- China

- /

- Communications

- /

- SZSE:300627

Risks To Shareholder Returns Are Elevated At These Prices For Shanghai Huace Navigation Technology Ltd (SZSE:300627)

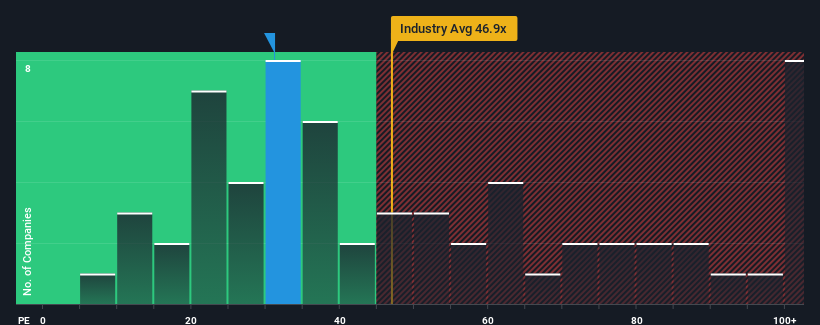

There wouldn't be many who think Shanghai Huace Navigation Technology Ltd's (SZSE:300627) price-to-earnings (or "P/E") ratio of 31.1x is worth a mention when the median P/E in China is similar at about 30x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Shanghai Huace Navigation Technology certainly has been doing a good job lately as it's been growing earnings more than most other companies. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for Shanghai Huace Navigation Technology

What Are Growth Metrics Telling Us About The P/E?

Shanghai Huace Navigation Technology's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings growth, the company posted a terrific increase of 23%. The strong recent performance means it was also able to grow EPS by 98% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Shifting to the future, estimates from the five analysts covering the company suggest earnings should grow by 25% over the next year. That's shaping up to be materially lower than the 36% growth forecast for the broader market.

With this information, we find it interesting that Shanghai Huace Navigation Technology is trading at a fairly similar P/E to the market. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

What We Can Learn From Shanghai Huace Navigation Technology's P/E?

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Shanghai Huace Navigation Technology's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Shanghai Huace Navigation Technology that you should be aware of.

You might be able to find a better investment than Shanghai Huace Navigation Technology. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300627

Shanghai Huace Navigation Technology

Shanghai Huace Navigation Technology Ltd.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives