- South Korea

- /

- Professional Services

- /

- KOSDAQ:A204620

3 Asian Stocks Estimated To Be Trading Below Fair Value By Up To 45.8%

Reviewed by Simply Wall St

As global markets navigate a complex landscape of economic indicators and geopolitical developments, Asian stocks present intriguing opportunities for investors. In this environment, identifying undervalued stocks can be particularly appealing, as they may offer potential value amid broader market fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xi'an International Medical Investment (SZSE:000516) | CN¥4.79 | CN¥9.38 | 48.9% |

| WT Microelectronics (TWSE:3036) | NT$134.00 | NT$267.06 | 49.8% |

| Visional (TSE:4194) | ¥9987.00 | ¥19552.71 | 48.9% |

| SK hynix (KOSE:A000660) | ₩571000.00 | ₩1133582.49 | 49.6% |

| Samyang Foods (KOSE:A003230) | ₩1401000.00 | ₩2750940.82 | 49.1% |

| Nippon Thompson (TSE:6480) | ¥706.00 | ¥1406.48 | 49.8% |

| Ningxia Building Materials GroupLtd (SHSE:600449) | CN¥13.21 | CN¥26.19 | 49.6% |

| New Zealand King Salmon Investments (NZSE:NZK) | NZ$0.196 | NZ$0.39 | 49.2% |

| Nanjing COSMOS Chemical (SZSE:300856) | CN¥14.72 | CN¥29.31 | 49.8% |

| JINS HOLDINGS (TSE:3046) | ¥6090.00 | ¥12164.26 | 49.9% |

Here we highlight a subset of our preferred stocks from the screener.

Global Tax Free (KOSDAQ:A204620)

Overview: Global Tax Free Co., Ltd. is a tax refund company serving foreign tourists in South Korea, Singapore, Japan, and France with a market cap of ₩479.96 billion.

Operations: The company generates revenue from its IT Business Division (₩17.78 billion), Cosmetics Business Sector (₩2.65 billion), and Tax Refund Business Sector (₩129.75 billion).

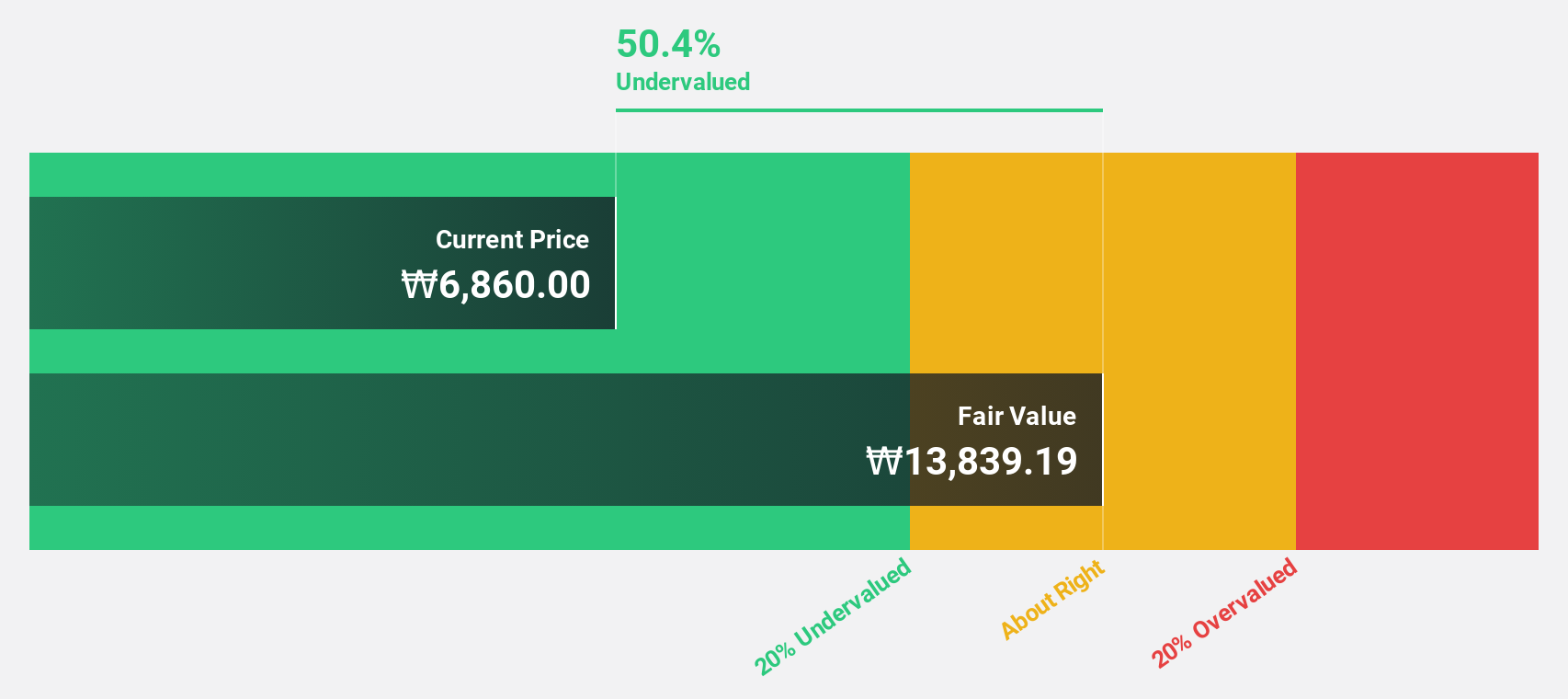

Estimated Discount To Fair Value: 45.8%

Global Tax Free is trading at ₩6830, significantly below its estimated fair value of ₩12603.45, suggesting it may be undervalued based on cash flows. Despite recent share price volatility, the company became profitable this year and forecasts indicate a 15.8% annual revenue growth rate, outpacing the Korean market's 10.5%. However, its earnings growth is expected to lag behind the broader market despite being significant at over 20% annually in upcoming years.

- Our earnings growth report unveils the potential for significant increases in Global Tax Free's future results.

- Get an in-depth perspective on Global Tax Free's balance sheet by reading our health report here.

Karmarts (SET:KAMART)

Overview: Karmarts Public Company Limited, along with its subsidiaries, operates in Thailand by manufacturing, packaging, importing, and distributing cosmetics and consumer products with a market cap of THB11.40 billion.

Operations: The company's revenue primarily comes from the manufacture and distribution of consumer products, generating THB3.40 billion, supplemented by warehouse rental income of THB26.68 million.

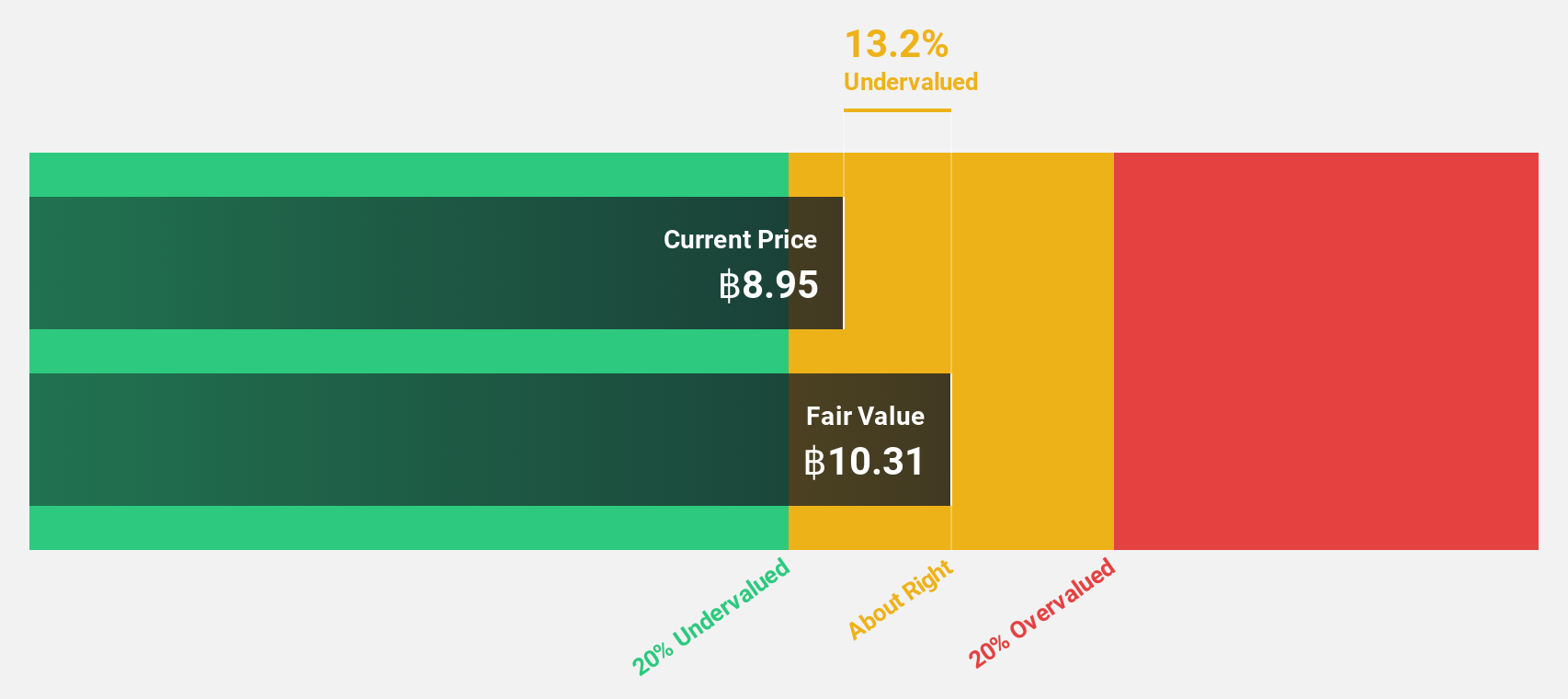

Estimated Discount To Fair Value: 13.2%

Karmarts, trading at THB8.95, is 13.2% below its estimated fair value of THB10.31, indicating potential undervaluation based on cash flows. The company's earnings are forecasted to grow at 19.2% annually, outpacing the Thai market's 12.6%. However, its dividend yield of 4.92% isn't well covered by free cash flows. Recent earnings show steady growth with third-quarter revenue reaching THB871.93 million from last year's THB815.95 million and net income slightly increasing to THB181.43 million.

- In light of our recent growth report, it seems possible that Karmarts' financial performance will exceed current levels.

- Navigate through the intricacies of Karmarts with our comprehensive financial health report here.

Jiangsu Tongxingbao Intelligent Transportation Technology (SZSE:301339)

Overview: Jiangsu Tongxingbao Intelligent Transportation Technology Co., Ltd. offers smart transportation platform solutions for highways, trunk roads, and urban transportation in China, with a market cap of CN¥9.05 billion.

Operations: The company's revenue is primarily derived from its Software and Information Technology segment, amounting to CN¥973.70 million.

