Stock Analysis

- China

- /

- Electronic Equipment and Components

- /

- SZSE:301339

High Growth Tech Stocks To Watch In November 2024

Reviewed by Simply Wall St

As global markets experience a mix of cautious optimism and volatility, with the Nasdaq Composite and S&P MidCap 400 Index reaching record highs before retreating, investors are closely monitoring how economic indicators like job data and manufacturing activity impact market sentiment. In this environment, identifying high-growth tech stocks involves looking for companies that demonstrate resilience amidst fluctuating earnings reports and broader market challenges, positioning themselves well in an evolving economic landscape.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.41% | 70.53% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 31.20% | 72.26% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1285 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

JWIPC Technology (SZSE:001339)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: JWIPC Technology Co., Ltd. focuses on researching, developing, and manufacturing IoT hardware solutions with a market capitalization of CN¥8.47 billion.

Operations: JWIPC Technology Co., Ltd. engages in the research, development, and manufacturing of IoT hardware solutions. The company operates within a market valued at CN¥8.47 billion, focusing on innovative technology products tailored for the Internet of Things sector.

JWIPC Technology has demonstrated a robust financial performance with a notable increase in net income from CNY 31.33 million to CNY 82.2 million over the past nine months, reflecting an earnings growth of 65.4% year-over-year, surpassing the tech industry's average of 6.8%. This growth is underpinned by significant R&D investments, aligning with an earnings forecast to expand by 41.1% annually, outpacing the broader Chinese market's expectation of 26.1%. Moreover, consistent dividend payments underscore a commitment to shareholder returns amidst these expansions. The company's strategic focus on innovation is evident from its R&D expenditure trends which are crucial for sustaining long-term competitiveness in the high-tech sector where JWIPC operates. With revenue projected to grow at an annual rate of 19.2%, slightly below the ambitious threshold of 20% but still above China’s market average of 13.9%, JWIPC is positioning itself as a resilient player in technology advancement and market expansion efforts.

- Unlock comprehensive insights into our analysis of JWIPC Technology stock in this health report.

Examine JWIPC Technology's past performance report to understand how it has performed in the past.

Vanjee Technology (SZSE:300552)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Vanjee Technology Co., Ltd. specializes in providing intelligent transportation systems in China and has a market capitalization of CN¥8.20 billion.

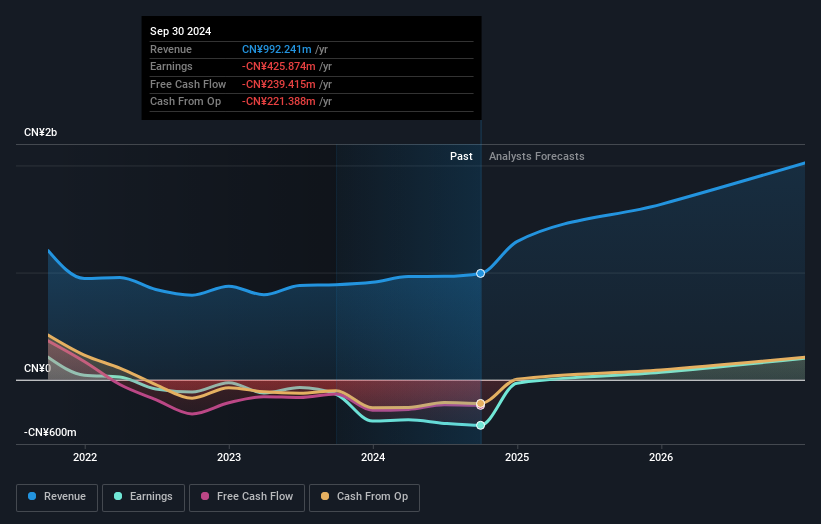

Operations: Vanjee Technology focuses on the intelligent transportation industry, generating CN¥992.24 million in revenue from this segment.

Despite a challenging financial landscape with a net loss widening to CNY 237.39 million from CNY 197.04 million year-over-year, Vanjee Technology demonstrates potential through aggressive revenue growth, up by 15.4% to CNY 624.71 million. This growth is propelled by significant R&D investments, which are essential for innovation in the tech sector; notably, R&D expenses have surged in line with efforts to refine technological offerings and capture market share. The company's inclusion in the S&P Global BMI Index underscores its evolving industry presence and potential for future profitability, projected to materialize within three years with an expected annual profit growth of 122.41%. These elements highlight Vanjee's strategic push towards becoming a notable contender in high-tech markets despite current profitability challenges.

- Dive into the specifics of Vanjee Technology here with our thorough health report.

Evaluate Vanjee Technology's historical performance by accessing our past performance report.

Jiangsu Tongxingbao Intelligent Transportation Technology (SZSE:301339)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangsu Tongxingbao Intelligent Transportation Technology Co., Ltd. specializes in the development and production of intelligent transportation systems, with a market capitalization of CN¥8.94 billion.

Operations: Tongxingbao generates revenue primarily from its computer peripherals segment, amounting to CN¥823.39 million.

Jiangsu Tongxingbao Intelligent Transportation Technology has demonstrated a robust financial performance, with recent reports showing a revenue increase to CNY 533.77 million from CNY 451.99 million year-over-year, alongside a net income rise to CNY 167.11 million from CNY 155.33 million. This growth is underpinned by significant R&D investments, reflecting in the company's strategic focus on innovation within the intelligent transportation sector—R&D expenses have notably aligned with this vision, fostering advancements that could steer future industry standards. Moreover, projected annual earnings growth of 31.1% and revenue forecasts growing at 22.5% per annum suggest potential for sustained upward trajectories in its market segments, positioning the firm well against competitors in high-tech industries where technological leadership is critical.

Where To Now?

- Navigate through the entire inventory of 1285 High Growth Tech and AI Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301339

Jiangsu Tongxingbao Intelligent Transportation Technology

Jiangsu Tongxingbao Intelligent Transportation Technology Co., Ltd.