- China

- /

- Electronic Equipment and Components

- /

- SZSE:301045

Revenues Not Telling The Story For Talant Optronics (Suzhou) Co., Ltd. (SZSE:301045) After Shares Rise 30%

Talant Optronics (Suzhou) Co., Ltd. (SZSE:301045) shareholders are no doubt pleased to see that the share price has bounced 30% in the last month, although it is still struggling to make up recently lost ground. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 4.6% over the last year.

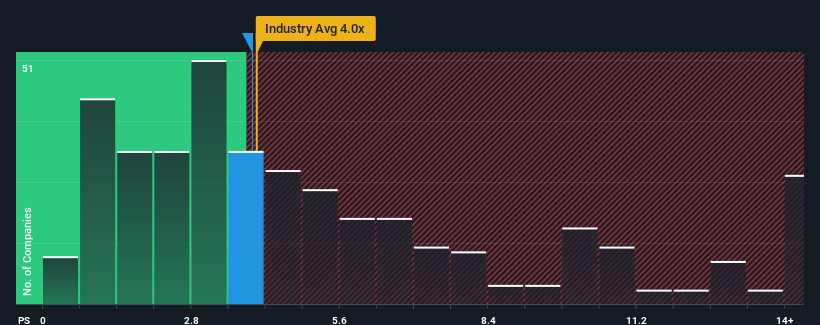

Even after such a large jump in price, there still wouldn't be many who think Talant Optronics (Suzhou)'s price-to-sales (or "P/S") ratio of 3.9x is worth a mention when the median P/S in China's Electronic industry is similar at about 4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Talant Optronics (Suzhou)

How Has Talant Optronics (Suzhou) Performed Recently?

As an illustration, revenue has deteriorated at Talant Optronics (Suzhou) over the last year, which is not ideal at all. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for Talant Optronics (Suzhou), take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Talant Optronics (Suzhou)?

In order to justify its P/S ratio, Talant Optronics (Suzhou) would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 27% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 21% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 25% shows it's an unpleasant look.

In light of this, it's somewhat alarming that Talant Optronics (Suzhou)'s P/S sits in line with the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Final Word

Talant Optronics (Suzhou)'s stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We find it unexpected that Talant Optronics (Suzhou) trades at a P/S ratio that is comparable to the rest of the industry, despite experiencing declining revenues during the medium-term, while the industry as a whole is expected to grow. Even though it matches the industry, we're uncomfortable with the current P/S ratio, as this dismal revenue performance is unlikely to support a more positive sentiment for long. If recent medium-term revenue trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You need to take note of risks, for example - Talant Optronics (Suzhou) has 5 warning signs (and 1 which is significant) we think you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Talant Optronics (Suzhou) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301045

Talant Optronics (Suzhou)

Engages in the research and development, production, and sale of photoelectric light guide plates and related components in China and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives