- China

- /

- Electronic Equipment and Components

- /

- SZSE:300790

Asian Growth Companies With High Insider Ownership Growing Earnings Up To 30%

Reviewed by Simply Wall St

Amid global economic uncertainties and trade tensions, the Asian markets have presented a mixed picture, with some regions experiencing slowdowns while others show resilience. In this environment, growth companies with high insider ownership can be particularly appealing as they often indicate strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 60.9% |

| Vuno (KOSDAQ:A338220) | 15.6% | 109.8% |

| Sineng ElectricLtd (SZSE:300827) | 36% | 25.8% |

| Samyang Foods (KOSE:A003230) | 11.7% | 27.2% |

| Oscotec (KOSDAQ:A039200) | 12.7% | 98.7% |

| Novoray (SHSE:688300) | 23.6% | 28.2% |

| M31 Technology (TPEX:6643) | 30.8% | 63.4% |

| Laopu Gold (SEHK:6181) | 35.5% | 43% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 26.5% |

| Fulin Precision (SZSE:300432) | 13.6% | 43.7% |

Here we highlight a subset of our preferred stocks from the screener.

Aoshikang Technology (SZSE:002913)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Aoshikang Technology Co., Ltd. is involved in the research, development, production, and sale of printed circuit boards, with a market cap of CN¥12.52 billion.

Operations: The company generates revenue of CN¥4.75 billion from its printed circuit board segment.

Insider Ownership: 19.7%

Earnings Growth Forecast: 30.5% p.a.

Aoshikang Technology exhibits strong growth potential with forecasted earnings growth of 30.5% annually, outpacing the Chinese market's average. However, its profit margins have declined from 11.6% to 7.4%, and its Return on Equity is expected to remain modest at 14.9%. The company trades at a favorable price-to-earnings ratio of 35.4x compared to the market, and recent share buybacks indicate confidence in its valuation despite an unstable dividend history and no significant insider trading activity recently noted.

- Take a closer look at Aoshikang Technology's potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Aoshikang Technology is trading behind its estimated value.

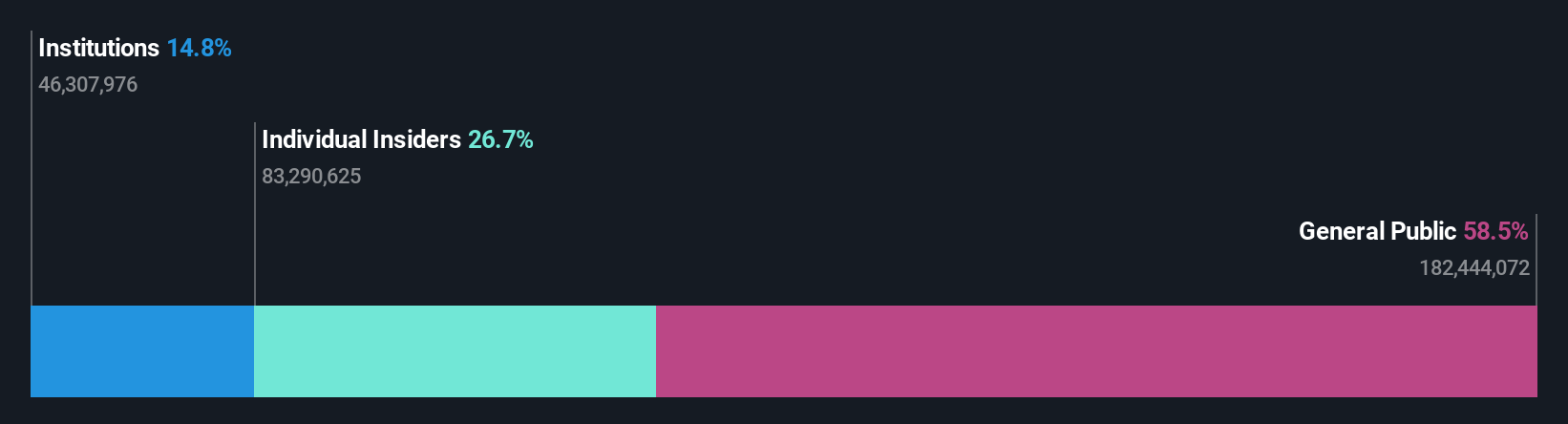

Shenzhen Sinexcel ElectricLtd (SZSE:300693)

