- China

- /

- Electronic Equipment and Components

- /

- SZSE:300679

Should You Be Adding Electric Connector Technology (SZSE:300679) To Your Watchlist Today?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like Electric Connector Technology (SZSE:300679), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Electric Connector Technology with the means to add long-term value to shareholders.

View our latest analysis for Electric Connector Technology

How Quickly Is Electric Connector Technology Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Over the last three years, Electric Connector Technology has grown EPS by 16% per year. That's a good rate of growth, if it can be sustained.

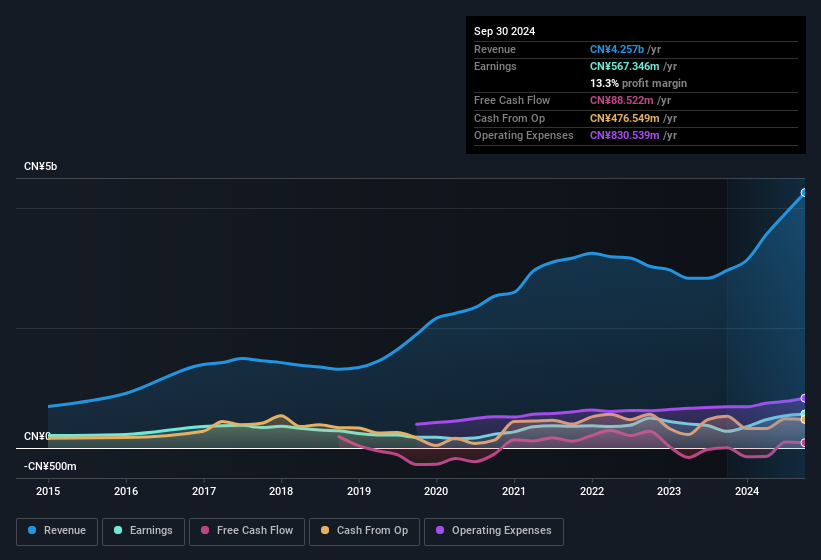

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that Electric Connector Technology is growing revenues, and EBIT margins improved by 5.2 percentage points to 13%, over the last year. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Electric Connector Technology?

Are Electric Connector Technology Insiders Aligned With All Shareholders?

Theory would suggest that it's an encouraging sign to see high insider ownership of a company, since it ties company performance directly to the financial success of its management. So as you can imagine, the fact that Electric Connector Technology insiders own a significant number of shares certainly is appealing. In fact, they own 40% of the shares, making insiders a very influential shareholder group. This should be a welcoming sign for investors because it suggests that the people making the decisions are also impacted by their choices. That means they have plenty of their own capital riding on the performance of the business!

Is Electric Connector Technology Worth Keeping An Eye On?

As previously touched on, Electric Connector Technology is a growing business, which is encouraging. If that's not enough on its own, there is also the rather notable levels of insider ownership. That combination is very appealing. So yes, we do think the stock is worth keeping an eye on. You still need to take note of risks, for example - Electric Connector Technology has 1 warning sign we think you should be aware of.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in CN with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Electric Connector Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300679

Electric Connector Technology

Engages in the research, design, development, manufacture, and sale of micro electronic connectors and interconnection system related products in China, North America, Europe, Japan, the Asia Pacific, and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success