Stock Analysis

Exploring High Growth Tech Stocks From None With Promising Potential

Reviewed by Simply Wall St

As global markets continue to experience record highs, with small-cap indices like the Russell 2000 reaching new peaks, investor sentiment remains buoyant despite ongoing geopolitical tensions and economic uncertainties. In this dynamic environment, identifying high-growth tech stocks with strong fundamentals and innovative potential can be crucial for navigating market volatility and capitalizing on emerging opportunities.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Pharma Mar | 25.97% | 56.89% | ★★★★★★ |

| CD Projekt | 21.20% | 28.62% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.35% | 70.33% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.98% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.34% | ★★★★★★ |

Click here to see the full list of 1288 stocks from our High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

VGI (SET:VGI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: VGI Public Company Limited, with a market cap of THB31.57 billion, operates in Thailand primarily by providing advertising services through its various subsidiaries.

Operations: VGI generates revenue primarily through its Transit, Distribution, and Digital Services segments, with Transit contributing THB2.55 billion and Digital Services THB1.86 billion. The company focuses on advertising services across these key areas in Thailand.

VGI, amidst a challenging tech landscape, shows promising signs with an expected profitability turnaround within three years and a noteworthy revenue growth projection of 10.6% annually, outpacing the Thai market's 6.5%. This growth is underpinned by substantial R&D investments which have surged by 129.2% year-over-year, reflecting the company's commitment to innovation despite current unprofitability. Recent financials reveal a mixed picture: while Q2 sales increased to THB 407.69 million from THB 317.53 million year-over-year, net income dipped to THB 78.05 million from THB 165.88 million, indicating cost pressures yet an overall recovery in half-year performance with net income improving significantly from a loss last year to THB 140.81 million this semester.

- Delve into the full analysis health report here for a deeper understanding of VGI.

Explore historical data to track VGI's performance over time in our Past section.

NanJing GOVA Technology (SHSE:688539)

Simply Wall St Growth Rating: ★★★★★☆

Overview: NanJing GOVA Technology Co., Ltd. specializes in the research, design, development, production, and sale of sensors and sensor network systems in China with a market cap of CN¥4.70 billion.

Operations: The company generates revenue primarily from its Electronic Test & Measurement Instruments segment, with sales amounting to CN¥365.35 million.

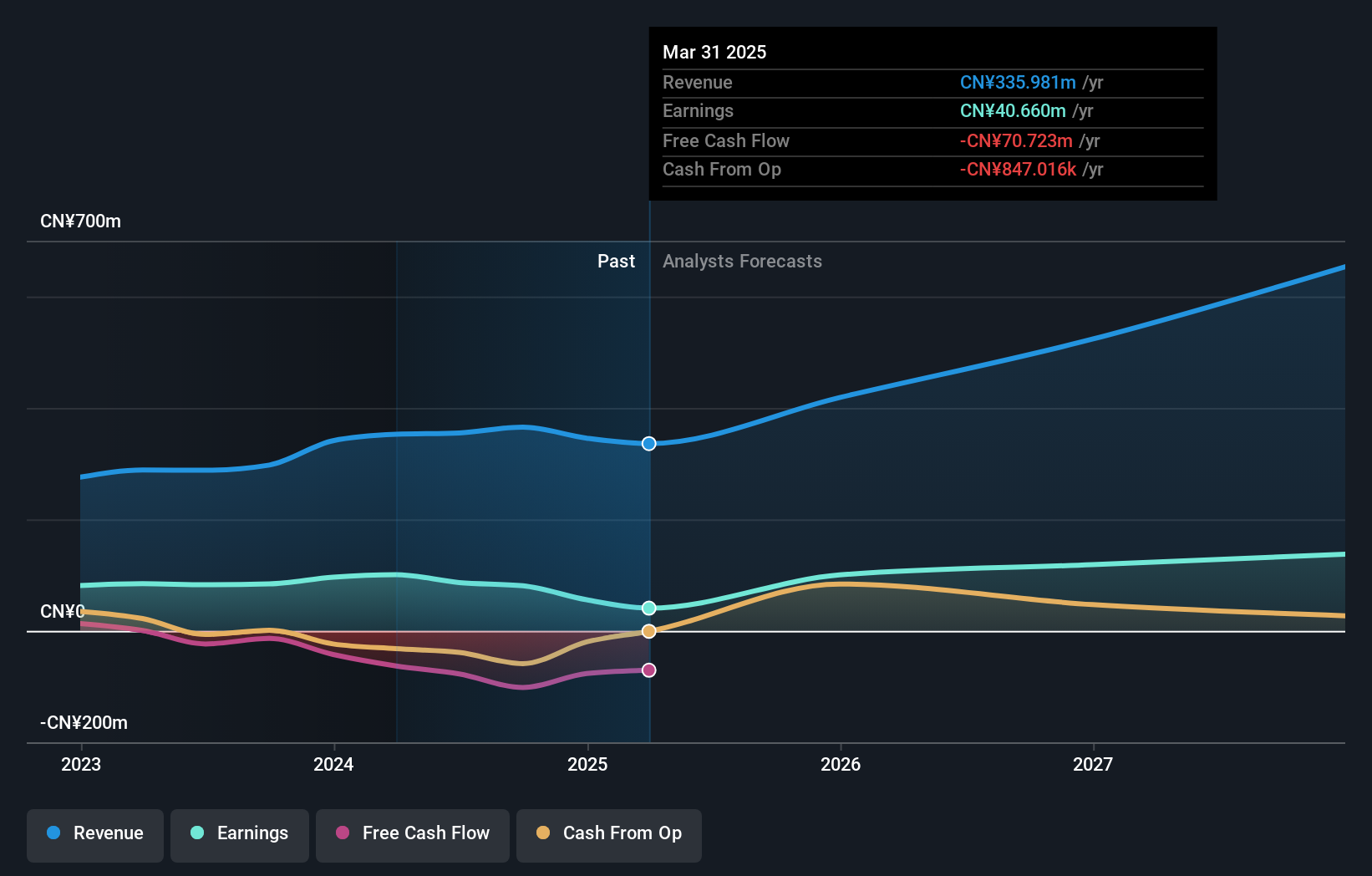

NanJing GOVA Technology is navigating a dynamic tech environment with robust future prospects, underscored by its anticipated revenue and earnings growth rates of 27.8% and 35.9% per year, respectively—both figures notably outpacing broader market averages. This aggressive expansion trajectory is supported by significant R&D commitments, which have strategically focused on developing advanced tech solutions, accounting for a substantial portion of their budget as evidenced by recent financial disclosures highlighting increased R&D spending to enhance competitive positioning in the fast-evolving tech sector. Recent corporate actions including share repurchases reflect confidence in their strategic direction, reinforcing the company's resilience amidst operational challenges such as the recent dip in net income reported in Q3 2024.

- Take a closer look at NanJing GOVA Technology's potential here in our health report.

Learn about NanJing GOVA Technology's historical performance.

POCO Holding (SZSE:300811)

Simply Wall St Growth Rating: ★★★★★☆

Overview: POCO Holding Co., Ltd. specializes in the development, production, and sale of alloy soft magnetic powder and cores, along with related inductance components for electronic equipment manufacturers, with a market cap of CN¥13.80 billion.

Operations: POCO Holding focuses on producing and distributing alloy soft magnetic materials and inductance components, targeting electronic equipment manufacturers. The company operates with a market capitalization of CN¥13.80 billion, emphasizing its role in the electronics supply chain.

