- China

- /

- Communications

- /

- SZSE:300698

Wanma Technology Co., Ltd. (SZSE:300698) Stock Rockets 55% As Investors Are Less Pessimistic Than Expected

Wanma Technology Co., Ltd. (SZSE:300698) shares have had a really impressive month, gaining 55% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 43%.

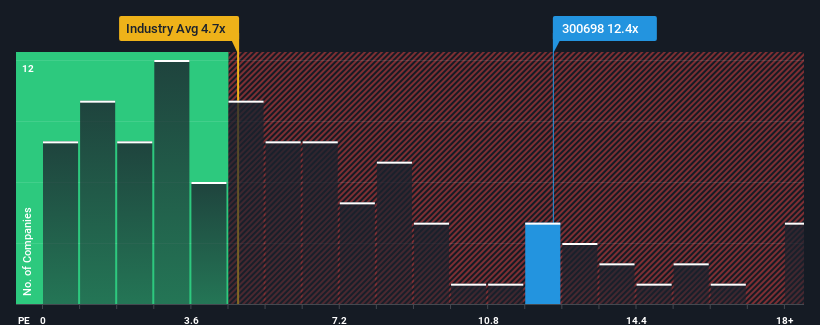

Since its price has surged higher, Wanma Technology's price-to-sales (or "P/S") ratio of 12.4x might make it look like a strong sell right now compared to other companies in the Communications industry in China, where around half of the companies have P/S ratios below 4.7x and even P/S below 2x are quite common. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Wanma Technology

What Does Wanma Technology's P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, Wanma Technology has been relatively sluggish. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. If not, then existing shareholders may be very nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Wanma Technology will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

Wanma Technology's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered a decent 10.0% gain to the company's revenues. However, this wasn't enough as the latest three year period has seen an unpleasant 13% overall drop in revenue. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 41% during the coming year according to the three analysts following the company. With the industry predicted to deliver 42% growth , the company is positioned for a comparable revenue result.

With this information, we find it interesting that Wanma Technology is trading at a high P/S compared to the industry. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Wanma Technology's P/S?

Wanma Technology's P/S has grown nicely over the last month thanks to a handy boost in the share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Given Wanma Technology's future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Wanma Technology (1 shouldn't be ignored!) that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Wanma Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300698

Wanma Technology

Engages in the research and development, production, system integration, and sales of communication and medical information equipment.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives