- China

- /

- Electronic Equipment and Components

- /

- SZSE:300976

Investors Appear Satisfied With Dongguan Tarry Electronics Co.,Ltd's (SZSE:300976) Prospects As Shares Rocket 50%

The Dongguan Tarry Electronics Co.,Ltd (SZSE:300976) share price has done very well over the last month, posting an excellent gain of 50%. Looking back a bit further, it's encouraging to see the stock is up 41% in the last year.

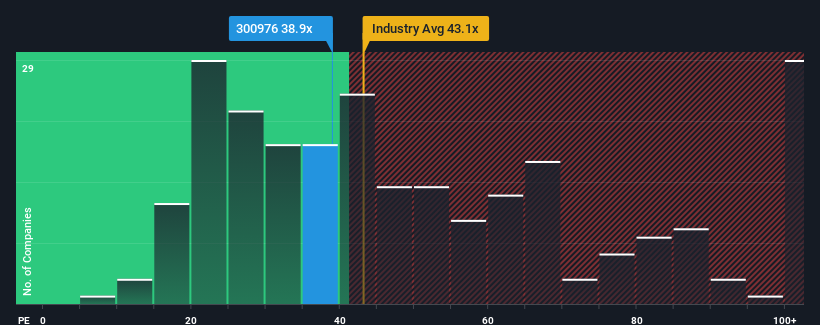

After such a large jump in price, given around half the companies in China have price-to-earnings ratios (or "P/E's") below 33x, you may consider Dongguan Tarry ElectronicsLtd as a stock to potentially avoid with its 38.9x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

There hasn't been much to differentiate Dongguan Tarry ElectronicsLtd's and the market's retreating earnings lately. One possibility is that the P/E is high because investors think the company can turn things around and break free from the broader downward trend in earnings. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Dongguan Tarry ElectronicsLtd

Is There Enough Growth For Dongguan Tarry ElectronicsLtd?

In order to justify its P/E ratio, Dongguan Tarry ElectronicsLtd would need to produce impressive growth in excess of the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 1.8%. As a result, earnings from three years ago have also fallen 55% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the sole analyst covering the company suggest earnings should grow by 29% per year over the next three years. That's shaping up to be materially higher than the 19% per annum growth forecast for the broader market.

In light of this, it's understandable that Dongguan Tarry ElectronicsLtd's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Dongguan Tarry ElectronicsLtd's P/E is getting right up there since its shares have risen strongly. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Dongguan Tarry ElectronicsLtd's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Dongguan Tarry ElectronicsLtd that you should be aware of.

Of course, you might also be able to find a better stock than Dongguan Tarry ElectronicsLtd. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300976

Dongguan Tarry ElectronicsLtd

Manufactures and sells precision die cutting products, foam protective film tapes, insulation heat conduction products, EMI shielding products, sewing and high frequency earmuffs, headbands, and assembly automation equipment in China.

High growth potential with solid track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success