- China

- /

- Electronic Equipment and Components

- /

- SZSE:300615

Earnings are growing at XDC Industries (Shenzhen) (SZSE:300615) but shareholders still don't like its prospects

Long term investing is the way to go, but that doesn't mean you should hold every stock forever. We don't wish catastrophic capital loss on anyone. Anyone who held XDC Industries (Shenzhen) Limited (SZSE:300615) for five years would be nursing their metaphorical wounds since the share price dropped 71% in that time. And some of the more recent buyers are probably worried, too, with the stock falling 48% in the last year. Shareholders have had an even rougher run lately, with the share price down 31% in the last 90 days.

If the past week is anything to go by, investor sentiment for XDC Industries (Shenzhen) isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

View our latest analysis for XDC Industries (Shenzhen)

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the unfortunate half decade during which the share price slipped, XDC Industries (Shenzhen) actually saw its earnings per share (EPS) improve by 13% per year. So it doesn't seem like EPS is a great guide to understanding how the market is valuing the stock. Alternatively, growth expectations may have been unreasonable in the past.

Due to the lack of correlation between the EPS growth and the falling share price, it's worth taking a look at other metrics to try to understand the share price movement.

We don't think that the 1.1% is big factor in the share price, since it's quite small, as dividends go. Revenue is actually up 25% over the time period. A more detailed examination of the revenue and earnings may or may not explain why the share price languishes; there could be an opportunity.

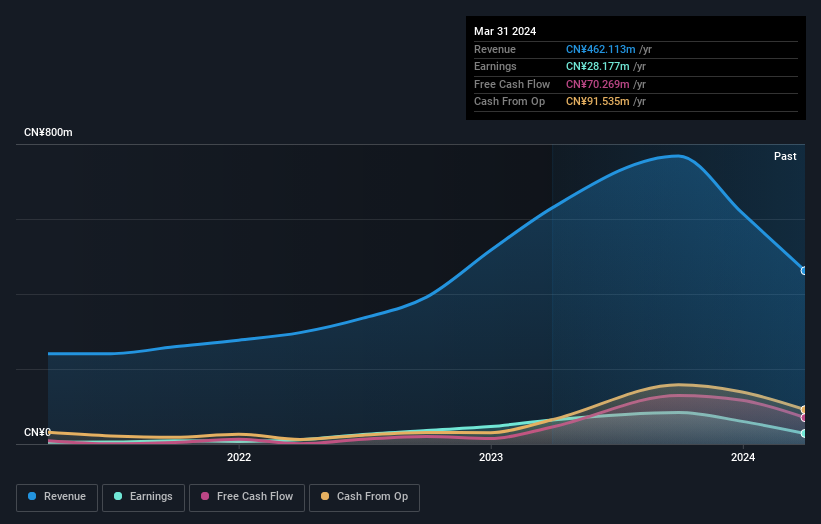

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

We regret to report that XDC Industries (Shenzhen) shareholders are down 47% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 12%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 11% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand XDC Industries (Shenzhen) better, we need to consider many other factors. For instance, we've identified 2 warning signs for XDC Industries (Shenzhen) that you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300615

XDC Industries (Shenzhen)

Researches and develops, manufactures, and sells radio frequency metal components for the mobile communication industry worldwide.

Excellent balance sheet with questionable track record.