- China

- /

- Electronic Equipment and Components

- /

- SZSE:300807

Some Zhengzhou Tiamaes Technology Co.,Ltd (SZSE:300807) Shareholders Look For Exit As Shares Take 33% Pounding

Zhengzhou Tiamaes Technology Co.,Ltd (SZSE:300807) shareholders won't be pleased to see that the share price has had a very rough month, dropping 33% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 13% in that time.

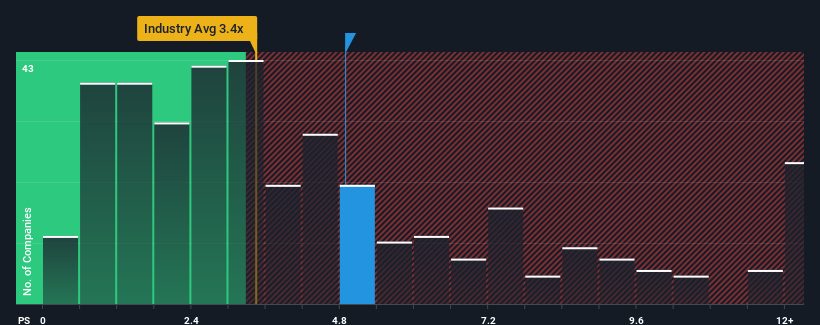

In spite of the heavy fall in price, when almost half of the companies in China's Electronic industry have price-to-sales ratios (or "P/S") below 3.4x, you may still consider Zhengzhou Tiamaes TechnologyLtd as a stock probably not worth researching with its 4.9x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Zhengzhou Tiamaes TechnologyLtd

What Does Zhengzhou Tiamaes TechnologyLtd's P/S Mean For Shareholders?

For example, consider that Zhengzhou Tiamaes TechnologyLtd's financial performance has been pretty ordinary lately as revenue growth is non-existent. It might be that many are expecting an improvement to the uninspiring revenue performance over the coming period, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Zhengzhou Tiamaes TechnologyLtd's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Zhengzhou Tiamaes TechnologyLtd would need to produce impressive growth in excess of the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 14% drop in revenue. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

In contrast to the company, the rest of the industry is expected to grow by 23% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this information, we find it concerning that Zhengzhou Tiamaes TechnologyLtd is trading at a P/S higher than the industry. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

What We Can Learn From Zhengzhou Tiamaes TechnologyLtd's P/S?

There's still some elevation in Zhengzhou Tiamaes TechnologyLtd's P/S, even if the same can't be said for its share price recently. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Zhengzhou Tiamaes TechnologyLtd revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. When we see revenue heading backwards and underperforming the industry forecasts, we feel the possibility of the share price declining is very real, bringing the P/S back into the realm of reasonability. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

You always need to take note of risks, for example - Zhengzhou Tiamaes TechnologyLtd has 2 warning signs we think you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Zhengzhou Tiamaes Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300807

Zhengzhou Tiamaes Technology

Zhengzhou Tiamaes Technology Co., Ltd provides comprehensive solutions for urban bus operation, management, and services based on internet of vehicles technology in China.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives