor and InstrumentLtd | 24.87% | 38.87% | ★★★★★★ |

| Eoptolink Technology | 45.04% | 42.92% | ★★★★★★ |

| Bio-Thera Solutions | 26.85% | 117.16% | ★★★★★★ |

| Huayi Brothers Media | 37.55% | 103.97% | ★★★★★★ |

Let's uncover some gems from our specialized screener.

Zhejiang Lante Optics (SHSE:688127)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zhejiang Lante Optics Co., Ltd. is a company that manufactures and sells optical products in China, with a market capitalization of CN¥9.58 billion.

Operations: Lante Optics focuses on the production and sale of optical products, with its primary revenue stream coming from photographic equipment and supplies, generating CN¥931.70 million.

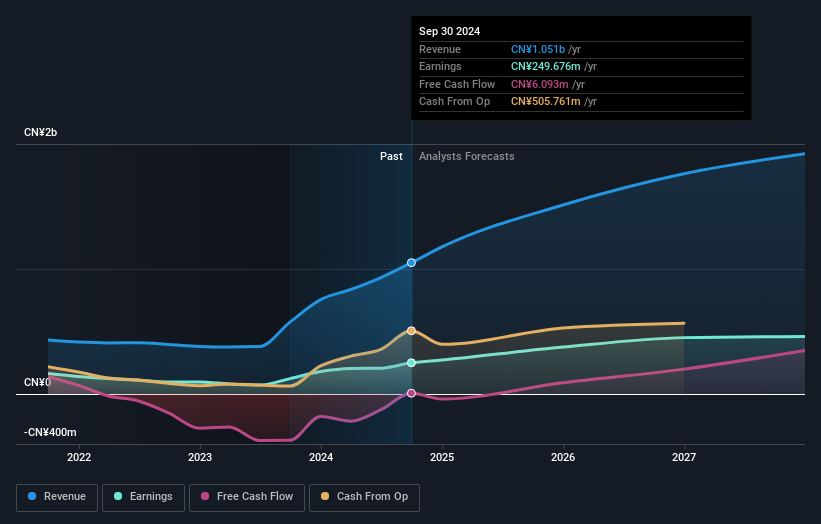

Zhejiang Lante Optics has demonstrated robust growth, with recent earnings showing a surge in sales to CNY 786.31 million from CNY 490.2 million year-over-year, and net income more than doubling to CNY 161.58 million. This performance is underscored by significant investment in R&D, crucial for sustaining its competitive edge in the high-tech optics sector. The company's revenue growth forecast at 21.2% annually outpaces the broader Chinese market's 13.5%, reflecting strong market demand and innovative capabilities. Moreover, expected earnings growth of approximately 23.9% annually highlights potential for continued financial health and industry leadership, despite a volatile share price suggesting investor caution amid rapid expansion phases.

- Get an in-depth perspective on Zhejiang Lante Optics' performance by reading our health report here.

Understand Zhejiang Lante Optics' track record by examining our Past report.

Beijing E-Hualu Information Technology (SZSE:300212)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing E-Hualu Information Technology Co., Ltd. operates in the information technology sector, focusing on digital solutions and services, with a market cap of CN¥22.20 billion.

Operations: The company generates revenue primarily from digital solutions and services within the information technology sector. It has a market capitalization of CN¥22.20 billion, indicating its significant presence in the industry.