Simply Wall St Growth Rating: ★★★★★★

Overview: Shenzhen Sinexcel Electric Co., Ltd. operates as a provider of energy interconnection ecosystems across multiple continents, including Asia, Oceania, Europe, North America, South America, and Africa, with a market cap of CN¥10.50 billion.

Operations: Shenzhen Sinexcel Electric Co., Ltd. generates revenue through its energy interconnection ecosystem, serving regions such as Asia, Oceania, Europe, North America, South America, and Africa.

Insider Ownership: 28.9%

Earnings Growth Forecast: 26.1% p.a.

Shenzhen Sinexcel Electric Ltd. shows promising growth prospects with expected annual earnings and revenue growth significantly above the Chinese market average, at 26.1% and 24.7%, respectively. The company is trading well below its estimated fair value, suggesting potential undervaluation compared to peers. Recent strategic partnerships and innovations in energy management and EV charging bolster its competitive edge, although it has an unstable dividend track record with no recent insider trading activity reported.

- Get an in-depth perspective on Shenzhen Sinexcel ElectricLtd's performance by reading our analyst estimates report here.

- The analysis detailed in our Shenzhen Sinexcel ElectricLtd valuation report hints at an deflated share price compared to its estimated value.

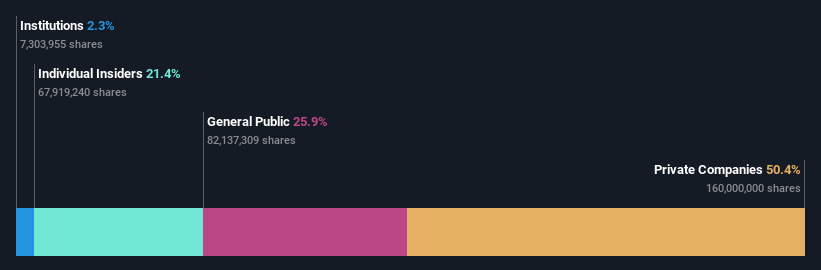

DongGuan YuTong Optical TechnologyLtd (SZSE:300790)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: DongGuan YuTong Optical Technology Co., Ltd. (SZSE:300790) operates in the optical technology sector and has a market capitalization of approximately CN¥8.83 billion.

Operations: Unfortunately, the provided text does not contain specific revenue segment information for DongGuan YuTong Optical Technology Co., Ltd. If you have additional details or another source with revenue segment data, I can help summarize it accordingly.

Insider Ownership: 32.6%

Earnings Growth Forecast: 29.4% p.a.

DongGuan YuTong Optical Technology Ltd. demonstrates robust growth potential with forecasted earnings growth of 29.4% annually, surpassing the Chinese market average. Despite slower revenue growth at 15.7%, it remains above the market rate. The price-to-earnings ratio of 46x suggests it is undervalued compared to industry peers, although its low return on equity and recent changes in company bylaws may warrant caution for investors focused on financial stability and governance structures.

- Delve into the full analysis future growth report here for a deeper understanding of DongGuan YuTong Optical TechnologyLtd.

- Insights from our recent valuation report point to the potential overvaluation of DongGuan YuTong Optical TechnologyLtd shares in the market.

Summing It All Up

- Unlock more gems! Our Fast Growing Asian Companies With High Insider Ownership screener has unearthed 587 more companies for you to explore.Click here to unveil our expertly curated list of 590 Fast Growing Asian Companies With High Insider Ownership.

- Interested In Other Possibilities? Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300790

DongGuan YuTong Optical TechnologyLtd

DongGuan YuTong Optical Technology Co.,Ltd.

Reasonable growth potential with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success