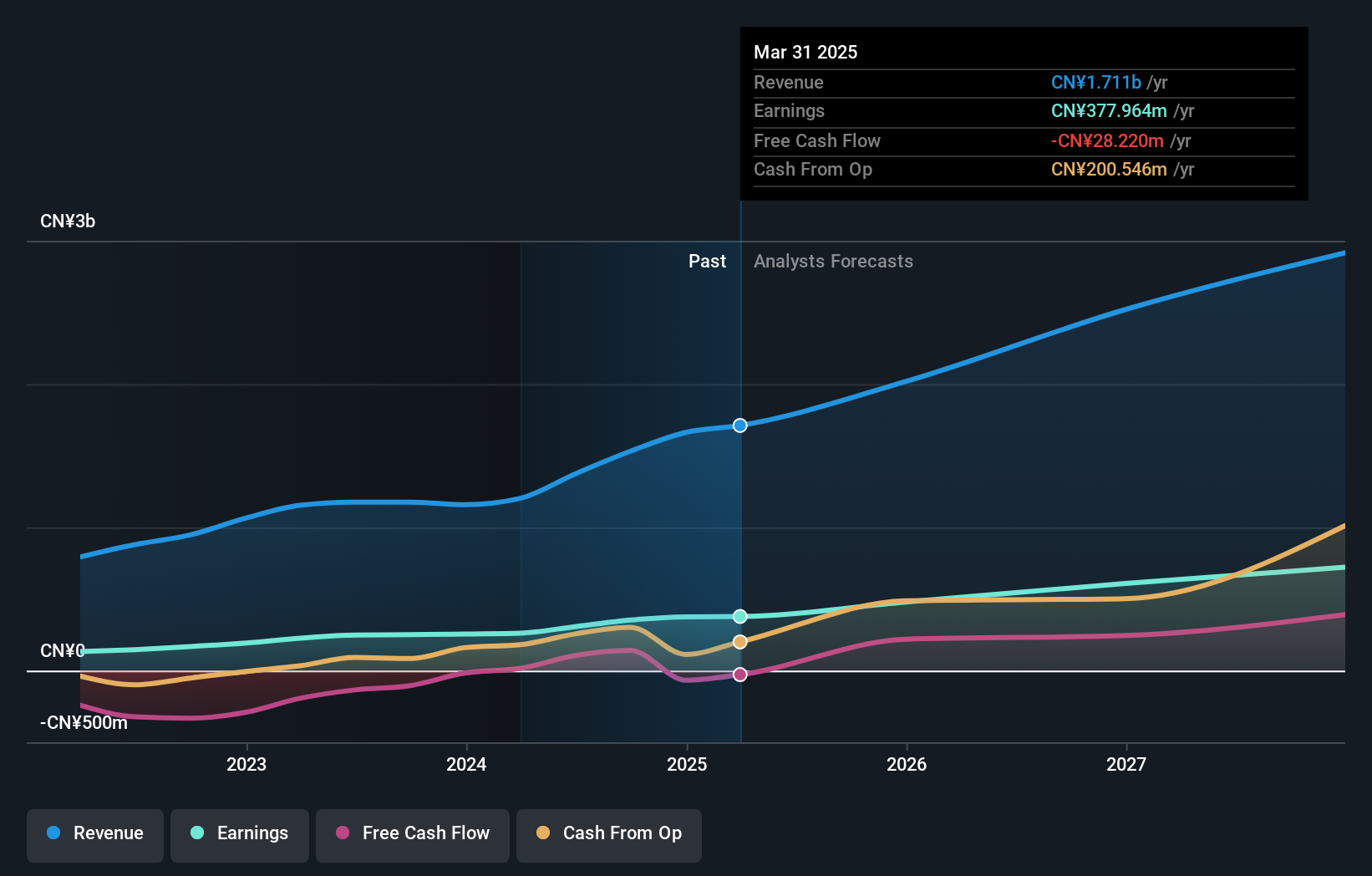

POCO Holding has demonstrated a robust growth trajectory, with revenue and earnings expanding by 25.6% and 26.6% per year respectively, outstripping broader market averages. This surge is backed by a significant commitment to R&D, which has been instrumental in fostering innovative solutions that keep the company competitive in the fast-paced tech sector. Recent financials reveal a notable increase in net income to CNY 286.48 million from CNY 188.86 million year-over-year, reflecting strong operational execution despite market challenges. The firm's strategic investments in technology development not only underscore its growth potential but also enhance its standing among high-profile clients, positioning it well for future advancements within the industry.

- Dive into the specifics of POCO Holding here with our thorough health report.

Review our historical performance report to gain insights into POCO Holding's's past performance.

Taking Advantage

- Unlock more gems! Our High Growth Tech and AI Stocks screener has unearthed 1285 more companies for you to explore.Click here to unveil our expertly curated list of 1288 High Growth Tech and AI Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:VGI

VGI

Engages in the arrangement and provision of advertising services in Thailand.