- China

- /

- Electronic Equipment and Components

- /

- SZSE:301013

With A 30% Price Drop For Shenzhen Lihexing Co.,Ltd. (SZSE:301013) You'll Still Get What You Pay For

Shenzhen Lihexing Co.,Ltd. (SZSE:301013) shareholders won't be pleased to see that the share price has had a very rough month, dropping 30% and undoing the prior period's positive performance. The recent drop has obliterated the annual return, with the share price now down 9.2% over that longer period.

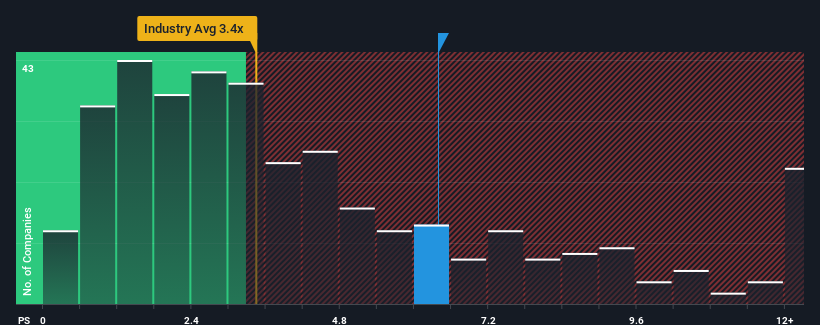

Even after such a large drop in price, you could still be forgiven for thinking Shenzhen LihexingLtd is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 6.4x, considering almost half the companies in China's Electronic industry have P/S ratios below 3.4x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Shenzhen LihexingLtd

How Has Shenzhen LihexingLtd Performed Recently?

Shenzhen LihexingLtd could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Shenzhen LihexingLtd will help you uncover what's on the horizon.How Is Shenzhen LihexingLtd's Revenue Growth Trending?

In order to justify its P/S ratio, Shenzhen LihexingLtd would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. This isn't what shareholders were looking for as it means they've been left with a 17% decline in revenue over the last three years in total. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 116% over the next year. With the industry only predicted to deliver 23%, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Shenzhen LihexingLtd's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Shenzhen LihexingLtd's P/S

A significant share price dive has done very little to deflate Shenzhen LihexingLtd's very lofty P/S. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Shenzhen LihexingLtd's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Shenzhen LihexingLtd, and understanding should be part of your investment process.

If these risks are making you reconsider your opinion on Shenzhen LihexingLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301013

Shenzhen LihexingLtd

Engages in the research and development, production, and sale of automation and intelligent equipment for information and communication technology industry in China.

Low risk with imperfect balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success