- Taiwan

- /

- Communications

- /

- TWSE:2345

High Growth Tech Stocks In Asia To Watch

Reviewed by Simply Wall St

Amid global economic shifts, Asian markets have been navigating a complex landscape with China's stock markets experiencing recent surges driven by domestic liquidity, despite broader economic slowdowns. In this environment, identifying high-growth tech stocks involves looking for companies that demonstrate resilience and adaptability to evolving market conditions and technological advancements.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 31.77% | 35.00% | ★★★★★★ |

| PharmaEssentia | 31.53% | 65.34% | ★★★★★★ |

| Fositek | 33.62% | 43.82% | ★★★★★★ |

| Zhongji Innolight | 26.48% | 27.46% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| Shengyi Electronics | 23.36% | 30.38% | ★★★★★★ |

| Foxconn Industrial Internet | 28.00% | 27.48% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| ALTEOGEN | 55.36% | 65.14% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's uncover some gems from our specialized screener.

Shenzhen Bromake New Material (SZSE:301387)

Simply Wall St Growth Rating: ★★★★★☆

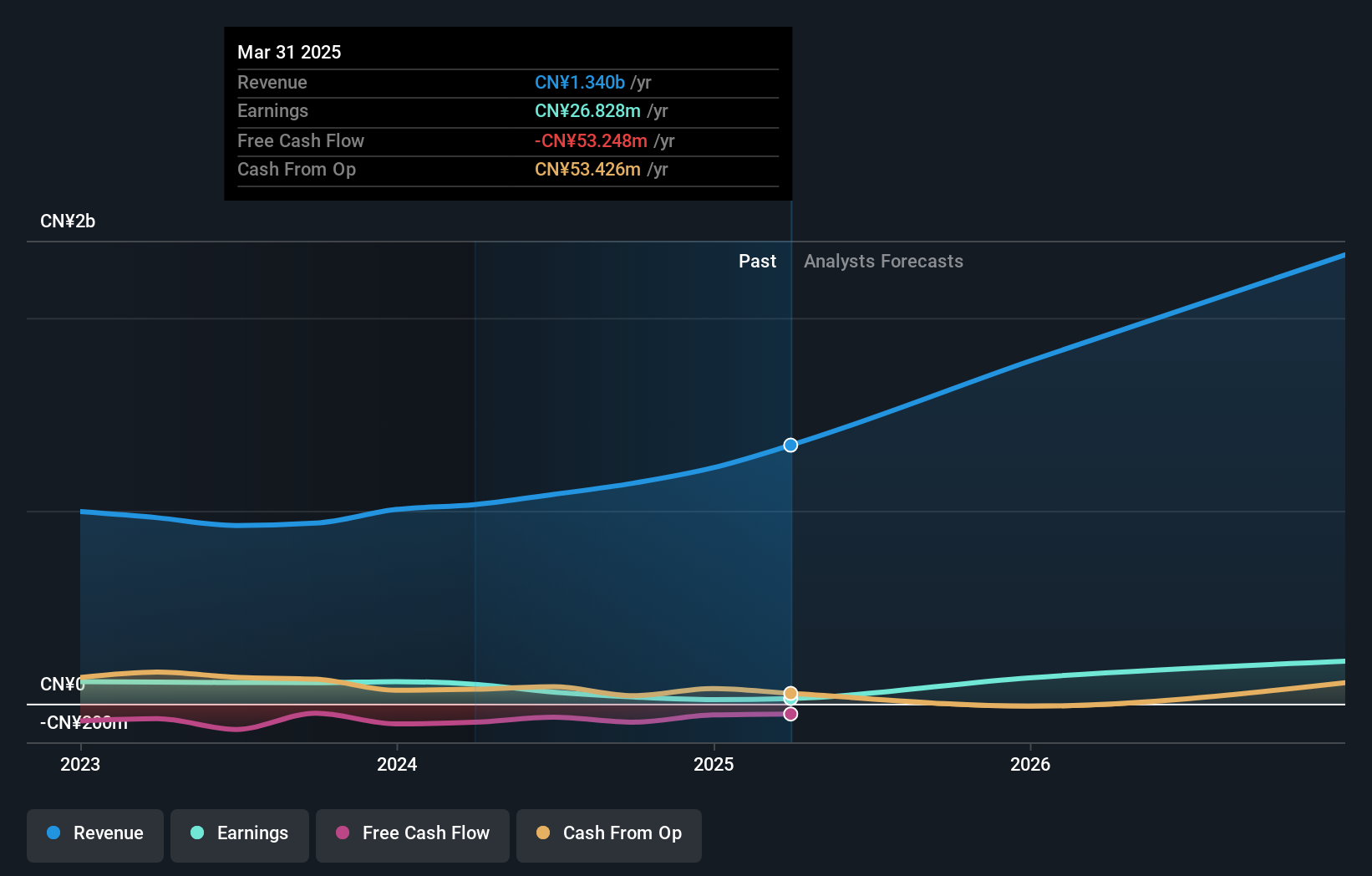

Overview: Shenzhen Bromake New Material Co., Ltd. focuses on the research, development, production, and sale of consumer electronics protective and functional products with a market cap of CN¥4.50 billion.

Operations: Shenzhen Bromake New Material Co., Ltd. generates revenue primarily from electronic components and parts, with sales amounting to CN¥1.47 billion.

Shenzhen Bromake New Material has demonstrated a robust turnaround, with H1 2025 revenues soaring to CNY 749.88 million from CNY 505.61 million the previous year, and net income reversing from a loss to CNY 23.22 million. This performance is underpinned by an aggressive R&D strategy, as evidenced by its significant investment in innovation relative to its revenue, aligning with an expected annual revenue growth of 30.7%. Recent corporate governance adjustments suggest strategic shifts that could further influence its operational dynamics and market positioning in the competitive tech landscape of Asia.

Digital Arts (TSE:2326)

Simply Wall St Growth Rating: ★★★★★☆

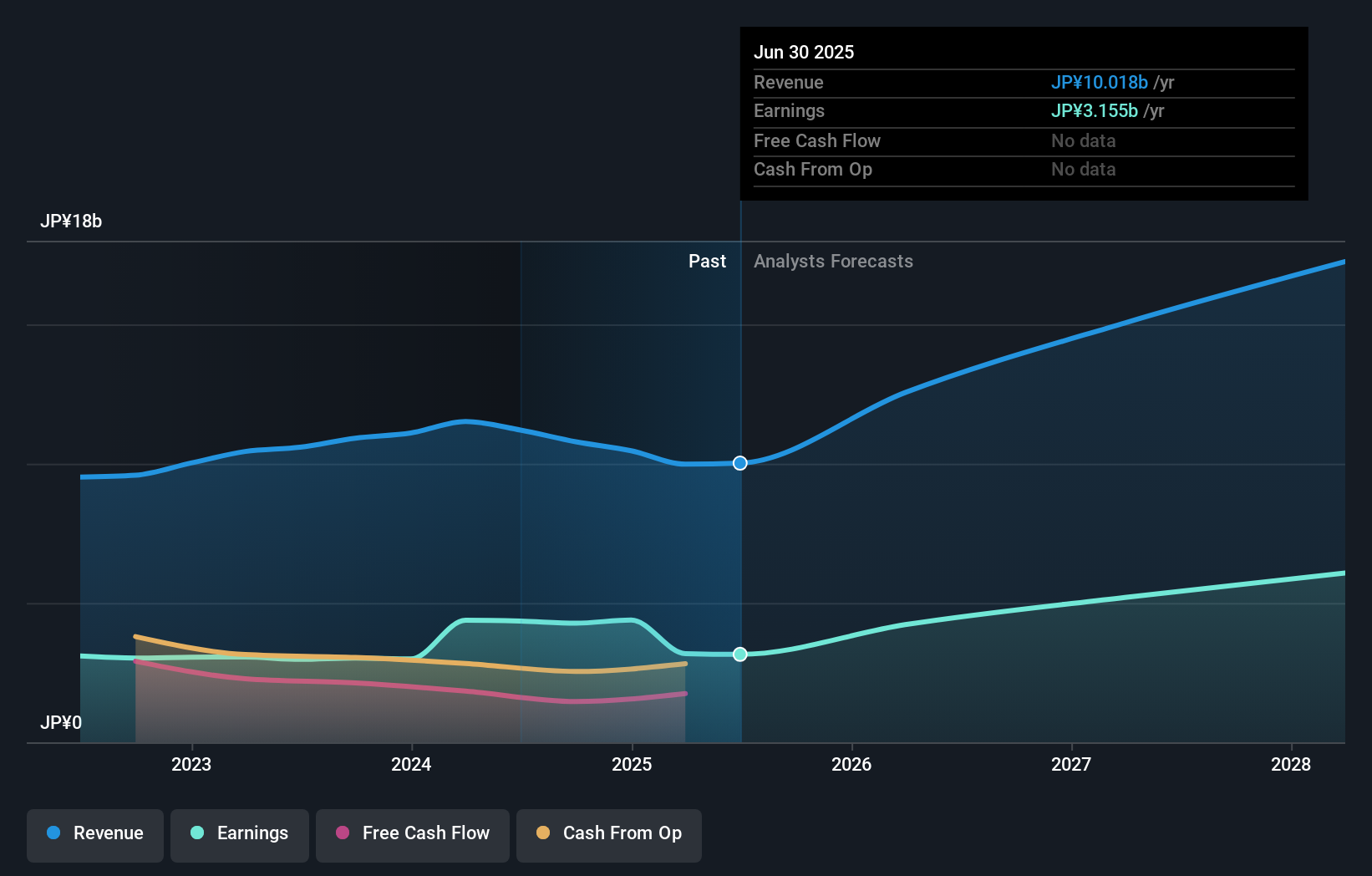

Overview: Digital Arts Inc. is a company that develops and markets internet security software and appliances across Japan, the United States, Europe, and the Asia Pacific with a market capitalization of ¥108.38 billion.

Operations: Digital Arts generates revenue primarily from its security business, which contributed ¥10.02 billion. The company focuses on developing and marketing internet security solutions across multiple regions, including Japan, the United States, Europe, and the Asia Pacific.

Digital Arts, amidst a volatile market, has announced a strategic share repurchase program aimed at enhancing shareholder value by buying back up to 63,000 shares for ¥500 million. This move underscores the company's robust financial health and commitment to capital efficiency. With an impressive forecast of 22.4% annual earnings growth outpacing the Japanese market's 8.2%, and revenue growth projections at 18.9% annually—exceeding the domestic average of 4.3%—Digital Arts is positioning itself as a dynamic contender in Asia's tech arena despite recent challenges in earnings performance compared to industry averages.

Accton Technology (TWSE:2345)