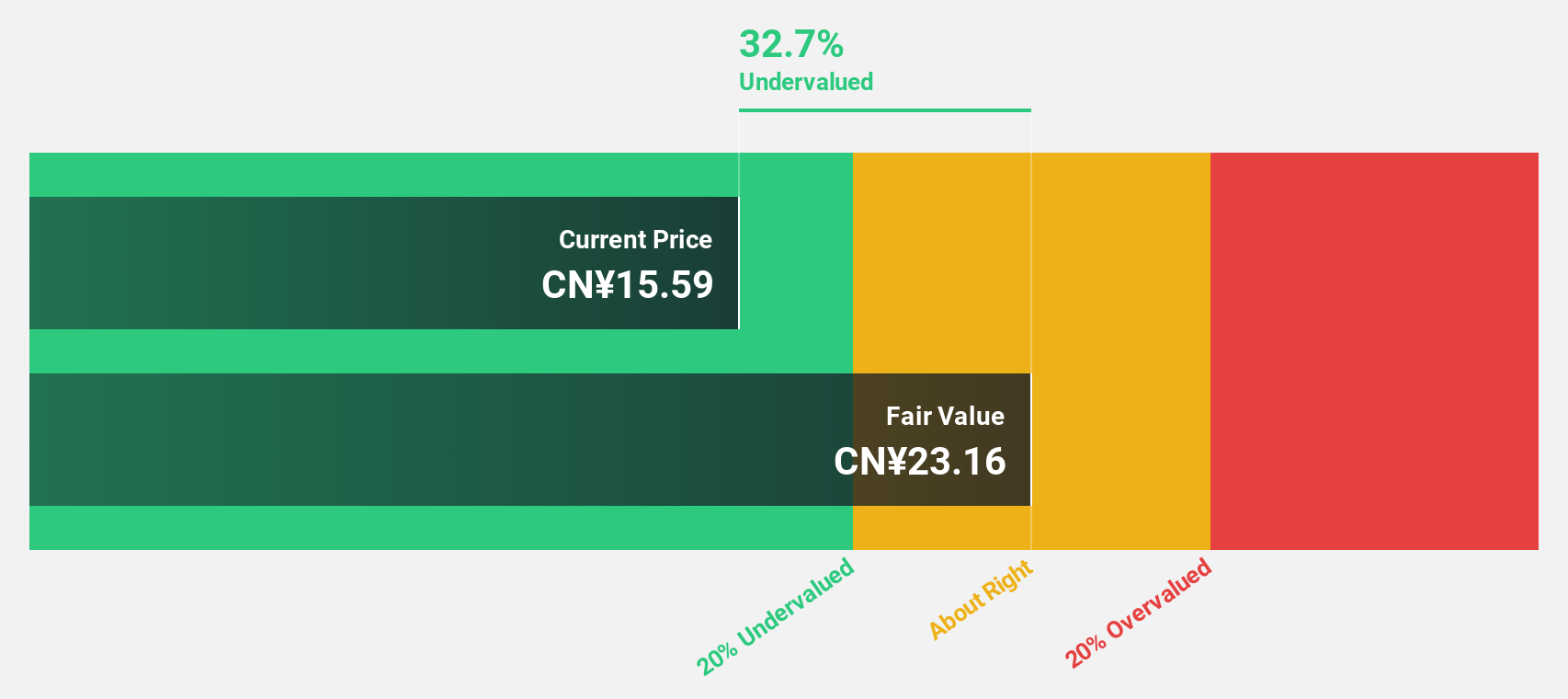

Estimated Discount To Fair Value: 32.7%

Jiangsu Tongxingbao Intelligent Transportation Technology's current trading price of CNY 15.59 is significantly below its estimated fair value of CNY 23.16, highlighting potential undervaluation based on cash flows. The company's earnings are expected to grow at a robust rate of 39.4% annually, surpassing the Chinese market's average growth forecast. Despite this, recent earnings show modest growth with net income for the nine months ending September 2025 slightly increasing to CNY 168.11 million from last year's CNY 167.11 million.

- The analysis detailed in our Jiangsu Tongxingbao Intelligent Transportation Technology growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Jiangsu Tongxingbao Intelligent Transportation Technology stock in this financial health report.

Key Takeaways

- Navigate through the entire inventory of 272 Undervalued Asian Stocks Based On Cash Flows here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A204620

Global Tax Free

Operates as tax refund company for foreign tourists in South Korea, Singapore, Japan, and France.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives