- China

- /

- Communications

- /

- SZSE:300571

Hangzhou Anysoft Information Technology Co., Ltd.'s (SZSE:300571) Price Is Right But Growth Is Lacking After Shares Rocket 49%

Hangzhou Anysoft Information Technology Co., Ltd. (SZSE:300571) shareholders have had their patience rewarded with a 49% share price jump in the last month. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 20% over that time.

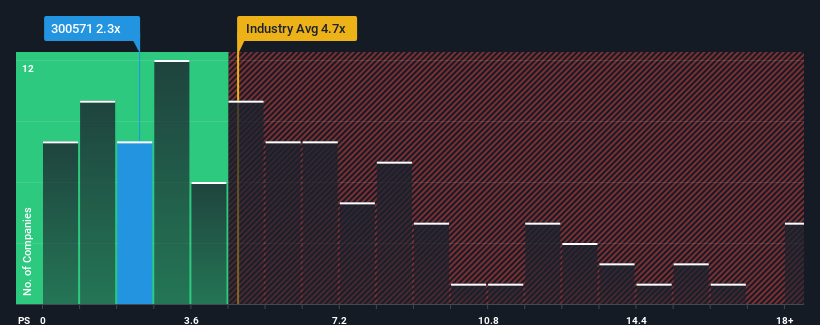

In spite of the firm bounce in price, Hangzhou Anysoft Information Technology may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 2.3x, considering almost half of all companies in the Communications industry in China have P/S ratios greater than 4.7x and even P/S higher than 8x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for Hangzhou Anysoft Information Technology

What Does Hangzhou Anysoft Information Technology's Recent Performance Look Like?

For example, consider that Hangzhou Anysoft Information Technology's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Hangzhou Anysoft Information Technology will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For Hangzhou Anysoft Information Technology?

In order to justify its P/S ratio, Hangzhou Anysoft Information Technology would need to produce anemic growth that's substantially trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 23%. The last three years don't look nice either as the company has shrunk revenue by 41% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 42% shows it's an unpleasant look.

With this information, we are not surprised that Hangzhou Anysoft Information Technology is trading at a P/S lower than the industry. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

The Bottom Line On Hangzhou Anysoft Information Technology's P/S

Hangzhou Anysoft Information Technology's recent share price jump still sees fails to bring its P/S alongside the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Hangzhou Anysoft Information Technology confirms that the company's shrinking revenue over the past medium-term is a key factor in its low price-to-sales ratio, given the industry is projected to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Before you settle on your opinion, we've discovered 3 warning signs for Hangzhou Anysoft Information Technology (2 can't be ignored!) that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Hangzhou Anysoft Information Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300571

Hangzhou Anysoft Information Technology

Hangzhou Anysoft Information Technology Co., Ltd.

Slightly overvalued with imperfect balance sheet.

Market Insights

Community Narratives