- China

- /

- Electronic Equipment and Components

- /

- SZSE:301421

Market Participants Recognise Nanjing Wavelength Opto-Electronic Science & Technology Co.,Ltd.'s (SZSE:301421) Revenues

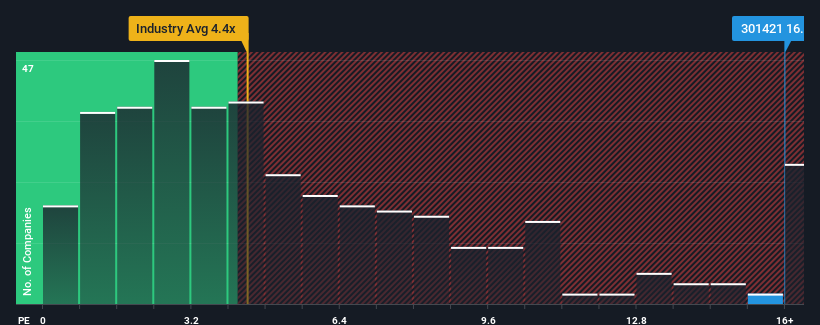

Nanjing Wavelength Opto-Electronic Science & Technology Co.,Ltd.'s (SZSE:301421) price-to-sales (or "P/S") ratio of 16x might make it look like a strong sell right now compared to the Electronic industry in China, where around half of the companies have P/S ratios below 4.4x and even P/S below 2x are quite common. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Nanjing Wavelength Opto-Electronic Science & TechnologyLtd

What Does Nanjing Wavelength Opto-Electronic Science & TechnologyLtd's P/S Mean For Shareholders?

Recent times haven't been great for Nanjing Wavelength Opto-Electronic Science & TechnologyLtd as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Nanjing Wavelength Opto-Electronic Science & TechnologyLtd's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as steep as Nanjing Wavelength Opto-Electronic Science & TechnologyLtd's is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company managed to grow revenues by a handy 7.4% last year. The solid recent performance means it was also able to grow revenue by 23% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Looking ahead now, revenue is anticipated to climb by 32% during the coming year according to the lone analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 26%, which is noticeably less attractive.

In light of this, it's understandable that Nanjing Wavelength Opto-Electronic Science & TechnologyLtd's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Nanjing Wavelength Opto-Electronic Science & TechnologyLtd's P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look into Nanjing Wavelength Opto-Electronic Science & TechnologyLtd shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Before you take the next step, you should know about the 3 warning signs for Nanjing Wavelength Opto-Electronic Science & TechnologyLtd (1 is a bit concerning!) that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Nanjing Wavelength Opto-Electronic Science & TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301421

Nanjing Wavelength Opto-Electronic Science & TechnologyLtd

Nanjing Wavelength Opto-Electronic Science & Technology Co.,Ltd.

Excellent balance sheet with slight risk.

Market Insights

Community Narratives