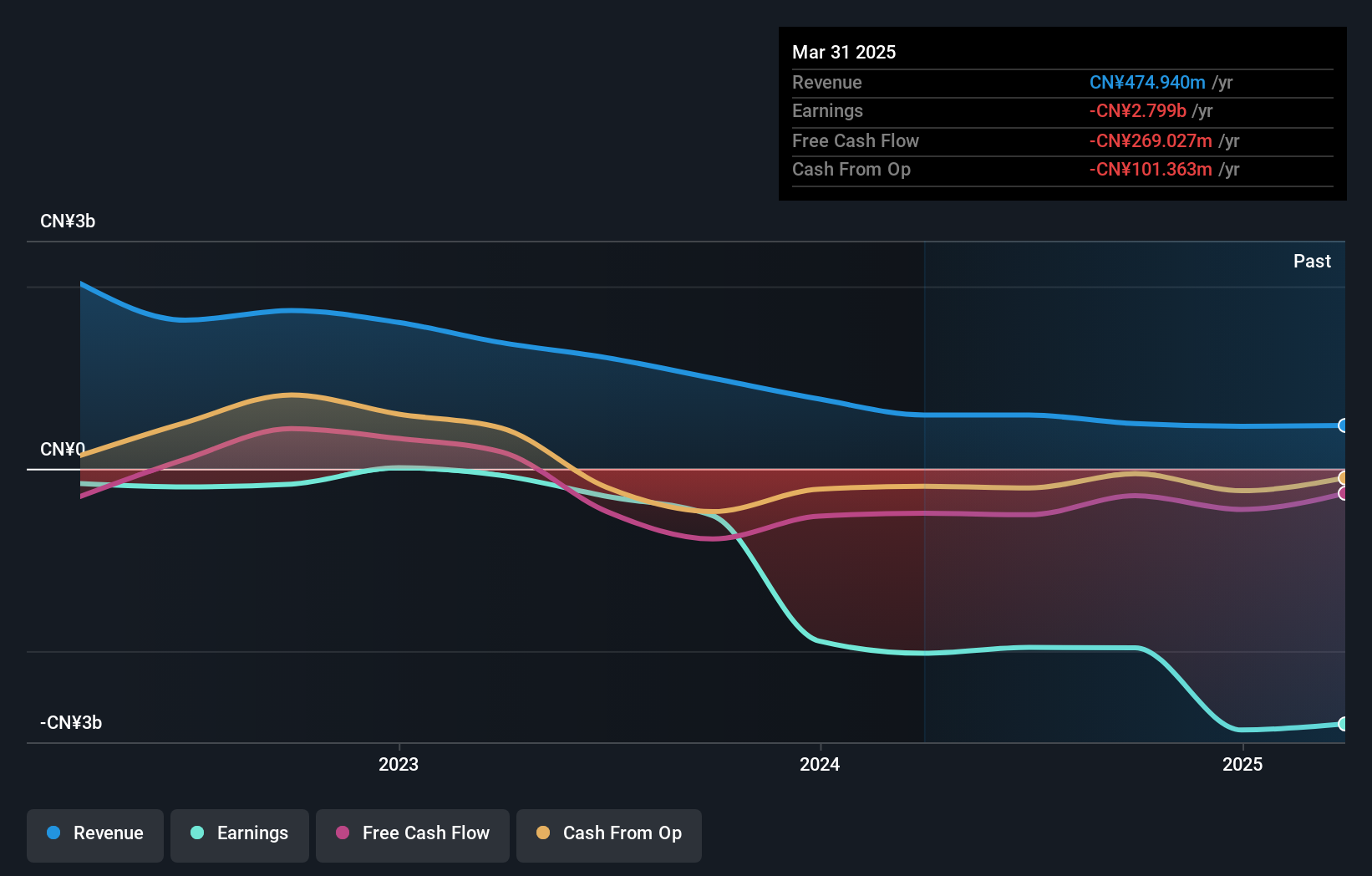

Beijing E-Hualu Information Technology, despite a challenging financial period with a net loss widening to CNY 368.4 million from CNY 298.04 million year-over-year, is poised for recovery with projected revenue growth at an impressive rate of 52% per year. This optimistic outlook is further supported by forecasts indicating earnings could surge by 142.25% annually over the next three years. The firm's commitment to innovation is evident in its substantial R&D expenses, which are crucial for maintaining competitiveness in the rapidly evolving tech landscape of China. Recent strategic meetings suggest significant corporate restructuring and potential recovery plans, aiming to stabilize and propel future growth amidst current financial uncertainties.

- Click to explore a detailed breakdown of our findings in Beijing E-Hualu Information Technology's health report.

Learn about Beijing E-Hualu Information Technology's historical performance.

Shenzhen Zesum Technology (SZSE:301486)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Zesum Technology Co., Ltd. focuses on the research, design, development, manufacture, and sale of precision electronic components in China with a market cap of CN¥6.42 billion.

Operations: Zesum Technology generates its revenue primarily through the sale of electronic components and parts, amounting to approximately CN¥689.92 million. The company is involved in various stages from research to manufacturing within this sector.

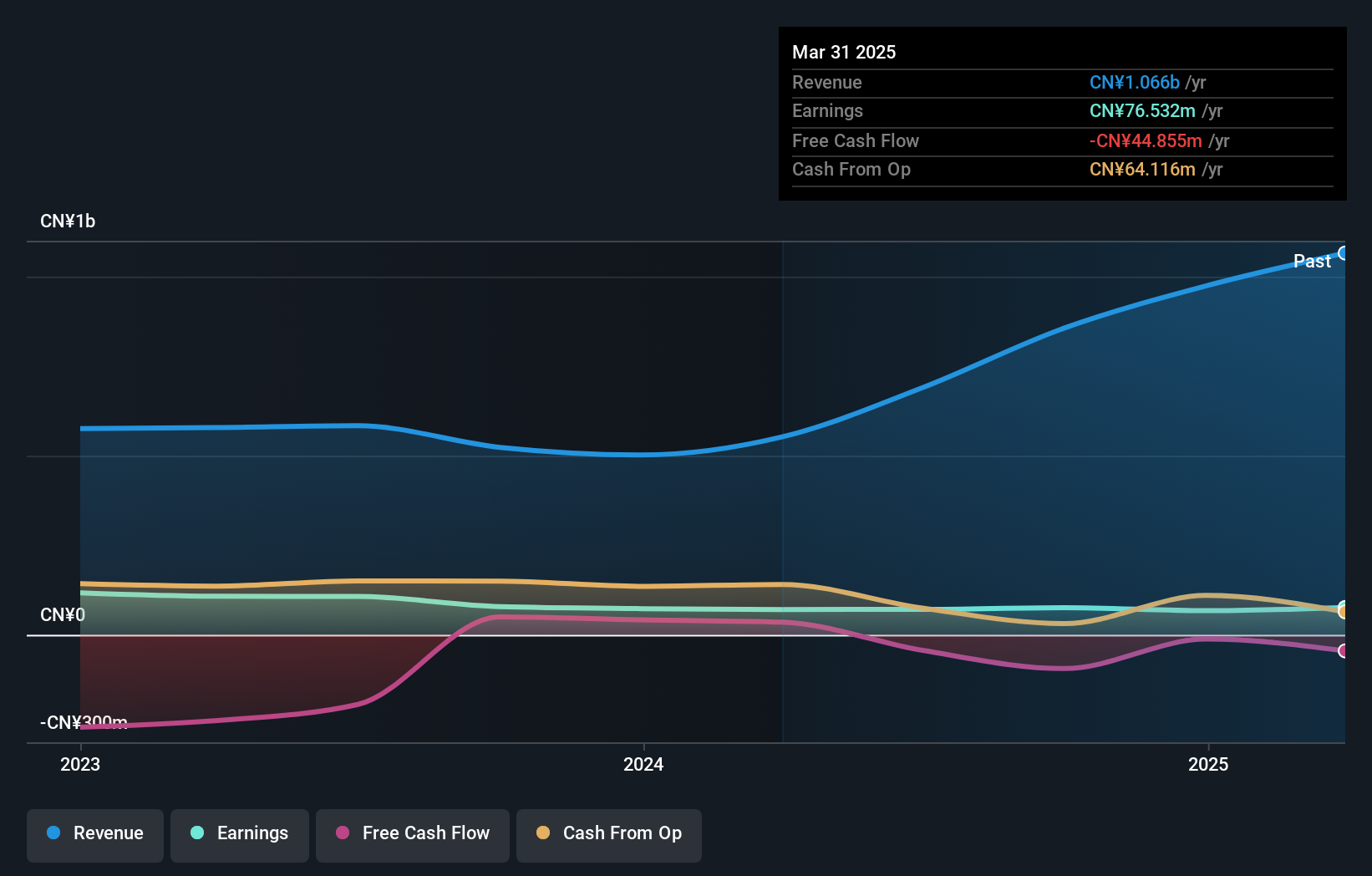

Shenzhen Zesum Technology has demonstrated a robust financial performance, with revenue soaring to CNY 438.18 million from CNY 250.22 million year-over-year, marking a significant growth rate of 29.2%. Despite a slight dip in net income from CNY 42.24 million to CNY 40.05 million, the company's commitment to innovation is evident in its escalating R&D expenses aimed at sustaining competitive advantage in China's tech sector. With earnings projected to grow by an impressive 31.9% annually, Zesum is strategically positioned for continued expansion amidst the evolving electronic industry landscape.

Key Takeaways

- Access the full spectrum of 257 Chinese High Growth Tech and AI Stocks by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301486

Shenzhen Zesum Technology

Engages in the research, design, development, manufacture, and sale of precision electronic components in China.

Flawless balance sheet slight.

Market Insights

Community Narratives