As global markets navigate a complex landscape characterized by rate cuts in Europe, strong U.S. consumer spending, and easing inflation in Japan and China, small-cap indices like the Russell 2000 have shown resilience with notable outperformance. In this dynamic environment, identifying high-growth tech stocks involves looking for companies that not only capitalize on emerging technologies such as AI but also demonstrate robust fundamentals to thrive amid fluctuating economic indicators.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Sarepta Therapeutics | 23.67% | 43.83% | ★★★★★★ |

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| KebNi | 34.75% | 86.11% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Travere Therapeutics | 27.74% | 70.00% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1265 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Talkweb Information SystemLtd (SZSE:002261)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Talkweb Information System Co., Ltd. operates in China, offering education services and mobile games, with a market capitalization of CN¥30.82 billion.

Operations: Talkweb Information System Co., Ltd. generates revenue primarily through its education services and mobile games sectors in China. The company has a market capitalization of approximately CN¥30.82 billion, reflecting its significant presence in these industries.

Talkweb Information System Co., Ltd. has demonstrated a robust revenue growth forecast of 15.6% annually, outpacing the Chinese market average of 13.5%. This growth is underpinned by significant R&D investments, aligning with industry trends toward enhanced digital and cloud solutions. Despite current unprofitability, the firm is expected to reverse this trend within three years, with earnings projected to surge by an impressive 71.2% per year. Recent financial disclosures reveal a mixed performance; while nine-month sales nearly doubled to CNY 2.94 billion from the previous year, net income drastically reduced to CNY 11.01 million from CNY 72.71 million, indicating potential scalability challenges or increased operational costs that could impact future profitability.

Jiangsu Hoperun Software (SZSE:300339)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangsu Hoperun Software Co., Ltd. is a software company that offers products, solutions, and services leveraging new generation information technology across China, Japan, Southeast Asia, North America, and other international markets with a market cap of CN¥54.60 billion.

Operations: Hoperun Software specializes in delivering advanced IT products, solutions, and services to various global markets. The company focuses on leveraging cutting-edge technologies to cater to diverse sectors across China and internationally.

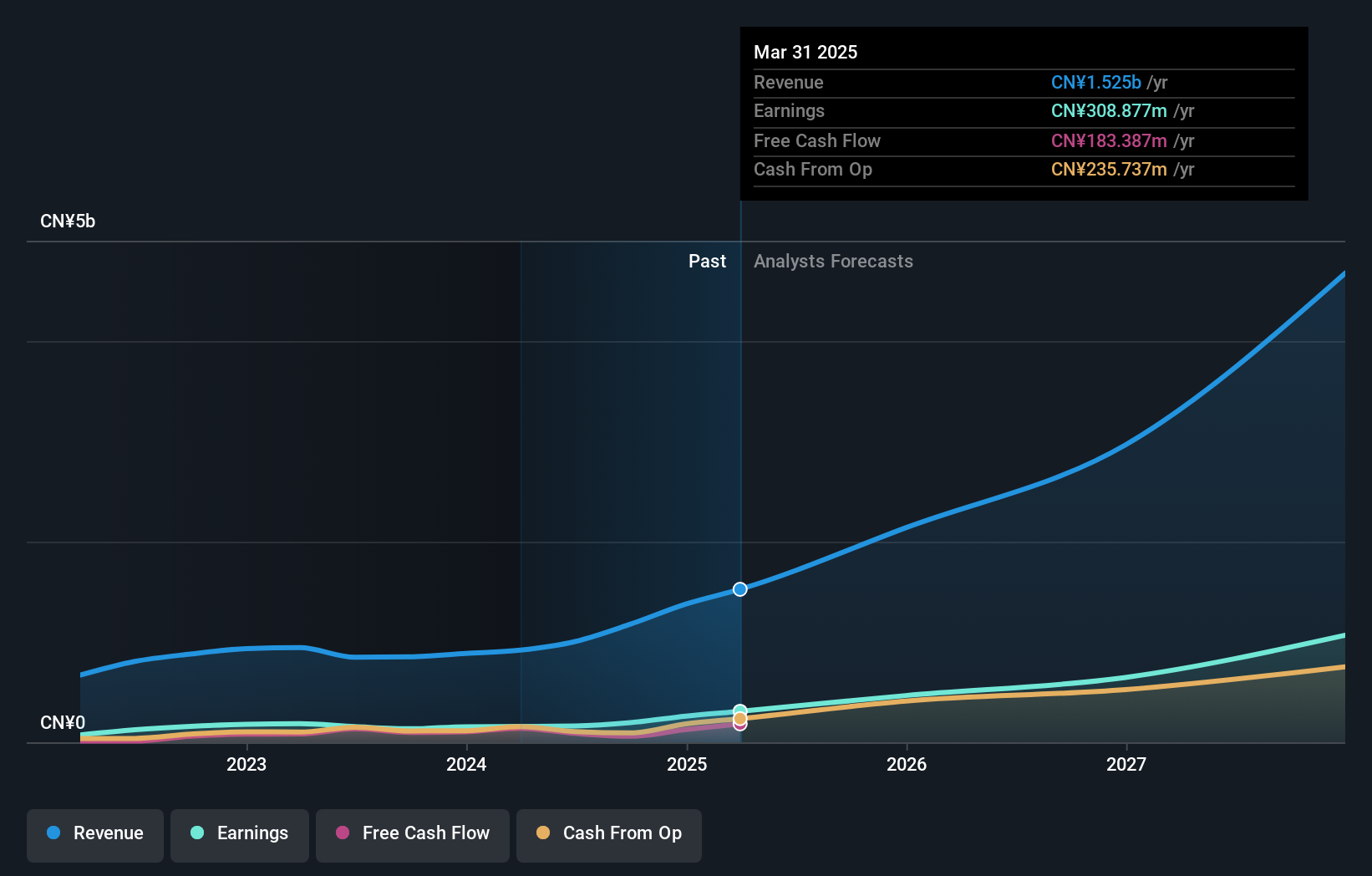

Jiangsu Hoperun Software has been navigating the tech landscape with a keen focus on R&D, dedicating a significant portion of its revenue to innovation. This commitment is reflected in their recent financials, where R&D expenses accounted for 20.1% of their total revenue, aligning with an industry trend that prioritizes continuous technological advancement. Despite this heavy investment, the company has managed to grow its earnings by 36.7% over the past year, showcasing efficient capital allocation that supports both growth and innovation. Moreover, recent results indicate a stable uptick in sales and net income, suggesting that their strategic focus may be yielding the intended outcomes as they adapt to evolving market demands in software development.

T&S CommunicationsLtd (SZSE:300570)

Simply Wall St Growth Rating: ★★★★★★

Overview: T&S Communications Co., Ltd. is engaged in the development, manufacturing, and sale of fiber optics communication products in China, with a market capitalization of CN¥10.49 billion.

Operations: T&S Communications focuses on the optical communication components segment, generating revenue of approximately CN¥999 million.

T&S Communications Ltd. has demonstrated robust growth, with a notable revenue increase of 34.7% per year, outpacing the broader CN market's 13.5% growth rate. This surge is supported by substantial R&D investments, which have risen to capture 40.8% of their annual earnings, underscoring a deep commitment to innovation in communications technology. Recent inclusion in the S&P Global BMI Index and a significant uptick in half-year earnings from CNY 390 million to CNY 509 million further validate its upward trajectory in the tech sector. These financial milestones not only highlight T&S's aggressive growth strategy but also suggest potential for sustained market impact, especially as it continues to outperform industry averages with projected annual profit growth of 40.85%.

Next Steps

- Access the full spectrum of 1265 High Growth Tech and AI Stocks by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300339

Jiangsu Hoperun Software

Operates as a software company that provides products, solutions, and services based on new generation information technology in China, Japan, Southeast Asia, North America, and internationally.

Excellent balance sheet with limited growth.

Market Insights

Community Narratives