- China

- /

- Electronic Equipment and Components

- /

- SZSE:300975

There's No Escaping Nanjing Sunlord Electronics Corporation Ltd.'s (SZSE:300975) Muted Revenues Despite A 27% Share Price Rise

Nanjing Sunlord Electronics Corporation Ltd. (SZSE:300975) shares have had a really impressive month, gaining 27% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 38% in the last year.

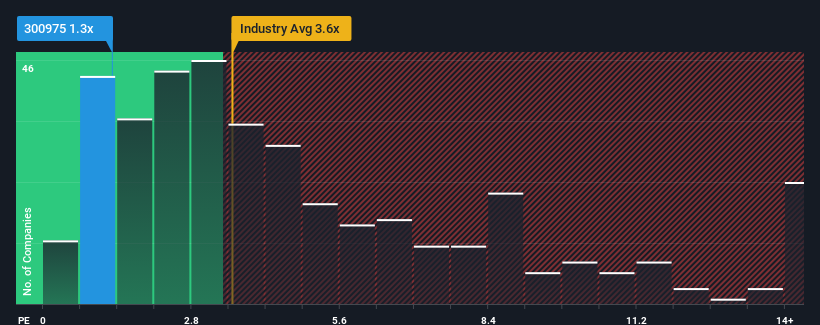

Although its price has surged higher, Nanjing Sunlord Electronics' price-to-sales (or "P/S") ratio of 1.3x might still make it look like a strong buy right now compared to the wider Electronic industry in China, where around half of the companies have P/S ratios above 3.6x and even P/S above 7x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Nanjing Sunlord Electronics

How Has Nanjing Sunlord Electronics Performed Recently?

For instance, Nanjing Sunlord Electronics' receding revenue in recent times would have to be some food for thought. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Nanjing Sunlord Electronics' earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Nanjing Sunlord Electronics?

In order to justify its P/S ratio, Nanjing Sunlord Electronics would need to produce anemic growth that's substantially trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 1.2%. Even so, admirably revenue has lifted 30% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 26% shows it's noticeably less attractive.

With this in consideration, it's easy to understand why Nanjing Sunlord Electronics' P/S falls short of the mark set by its industry peers. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

What We Can Learn From Nanjing Sunlord Electronics' P/S?

Shares in Nanjing Sunlord Electronics have risen appreciably however, its P/S is still subdued. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Nanjing Sunlord Electronics confirms that the company's revenue trends over the past three-year years are a key factor in its low price-to-sales ratio, as we suspected, given they fall short of current industry expectations. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Nanjing Sunlord Electronics (1 is a bit unpleasant!) that you need to be mindful of.

If you're unsure about the strength of Nanjing Sunlord Electronics' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Nanjing Sunlord Electronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300975

Acceptable track record with mediocre balance sheet.

Market Insights

Community Narratives