Simply Wall St Growth Rating: ★★★★★★

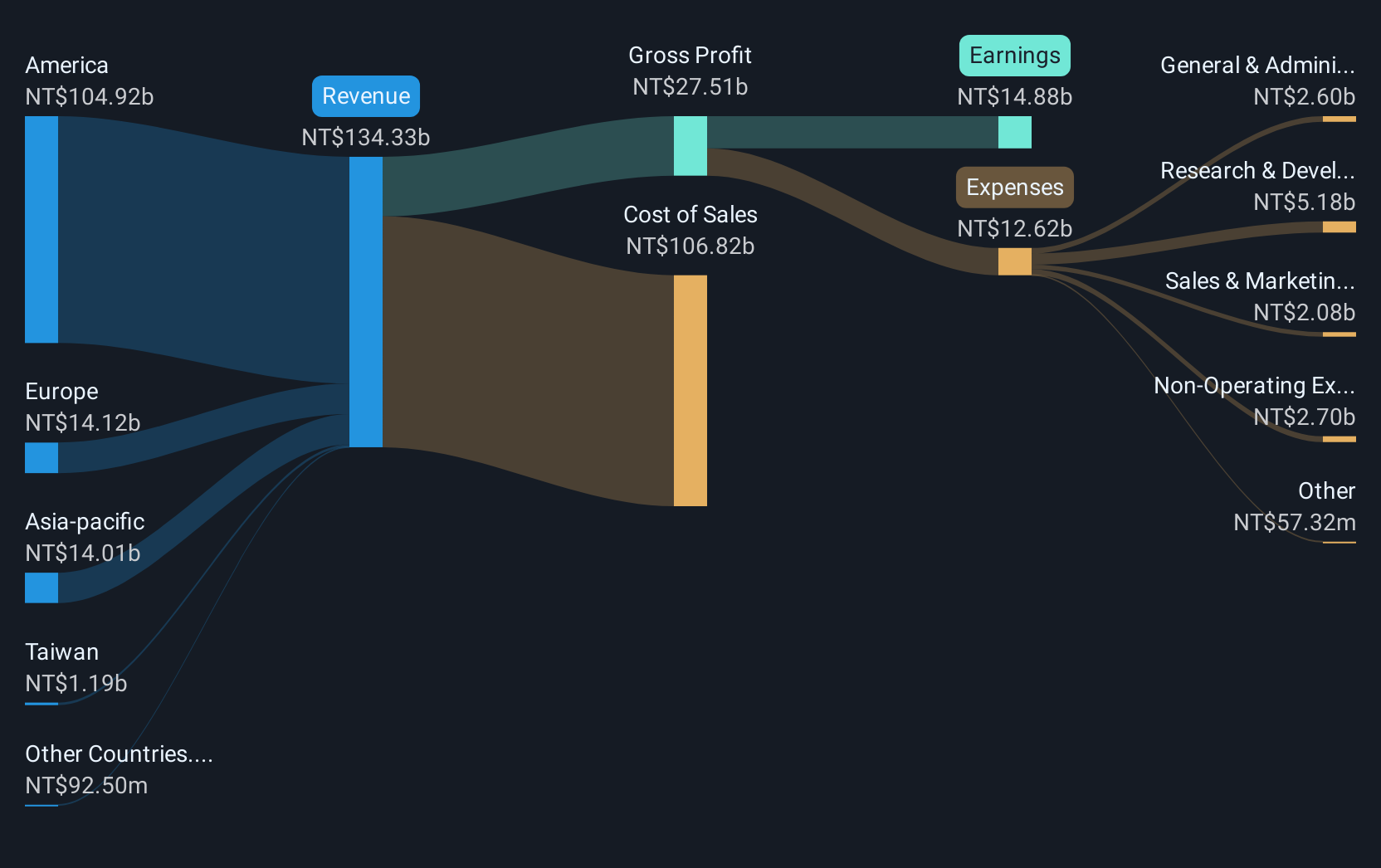

Overview: Accton Technology Corporation is engaged in the research, development, manufacturing, and sale of network communication equipment across Taiwan, America, the rest of Asia, Europe, and other international markets with a market cap of NT$570.09 billion.

Operations: Accton Technology Corporation generates revenue primarily from its computer networks segment, amounting to NT$170.52 billion. The company's operations span multiple regions, including Taiwan, America, Asia, and Europe.

Accton Technology, amidst a surge in sales to TWD 60.6 billion from TWD 24.4 billion year-over-year for Q2 2025, showcases robust growth and strategic expansion with its new Vietnamese subsidiary poised for further development with a USD 94.03 million budget. This aggressive expansion is complemented by a strong R&D focus, as evidenced by their recent earnings spike to TWD 5.03 billion from TWD 2.58 billion, reflecting a commitment to innovation and market competitiveness in the fast-evolving tech landscape of Asia.

- Click here and access our complete health analysis report to understand the dynamics of Accton Technology.

Gain insights into Accton Technology's past trends and performance with our Past report.

Summing It All Up

- Unlock more gems! Our Asian High Growth Tech and AI Stocks screener has unearthed 182 more companies for you to explore.Click here to unveil our expertly curated list of 185 Asian High Growth Tech and AI Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2345

Accton Technology

Develops, manufactures, and sells computer network systems and wireless land area network (LAN) hardware and software products in Taiwan, the United States, the Asian-Pacific, Europe, and internationally.

Exceptional growth potential with outstanding track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success