- China

- /

- Electronic Equipment and Components

- /

- SZSE:300726

Market Still Lacking Some Conviction On Zhuzhou Hongda Electronics Corp.,Ltd. (SZSE:300726)

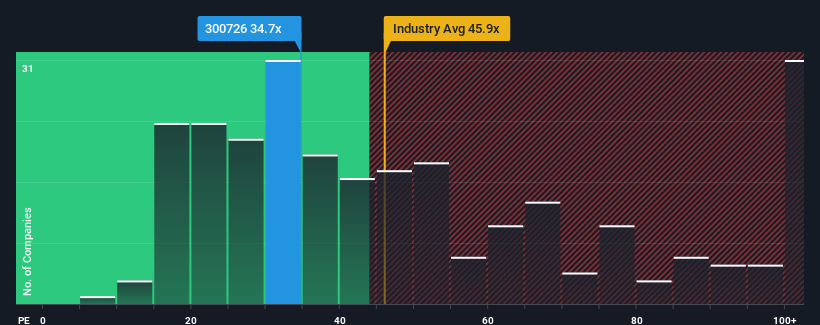

With a median price-to-earnings (or "P/E") ratio of close to 34x in China, you could be forgiven for feeling indifferent about Zhuzhou Hongda Electronics Corp.,Ltd.'s (SZSE:300726) P/E ratio of 34.7x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Recent times haven't been advantageous for Zhuzhou Hongda ElectronicsLtd as its earnings have been falling quicker than most other companies. One possibility is that the P/E is moderate because investors think the company's earnings trend will eventually fall in line with most others in the market. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

See our latest analysis for Zhuzhou Hongda ElectronicsLtd

How Is Zhuzhou Hongda ElectronicsLtd's Growth Trending?

There's an inherent assumption that a company should be matching the market for P/E ratios like Zhuzhou Hongda ElectronicsLtd's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 40% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 57% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 125% during the coming year according to the three analysts following the company. With the market only predicted to deliver 38%, the company is positioned for a stronger earnings result.

With this information, we find it interesting that Zhuzhou Hongda ElectronicsLtd is trading at a fairly similar P/E to the market. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Zhuzhou Hongda ElectronicsLtd currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 3 warning signs for Zhuzhou Hongda ElectronicsLtd that you should be aware of.

If you're unsure about the strength of Zhuzhou Hongda ElectronicsLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Zhuzhou Hongda ElectronicsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300726

Zhuzhou Hongda ElectronicsLtd

Engages in the research and development, manufacturing, sale, and servicing of electronic components and circuit modules in China.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives